The mortgage lending landscape is undergoing a significant shift, driven by advancements in technology. In Dubai, a city known for its rapid development and embrace of innovation, blockchain technology is poised to transform how mortgages are originated, processed, and serviced. This article explores how blockchain in real estate is revolutionizing mortgage lending in Dubai, highlighting the benefits, challenges, and future potential of this technology in the real estate sector.

DUBAI BANK GOES LIVE ON BLOCKCHAIN 🔥🔥🔥🔥🔥https://t.co/617zZ8IjpN

— DjPeterVas (@DjPeterVas1) February 14, 2021

Understanding Blockchain Technology

Blockchain is a decentralized, distributed ledger technology that allows for secure, transparent, and tamper-proof record-keeping. Each transaction is recorded in a “block” and linked to previous blocks, creating a chain of data that is visible to all participants. This characteristic makes blockchain particularly attractive for industries that require trust, transparency, and security—qualities that are essential in mortgage lending.

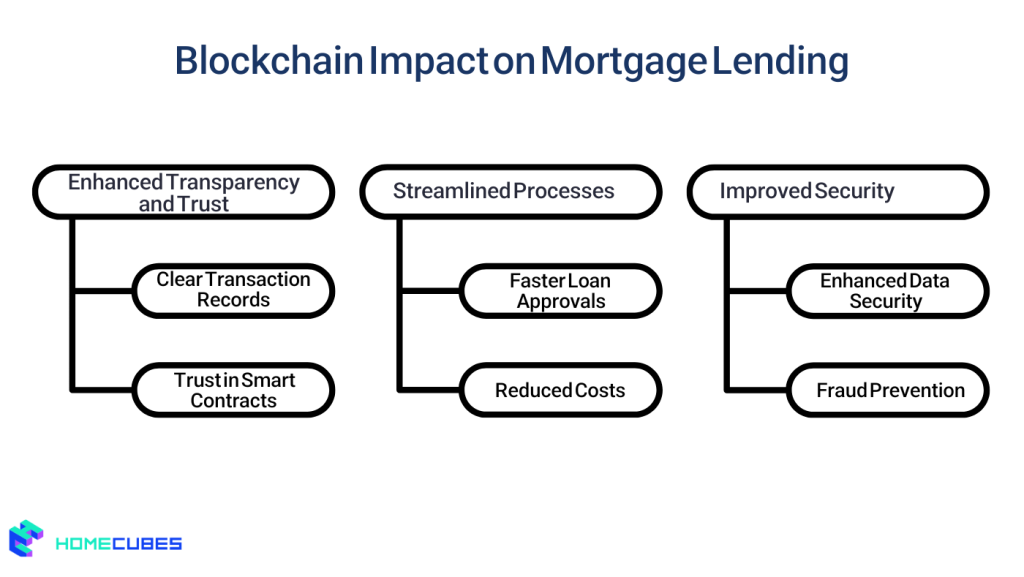

Enhanced Transparency and Trust

1. Clear Transaction Records

In mortgage lending, one of the primary advantages of blockchain is increasing transparency in Dubai real estate transactions. Every transaction recorded on the blockchain is immutable, meaning it cannot be altered or deleted. This creates a clear and traceable history of all transactions related to a mortgage, from application to closing.

For Dubai’s diverse population, which includes many expatriates and investors, having access to transparent records can make greater confidence in the mortgage process. This transparency reduces the potential for fraud and misrepresentation, making it easier for lenders to verify borrower identities and financial histories.

2. Trust in Smart Contracts

Blockchain enables the use of smart contracts—self-executing contracts with the terms of the agreement directly written into code. In mortgage lending, smart contracts can automate various processes, such as loan disbursements and payments, based on predefined conditions.

For instance, once a borrower meets specific criteria, such as providing necessary documentation and making an initial payment, the smart contract can automatically execute the next steps. This not only streamlines the process but also enhances trust between parties, as all actions are recorded and verifiable on the blockchain.

Streamlined Processes

1. Faster Loan Approvals

Traditionally, mortgage applications involve lengthy processes filled with paperwork and multiple intermediaries, resulting in delays. Blockchain technology simplifies and expedites these processes by providing a secure and instantaneous method for sharing information among stakeholders.

In Dubai, where speed is essential in the competitive real estate market, blockchain can facilitate quicker loan approvals. With all necessary documentation and verification conducted on a single platform, lenders can significantly reduce the time it takes to evaluate applications and disburse funds.

2. Reduced Costs

By automating processes and minimizing the need for intermediaries, blockchain can lead to substantial cost savings in mortgage lending. Traditional processes often involve numerous fees related to paperwork, title searches, and third-party services.

With blockchain, many of these costs can be eliminated or greatly reduced. For instance, title verification can be conducted more efficiently on a blockchain, as ownership records are easily accessible and verifiable. This reduction in costs can ultimately benefit both lenders and borrowers, making mortgage products more affordable.

Improved Security

1. Enhanced Data Security

Blockchain’s decentralized nature makes it highly secure. Unlike traditional databases that can be vulnerable to hacking, data stored on a blockchain is encrypted and distributed across multiple nodes. This means that a single point of failure is eliminated, significantly reducing the risk of data breaches.

For mortgage lenders in Dubai, this heightened security is crucial. Protecting sensitive borrower information, including financial data and personal details, is a top priority. Blockchain provides a secure environment for storing and managing this data, ensuring compliance with privacy regulations.

