As the real estate market evolves, the introduction of Non-Fungible Tokens (NFTs) has begun to revolutionize the way properties are bought, sold, and managed. Dubai, known for its forward-thinking approach and technological advancements, is at the forefront of this trend. This guide will provide you with an in-depth understanding of minting real estate NFTs in Dubai, covering everything from the basics of NFTs to the legal framework and the minting process itself. Make sure to fully understand the fractional NFT ownership in Dubai real estate market, if you are seeking investment opportunities in Dubai real estate NFTs.

Tokenization of Real Estate, will change the World of Finance.

Using blockchain technology will bring Real Estate investments to a completely different level, and take it to the digital era.It will create efficient mechanisms to increase the liquidity of real estate, simplify… pic.twitter.com/t7ny47GmaW

— JA (@ja1405_ja) April 20, 2024

Understanding NFTs

What are NFTs?

Non-Fungible Tokens (NFTs) are unique digital assets that represent ownership of a specific item or piece of content on a blockchain. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and can be exchanged for one another, NFTs are distinct and cannot be exchanged on a one-to-one basis. Each NFT contains specific information that makes it unique, which is ideal for representing ownership of real estate.

Why Real Estate NFTs?

The real estate market often faces challenges such as lack of transparency, lengthy transaction processes, and high costs. NFTs that represent tokenized tangible assets such as real estate property can address these issues by:

- Tokenizing Assets: Real estate can be divided into smaller fractions, allowing for fractional ownership.

- Transparency: The blockchain provides a transparent record of ownership and transaction history.

- Smart Contracts: Automated contracts can streamline transactions, reducing the need for intermediaries.

The Legal Landscape in Dubai

Regulatory Framework

Dubai is making significant strides in regulating blockchain technology and NFTs. The Dubai Land Department (DLD) has recognized the potential of utilizing blockchain in real estate transactions. The Real Estate Regulatory Agency (RERA) oversees regulations that apply to property transactions, including those involving NFTs.

Key regulations to be aware of include:

- Dubai Blockchain Strategy 2020: Aiming to make Dubai the first city fully powered by blockchain, this strategy enhances the use of blockchain in real estate.

- Property Ownership Laws: Foreigners can own real estate in designated areas, and understanding these laws is crucial when minting real estate NFTs.

Legal Considerations

Before minting real estate NFTs, consider the following legal aspects:

- Title Deeds: Ensure that the property title is clear and transferable.

- Compliance: Ensure adherence to local laws and regulations regarding property ownership and blockchain use.

- Smart Contract Legality: Verify the enforceability of smart contracts under UAE law.

