Introduction

Dubai is rewriting the rules of property investment. Traditionally, investors needed millions of dirhams to buy into luxury apartments or villas. Today, however, they can participate in the market with just a few thousand through fractional property ownership in Dubai through blockchain, where multiple investors co-own an asset — often represented by blockchain tokens.

These platforms distribute rental income, capital appreciation, and ownership rights proportionally, unlocking opportunities for both local and international investors. As the Dubai Land Department (DLD) and the Virtual Assets Regulatory Authority (VARA) advance frameworks for tokenized real estate, the role of a reliable fractional real estate ownership platform in Dubai is more important than ever.

🚨JUST IN: 🇦🇪 Dubai hit $399M in tokenized real estate sales in May, 17.4% of all deals.

Habibis injecting TRILLIONS into #RWA🚀 pic.twitter.com/h0Z18Q9LTC

— Real World Asset Watchlist (@RWAwatchlist_) June 9, 2025

This guide explores the leading platforms, compares benefits and risks, breaks down fees, and shares expert insights into the future of tokenized real estate in Dubai.

Table of Contents

- Understanding Fractional Real Estate in Dubai

- Top Fractional Real Estate Ownership Platforms in Dubai

- Benefits of Fractional Real Estate Ownership

- Risks and Challenges

- Mistakes to Avoid

- Fees and Charges

- Case Study: Investing in Downtown Dubai

- Future Outlook for Fractional Platforms

- FAQs

- Final Thoughts

- Homecubes: Your Future Partner in Tokenized Real Estate

Understanding Fractional Real Estate in Dubai

Fractional ownership divides a property into smaller investment units. Instead of buying a full AED 5 million villa, an investor might purchase AED 50,000 worth of tokens representing legal ownership rights.

Blockchain and Tokenization

Blockchain ensures tamper-proof records and automated income distribution through smart contracts. This transparency reduces disputes and attracts global investors who may not otherwise trust cross-border transactions.

Legal Framework

Dubai regulators are actively shaping the space:

- DLD has launched a Real Estate Tokenization eService (REES).

- VARA published its Virtual Assets & Related Activities Regulations 2023, which provide licensing standards for tokenized property.

Together, these initiatives provide the foundation for secure fractional platforms.

Top Fractional Real Estate Ownership Platforms in Dubai

1. AqarChain

- One of the UAE’s early blockchain-based tokenization platforms.

- Focuses on allowing secondary trading of property tokens.

- Caters to investors seeking liquidity and long-term blockchain integration.

2. SmartCrowd

- Regulated by the Dubai Financial Services Authority (DFSA).

- Allows investments from as little as AED 500, making it one of the most accessible platforms.

- Provides detailed property due diligence reports.

- Offers regular rental income payouts and transparent cost structures.

- Popular among first-time investors who want exposure without committing large sums.

3. Stake

- Focused on premium residential properties in prime Dubai areas like Downtown and Marina.

- Minimum investment: AED 2,000.

- Known for strong international appeal, attracting investors from Europe and Asia.

- Provides buy-back options on certain properties, offering some liquidity flexibility.

- Stake reported record investor inflows in 2024, reflecting Dubai’s rising global status.

4. Realiste AI

- Leverages artificial intelligence to identify undervalued properties.

- Offers data-driven predictions about appreciation potential.

- Combines AI analytics with fractional ownership tokens to provide a tech-forward investment experience.

- Ideal for investors who want to blend real estate exposure with predictive data insights.

5. Homecubes

- Positioned as a next-generation fractional platform tailored for Dubai’s property market.

- Currently awaiting VARA license approval before launching to the public to fully comply with UAE regulation on asset tokenization.

- Plans to integrate rental automation, blockchain-based compliance, and cross-border investor onboarding.

- Homecubes’ long-term vision includes becoming a marketplace where international investors can seamlessly access tokenized Dubai assets.

- Investors can register interest through Homecubes’ contact page.

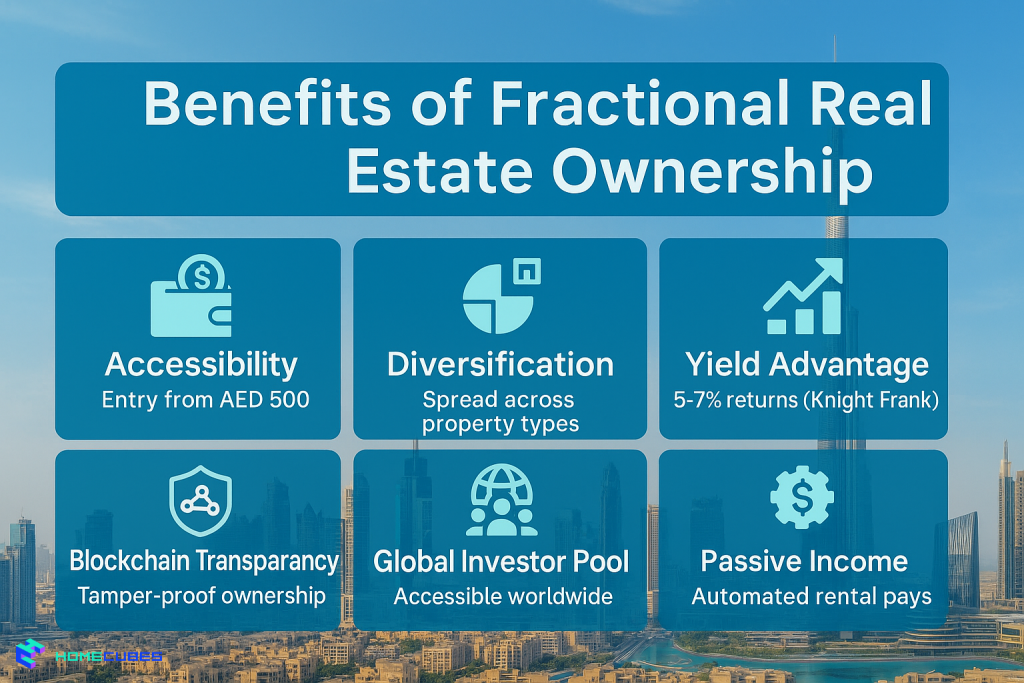

Benefits of Fractional Real Estate Ownership

- Accessibility – entry from AED 500 makes Dubai property affordable for small investors.

- Diversification – spread exposure across luxury apartments, villas, and offices.

- Yield Advantage – Knight Frank’s Destination Dubai 2025 shows yields of 5–7%, often higher than London, New York, or Singapore.

- Blockchain Transparency – tamper-proof ownership records build trust.

- Global Investor Pool – international buyers can participate remotely.

- