Dubai, a global hub for luxury real estate, attracts investors from all over the world with its high returns, opulent properties, and progressive regulations. When it comes to investing in property, potential buyers often face the dilemma of choosing between fractional ownership and full ownership. Both options offer unique advantages and come with their own sets of challenges. This article delves into the key differences between fractional ownership and full ownership, helping investors decide which is more suitable for them in the context of Dubai’s dynamic real estate market.

What is Fractional Ownership?

Fractional ownership refers to the model where multiple investors pool their resources to collectively own a share of a property. In this arrangement, each investor holds a percentage of the property rather than owning it outright. This concept is typically applicable to luxury real estate, vacation homes, and high-end developments, where the individual cost of ownership would otherwise be prohibitively expensive.

One of the most ingenious real estate strategies is the fractional model.

Why?

Imagine a developer erecting an ultra-luxurious condominium in a coveted resort area, akin to Aspen’s ski slopes.

The innovative aspect here is the division of ownership into fractional shares,… pic.twitter.com/VbBhbsIRsW

— Jake Wurzak (@JWurzak) December 20, 2023

In Dubai, fractional ownership allows investors to buy a share in high-value properties, often in prime locations like the Palm Jumeirah, Downtown Dubai, or Dubai Marina. The investor gains access to the property for a specific period each year, and they share in the rental income and potential appreciation of the asset based on their ownership percentage.

What is Full Ownership?

Full ownership, on the other hand, means that an investor owns the property outright. The buyer has complete control over the property, including the ability to rent, sell, or develop it as they see fit. In Dubai, full ownership can apply to both freehold properties (where the buyer owns the land and the property) and leasehold properties (where the buyer owns the building but not the land underneath).

For investors, full ownership offers a greater degree of control and flexibility. They can decide when to sell or rent out the property, and they do not need to share profits or decision-making with other investors. Additionally, full ownership often provides more opportunities for long-term capital appreciation, especially in a city like Dubai, where property values have historically risen at a rapid pace.

Fractional Ownership in Dubai: The Pros and Cons

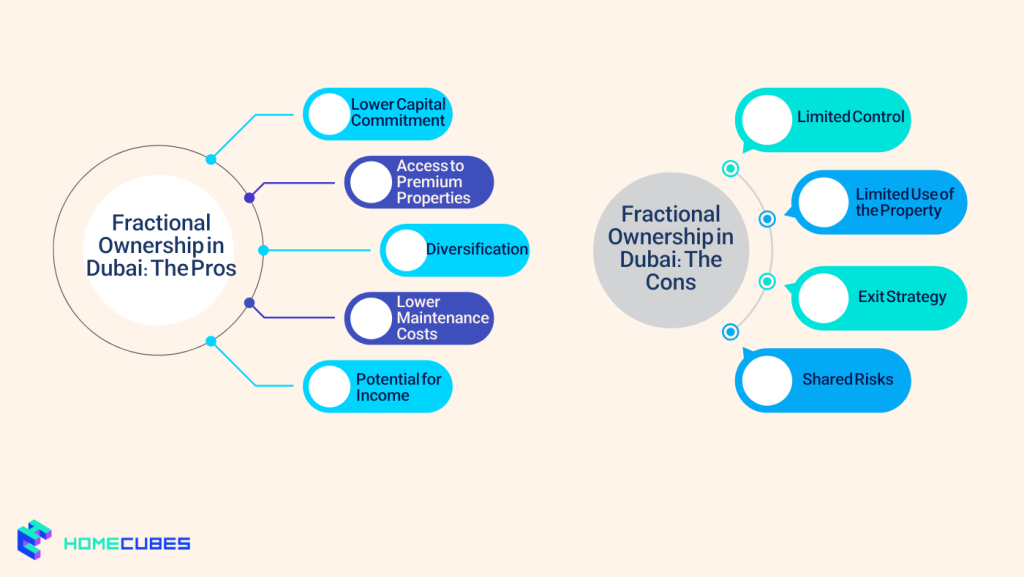

Pros:

- Lower Capital Commitment: One of the biggest attractions of fractional ownership is the reduced capital outlay. Instead of having to pay for the entire property, investors can buy a fraction of it, often as little as 1/8th or 1/10th. This makes it more accessible to a wider range of investors, particularly those who may not have the full funds to invest in high-end Dubai properties. Hence, fractional ownership empowers Dubai’s young investors as well as small-scale investors.

- Access to Premium Properties: Fractional ownership provides an opportunity to invest in luxury real estate in prime locations without bearing the full financial burden. Investors can gain access to high-end developments like five-star hotels, resorts, or iconic residential towers that might be beyond their budget if they were purchasing the property outright.

- Diversification: Fractional ownership allows investors to diversify their portfolios by investing in multiple properties rather than putting all their capital into a single real estate asset. For example, an investor could own fractions of several properties in different locations, helping to mitigate risk.

- Lower Maintenance Costs: In most fractional ownership schemes, the maintenance, repairs, and property management are handled by the developer or property management company. Investors don’t have to deal with the day-to-day upkeep of the property, which is particularly advantageous for those who want a more hands-off investment.