2. Fraud Prevention

Fraud is a persistent challenge in the mortgage industry, with instances of identity theft and false documentation impacting lenders and borrowers alike. Blockchain technology can help mitigate these risks through its transparent and immutable record-keeping.

By utilizing blockchain, lenders can verify the authenticity of documents and borrower identities more efficiently. For example, property titles can be securely recorded on the blockchain, making it easier to identify any discrepancies or fraudulent claims. This capability enhances the overall integrity of the mortgage lending process.

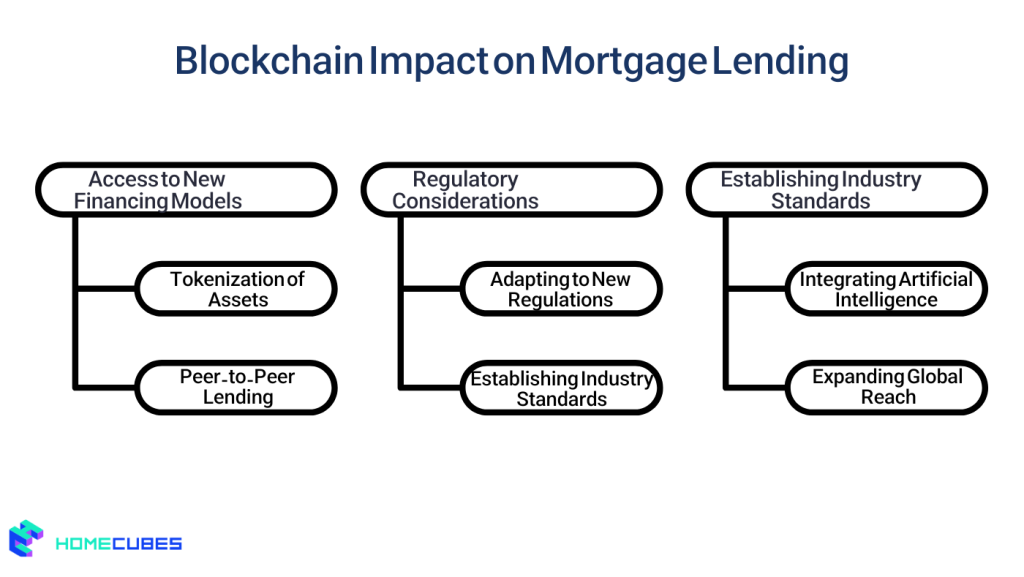

Access to New Financing Models

1. Tokenization of Assets

One of the most innovative applications of blockchain in mortgage lending is the tokenization of real estate assets.. This process of tokenizing a property involves creating digital tokens that represent ownership or shares in a property, allowing for fractional ownership.

It is expected that real estate tokenization is the future of real estate investment in Dubai . It allows smaller investors to participate in property ownership without needing substantial capital. Moreover, these tokens can be traded on blockchain platforms, providing liquidity that traditional mortgage products lack.

2. Peer-to-Peer Lending

Blockchain also facilitates peer-to-peer lending, where borrowers can directly connect with individual lenders through decentralized platforms. This model can lead to more favorable loan terms for borrowers and better returns for lenders, disrupting the traditional mortgage lending ecosystem.

In a market like Dubai, where expatriates and investors are looking for flexible financing options, peer-to-peer lending powered by blockchain can offer tailored solutions that cater to diverse needs.

Regulatory Considerations

1. Adapting to New Regulations

As blockchain technology becomes more prevalent in mortgage lending, regulatory frameworks will need to adapt. The Dubai government has been proactive in embracing blockchain, with initiatives aimed at integrating it into various sectors, including real estate.

However, the rapid pace of innovation poses challenges for regulators who must ensure consumer protection, data privacy, and financial stability. Stakeholders in the mortgage industry will need to work closely with regulatory bodies to develop guidelines that foster innovation while safeguarding the interests of all parties involved.

2. Establishing Industry Standards

As blockchain technology continues to evolve, establishing industry standards will be crucial. Standards can help ensure interoperability between different blockchain platforms and facilitate broader adoption across the mortgage lending landscape.

The Dubai real estate market, known for its diversity and international appeal, would benefit significantly from standardized practices that promote consistency and trust among investors, lenders, and borrowers.

Future Potential

1. Integrating Artificial Intelligence

The future of blockchain in mortgage lending may also involve integrating artificial intelligence (AI) and machine learning. These technologies can analyze vast amounts of data to identify patterns and assess creditworthiness more accurately.

Combining AI with blockchain can enhance risk assessment processes, allowing lenders to make more informed decisions and offer personalized mortgage products tailored to individual borrower profiles.

2. Expanding Global Reach

As Dubai continues to attract international investors, the global applicability of blockchain technology in mortgage lending will become increasingly relevant. By providing a secure, efficient, and transparent method for property transactions, blockchain can facilitate cross-border investments and enable foreign investors to navigate the UAE’s real estate market more easily.

Final Thoughts

Blockchain technology is set to revolutionize mortgage lending in Dubai, offering enhanced transparency, streamlined processes, improved security, and new financing models. As the market evolves, stakeholders must collaborate to address regulatory challenges and establish standards that foster innovation.

For Dubai residents and investors, the integration of blockchain in mortgage lending promises a more accessible, efficient, and secure way to finance real estate purchases. As this technology continues to mature, it has the potential to transform not only the mortgage industry but also the broader real estate landscape in the UAE and beyond.

Homecubes as the leading property tokenization platform in Dubai has got exciting real estate fractional investment projects in the pipeline. Please contact us with confidence, if you need further information about such investment opportunities in Prime locations across Dubai.