Introduction: The Emergence of UAE’s Tier-2 Cities as Investment Hotspots

The UAE’s real estate landscape is no longer defined solely by Dubai and Abu Dhabi. While these Tier-1 cities remain global investment magnets, the spotlight is now shifting to Tier-2 cities—Sharjah, Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain. These cities are experiencing robust transformation driven by a strategic blend of affordability, infrastructure development, lifestyle offerings, and policy support.

From sustainable mega-projects to freehold residential zones, Tier-2 Cities Growth is capturing the attention of investors, end-users, and government planners alike. These emerging markets offer high growth potential with lower entry barriers and fewer saturation risks—making them ideal for those looking to diversify portfolios or settle in cost-effective yet dynamic urban environments.

GM Legends!

I am in the process of buying a number of properties on Marjan Island RAK UAE and look why below! ⬇️

I’m not telling you to buy any particular development but in general this is one of the best RWAs investment to look at IMO before completion in 2026!

I am really… pic.twitter.com/HaitIcVbfq

— MANDO CT (@XMaximist) November 26, 2023

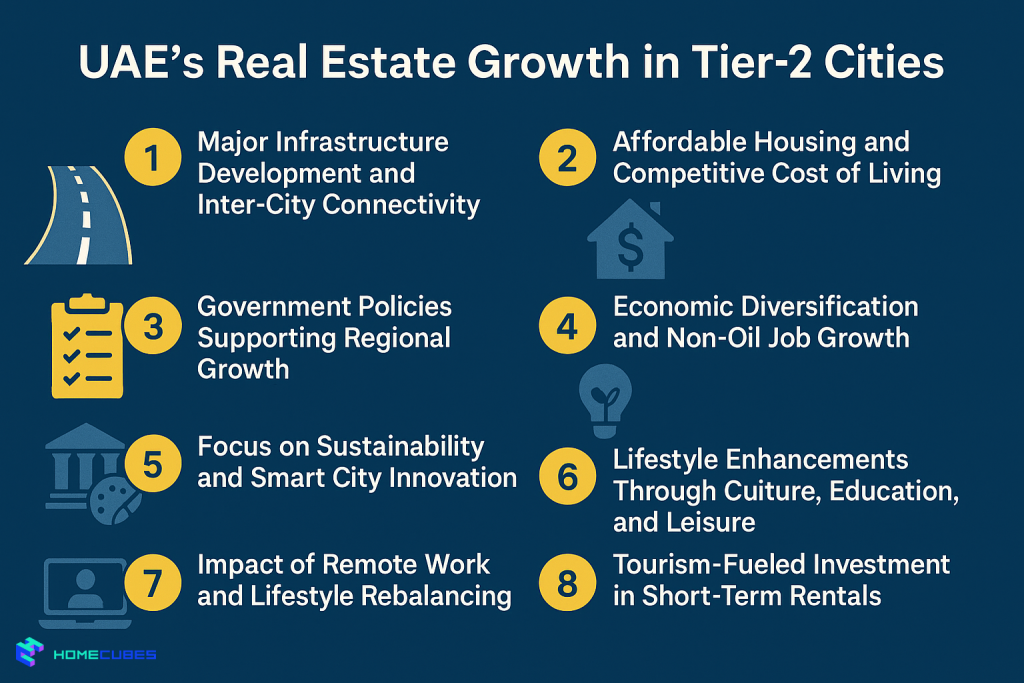

In this article, we’ll explore 8 powerful trends fueling the real estate boom in the UAE’s Tier-2 cities, backed by real case studies, market data, and a look ahead at the evolving investment landscape.

1. Major Infrastructure Development and Inter-City Connectivity

Massive public investments in infrastructure are dramatically increasing the accessibility and appeal of Tier-2 cities. Projects such as highway expansions, modernized public transport systems, upgraded sewage and utility grids, and smart lighting installations are turning once-overlooked districts into viable real estate hubs.

For example, Sharjah’s government recently invested over AED 13.1 billion into road and sewage projects across its industrial zones and emerging suburbs. These improvements have eased inter-emirate commutes and spurred residential development in areas like Muwaileh and Aljada.

Increased road access to Dubai and Abu Dhabi from cities like Ajman and Ras Al Khaimah has allowed professionals to live affordably in Tier-2 zones while commuting efficiently to Tier-1 workplaces. This surge in livability and mobility is directly accelerating Tier-2 Cities Growth.

Read more on UAE infrastructure trends

2. Affordable Housing and Competitive Cost of Living

Even though there are rules for rent increase by landlords in Dubai, property prices and rental rates climb in Dubai and Abu Dhabi. By uncovering hidden rental costs in Dubai and other major cities, even more financial pressure is expected on families. Hence, more families and professionals are turning to Tier-2 cities for affordability. Ajman, for example, offers average apartment prices 30–40% lower than neighboring Dubai. Similarly, Ras Al Khaimah and Fujairah provide larger spaces, scenic surroundings, and beachfront access at a fraction of Tier-1 costs.