- Potential for Income: Depending on the structure of the fractional ownership arrangement, investors can use fractional property ownership to earn passive income from rental returns generated by the property when it is not being used by them. This income is typically distributed proportionally based on each investor’s share.

Cons:

- Limited Control: In fractional ownership, decisions regarding the property, such as when it is rented or sold, are made collectively among the owners. If there are disagreements or differing investment strategies, this lack of control can be a downside.

- Limited Use of the Property: The time spent using the property is typically divided according to each investor’s share. For example, if you own 1/10th of a property, you might have access to the property for one month per year. This can be a disadvantage if you intend to use the property more frequently.

- Exit Strategy: Selling a fractional share can be more complicated than selling a fully-owned property. Finding buyers for a fractional share can be more challenging, and the resale value may not always be as high as expected. In some cases, the property developer or management company may be the only entity able to facilitate a sale.

- Shared Risks: While fractional ownership offers the advantage of shared financial responsibility, it also means that the risks are distributed among all investors. If the property loses value or fails to generate the expected rental income, all owners share the burden.

Full Ownership in Dubai: The Pros and Cons

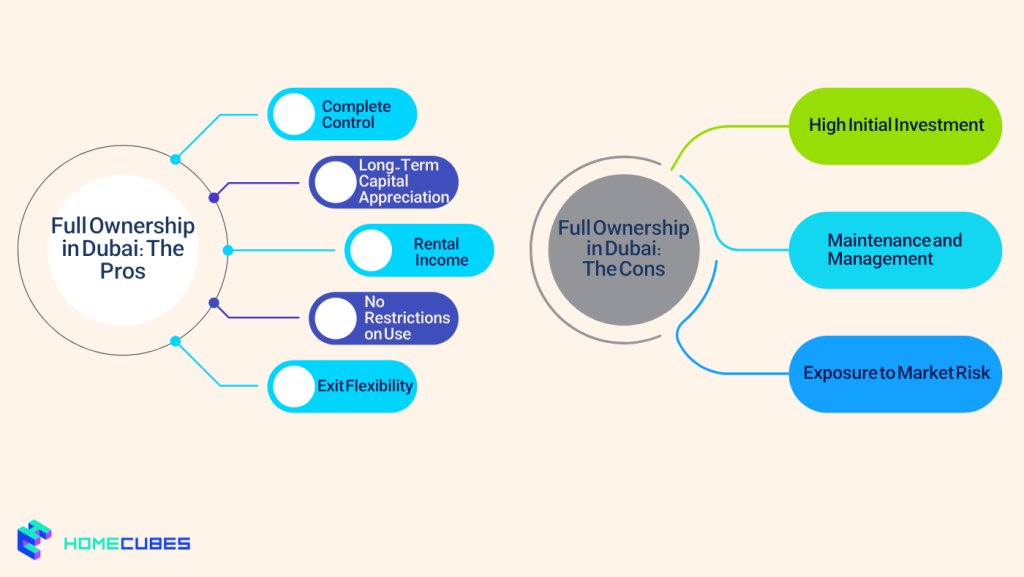

Pros:

- Complete Control: Full ownership provides total control over the property. Investors can make all decisions regarding the property’s use, whether that’s renting it out, renovating it, or selling it. This autonomy is particularly appealing to those who want to have full discretion over their investment.

- Long-Term Capital Appreciation: Dubai’s real estate market has historically shown strong potential for capital appreciation, especially in high-demand areas. Full ownership allows investors to fully benefit from any increase in property values over time. As an owner, you have the option to hold the property indefinitely, waiting for the right time to sell at a profit.

- Rental Income: Full ownership allows investors to rent the property out for short-term or long-term leases. Investors can choose how to manage the property and decide on rent prices without having to share income with other owners. This provides an opportunity to generate consistent cash flow.

- No Restrictions on Use: As a full owner, there are no restrictions on the amount of time you can spend at the property. This is particularly important for investors looking for second homes, vacation properties, or those who want to stay in their property frequently.

- Exit Flexibility: Selling a property that you fully own is often easier than selling a fractional share. There’s a broader market for fully-owned properties, and the investor has more freedom to choose when to sell and at what price.

Cons:

- High Initial Investment: The primary disadvantage of full ownership is the significant capital required to purchase a property outright. In Dubai, prices for luxury and prime real estate can be substantial, making it a more expensive option compared to fractional ownership.

- Maintenance and Management: Full ownership requires the investor to bear the costs and responsibility for maintenance, repairs, and property management. This can be time-consuming and costly, especially if the property is left vacant for extended periods.

- Exposure to Market Risk: While full ownership offers the potential for capital appreciation, it also exposes investors to greater market risks. Real estate values can fluctuate, and if the market experiences a downturn, the investor bears the full brunt of the loss.

Bottomline

Dubai’s real estate market offers opportunities for both types of investors, but the right choice will depend on the individual’s investment strategy and level of involvement in property management. For seasoned investors or those looking for a more hands-off investment, fractional ownership can be an appealing way to participate in Dubai’s booming property market. For those seeking long-term gains and the full benefits of property ownership, full ownership remains the gold standard.

Homecubes, as the leading fractional ownership platform focusing on the Dubai real estate market, has got exciting fractional ownership projects in the pipeline. Feel free to contact us for further information on fractional property investment opportunities in the Dubai real estate market.