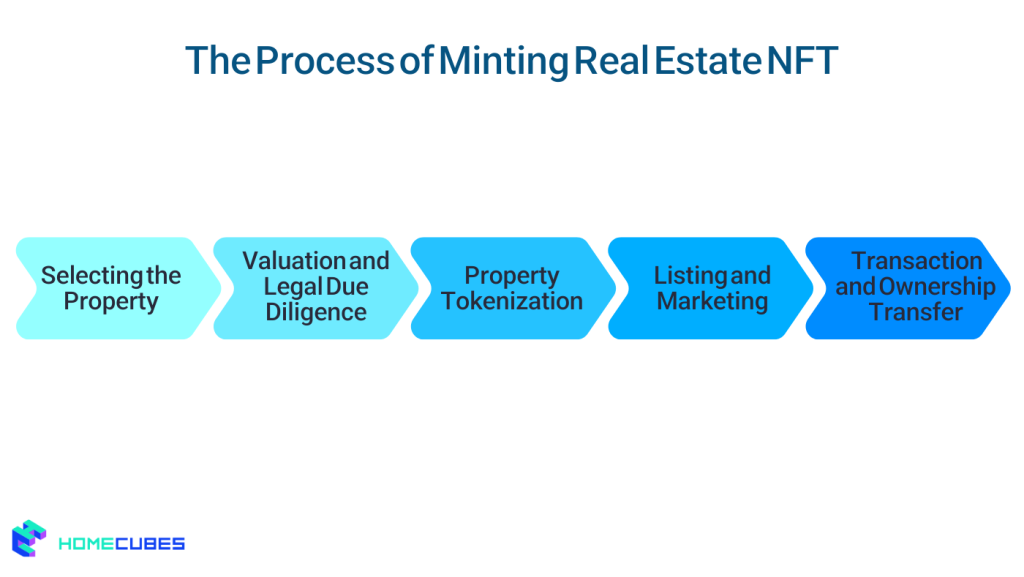

The Minting Process

Step 1: Selecting the Property

Choose a property that you wish to tokenize. This could be a residential unit, commercial space, or land. Conduct a thorough market analysis to assess the property’s value and demand.

Step 2: Valuation and Legal Due Diligence

Before minting the NFT, conduct a valuation of the property. Engage real estate professionals to ensure accurate pricing and to confirm the legal status of the property, including ownership and any encumbrances.

Step 3: Tokenization

Choosing a Blockchain

Select a suitable blockchain for minting the NFT. Ethereum blockchain network is the most popular choice due to its robust NFT standards (ERC-721 and ERC-1155), but other blockchains like Binance Smart Chain and Tezos are gaining traction for their lower fees and faster transaction speeds.

Creating the NFT

- Smart Contract Development: Develop a smart contract that outlines the properties of the NFT, including ownership rights, transferability, and any royalties for resale.

- Minting the NFT: Use a platform or tool that allows you to mint your NFT. Upload the property details, including images, description, and legal documentation.

Step 4: Listing and Marketing

Once the NFT is minted, list it on an NFT marketplace that supports real estate transactions. Popular platforms include OpenSea, Rarible, and specialized real estate NFT platforms. IT would be helpful to make yourself familiar with how NFT-based real estate sales works in Dubai. Effective marketing strategies should include:

- Social Media: Utilize platforms like LinkedIn and Instagram to showcase the property.

- Real Estate Websites: List the NFT on prominent real estate websites that cater to Dubai’s market.

- Virtual Tours: Provide virtual tours or interactive experiences to attract potential buyers.

Step 5: Transaction and Ownership Transfer

When a buyer is interested, the transaction process can be executed through the smart contract. This ensures:

- Automatic Transfer: Ownership transfer is automated and recorded on the blockchain.

- Escrow Services: Funds can be held in escrow until the transaction is complete, providing security for both parties.

Post-Minting Considerations

Managing Real Estate NFTs

After minting and selling the NFT, consider ongoing management:

- Rental Agreements: If the property is rented out, ensure rental agreements are clear and comply with local laws.

- Maintaining Value: Regularly update the property’s condition and market presence to maintain its value.

Legal Obligations

Stay informed about ongoing legal obligations regarding ownership rights, taxes, and compliance with local real estate regulations.

Potential Challenges

While the potential for real estate NFTs is immense, there are challenges to navigate:

- Market Adoption: Not all buyers are familiar with NFTs, which may limit market reach.

- Regulatory Changes: The regulatory landscape is still evolving, and businesses must adapt to new laws and standards.

- Technological Barriers: Users may face difficulties with the technology, which could hinder transactions.

Future Trends

The future of real estate NFTs in Dubai looks promising, with increasing acceptance of blockchain technology and digital assets. Trends to watch include:

- Increased Fractional Ownership: More properties will be tokenized, allowing multiple investors to own shares.

- Enhanced Security Measures: Advances in blockchain technology will improve security and reduce fraud risks.

- Integration with DeFi: The merging of NFTs with decentralized finance (DeFi) could create innovative investment opportunities.

Final Words

Minting real estate NFTs in Dubai offers a unique opportunity to leverage blockchain technology for property transactions. By understanding the regulatory landscape, following the minting process, and navigating the associated challenges, investors can unlock the potential of this emerging market. As Dubai continues to embrace innovation, the future of real estate NFTs looks bright, making now an opportune time to explore this exciting frontier.

Homecubes is minting their real estate NFTs in prime locations across Dubai. You are welcome to contact us for further information on our exciting real estate tokenization and Dubai property NFTs projects.