Developers have responded by launching middle-income, gated communities with flexible payment plans and value-driven amenities. These include residential enclaves like Naseem Al Bahr in Fujairah and Hayyan Villas in Sharjah.

Cost-of-living advantages extend beyond real estate. Schools, clinics, groceries, and recreational activities in Tier-2 cities are typically priced lower, making them more attractive for end-users looking to reduce long-term expenses without compromising lifestyle quality.

3. Government Policies Supporting Regional Growth

UAE authorities have strategically incentivized development outside major metropolises. These policies include freehold law extensions, investor visa reforms, and the expansion of free zones into smaller emirates.

Ras Al Khaimah’s Real Estate Regulatory Authority (RAK RERA), for instance, has streamlined licensing for developers and agents, while Sharjah has introduced its own real estate law enabling freehold ownership for non-GCC nationals in designated areas such as Aljada and Maryam Island.

Long-term residency programs such as the 10-year Golden Visa are also fueling foreign demand in Tier-2 cities by offering stability and family relocation pathways.

4. Economic Diversification and Non-Oil Job Growth

Tier-2 cities are rapidly diversifying beyond oil by nurturing industries like logistics, tourism, advanced manufacturing, and education. This diversification is creating new jobs and, in turn, fueling real estate demand.

For example, RAKEZ (Ras Al Khaimah Economic Zone) now hosts over 15,000 businesses, while Sharjah Publishing City Free Zone and Sharjah Research Technology and Innovation Park (SRTIP) are drawing regional talent and foreign enterprises.

These projects bring an influx of workers and support staff, increasing demand for rental and owned residential units. Similarly, the emergence of specialized medical and academic hubs in Fujairah and Ajman are contributing to steady population growth and associated housing needs.

5. Focus on Sustainability and Smart City Innovation

Sustainability is a core pillar of UAE’s future planning, and Tier-2 cities are leveraging it to attract environmentally-conscious investors and residents. As Projects are increasingly being designed with green materials, solar energy, smart metering, and car-free zones.

Sharjah’s Aljada by Arada includes electric vehicle infrastructure, walkable streets, and smart waste collection systems. Ajman’s Al Zorah Development integrates coastal preservation with golf courses, mangrove parks, and LEED-compliant housing.

These smart and sustainable features not only appeal to new-age buyers but also future-proof properties against evolving government regulations.

6. Lifestyle Enhancements Through Culture, Education, and Leisure

To draw residents and tourists alike, Tier-2 cities are enhancing their livability by investing in cultural institutions, education zones, and hospitality developments.

Sharjah, named UNESCO’s World Book Capital, offers museums, art houses, and libraries throughout its real estate zones. Ras Al Khaimah is promoting adventure tourism with hiking trails, Jebel Jais zipline parks, and wellness resorts. Fujairah continues expanding beach resorts and heritage attractions.

The expansion of international schools, hospitals, and retail zones within residential districts ensures that families can enjoy world-class services without traveling to Dubai or Abu Dhabi.

7. Impact of Remote Work and Lifestyle Rebalancing

The global shift toward remote work has unlocked a new demographic for Tier-2 Cities Growth: digital nomads, remote professionals, and hybrid workers seeking affordability, space, and serenity.

With the UAE’s Virtual Working Visa program and 5G connectivity extended to outer cities, professionals can now live in Sharjah or Fujairah and telecommute globally. This shift has increased demand for apartments with home office layouts and access to coworking lounges outside Tier-1 cities.

Communities in Ras Al Khaimah and Ajman are actively marketing to this audience by integrating fiber-optic broadband, smart access control, and wellness facilities into new buildings.

8. Tourism-Fueled Investment in Short-Term Rentals

Tourism initiatives are turning Tier-2 cities into investment zones for vacation homes and serviced apartments. Ras Al Khaimah, for example, saw a 118% rise in tourism between 2021 and 2023 and plans to host integrated resorts, cruise terminals, and branded hotels over the next five years.

Investors are acquiring beachfront or mountainside properties in these cities to capitalize on the growing demand for short-term rentals and digital detox retreats. The growth of platforms like Airbnb and the Dubai Tourism Department’s push for regulated vacation rentals are fueling this trend across northern emirates.

Read about Ras Al Khaimah’s Tourism

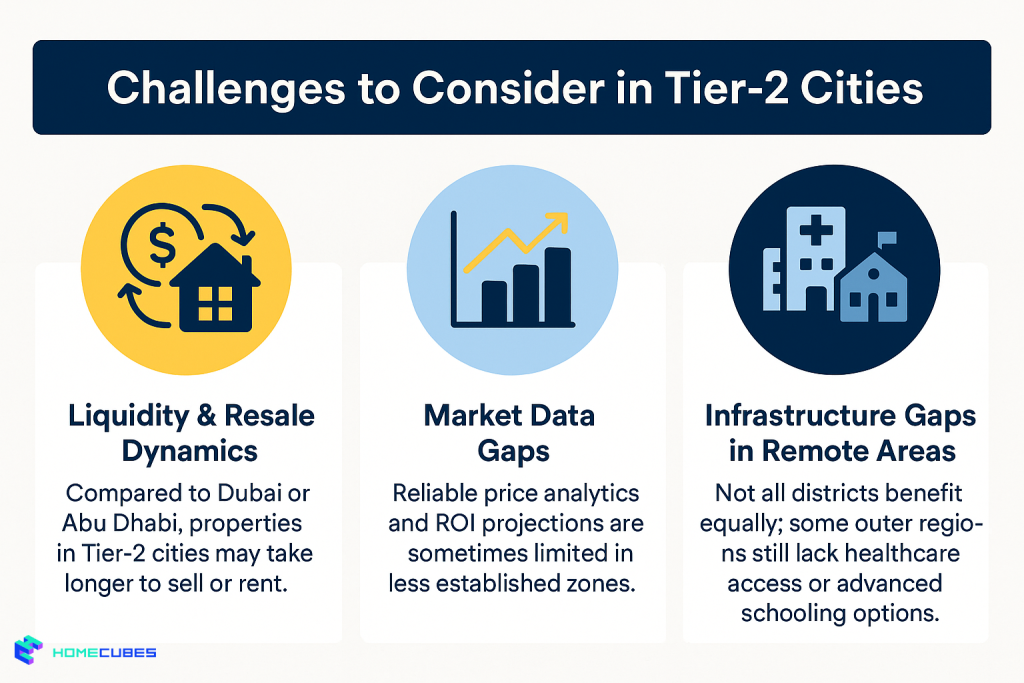

Challenges to Consider in Tier-2 Cities

While the growth trajectory is clear, investors should remain aware of the following challenges:

- Liquidity & Resale Dynamics: Compared to Dubai or Abu Dhabi, properties in Tier-2 cities may take longer to sell or rent.

- Market Data Gaps: Reliable price analytics and ROI projections are sometimes limited in less established zones.

- Infrastructure Gaps in Remote Areas: Not all districts benefit equally; some outer regions still lack healthcare access or advanced schooling options.

These can be mitigated through local partnerships, thorough market research, and on-the-ground inspections.

Future Outlook: A Sustainable and Decentralized Investment Future

As UAE urbanization expands outward, Tier-2 Cities Growth will continue to benefit from long-term urban master planning, tech-driven development, and more equitable real estate access. Government initiatives are expected to:

- Expand freehold ownership for international buyers

- Digitize property transactions and land registries

- Offer green financing incentives for eco-compliant projects

- Integrate Tier-2 cities into federal smart city and mobility platforms

This ongoing evolution signals that investors who enter these markets early may benefit from both rental yields and capital appreciation over a 5–10 year horizon.

Case Studies: Real Estate Success in Tier-2 Cities

Case Study 1: Aljada, Sharjah

Developed by Arada, Aljada is a mixed-use smart city with residences, retail, a business park, and leisure areas. Property prices here have risen 12–15% in three years, backed by demand from professionals commuting to Dubai.

Case Study 2: Al Zorah, Ajman

Al Zorah is a master-planned waterfront development offering golf villas, resorts, and marinas. Its low-density design and integration with nature have made it a magnet for long-term investors seeking high-end coastal real estate.

Case Study 3: Mina Al Arab, Ras Al Khaimah

This island-style development with beachfront townhouses and hotels has attracted international buyers and is benefiting from Ras Al Khaimah’s aggressive tourism campaigns.

Conclusion: Why Investors Should Watch UAE’s Tier-2 Cities Now

The momentum behind Tier-2 Cities Growth is unmistakable. Infrastructure upgrades, lifestyle improvements, economic reforms, and affordability are drawing a new generation of investors and residents to UAE’s next urban frontiers.

As Tier-1 markets mature and competition intensifies, Tier-2 cities offer untapped potential with increasing accessibility and institutional support. The time to act is now — before these rising cities fully converge with their Tier-1 counterparts.

Build Your Strategy with Homecubes

At Homecubes, we’re preparing the next generation of smart real estate tools — designed to help you assess and invest in high-potential markets like Sharjah, Ras Al Khaimah, Ajman, and beyond.

Although we are not yet operational as we await our VARA license, our future platform will offer:

- Access to fractional ownership in vetted Tier-2 projects

- ESG and ROI data for every listed property

- On-chain property tracking and compliance tools

📬 Contact Homecubes to be notified at launch and explore early opportunities in the UAE’s Tier-2 real estate boom.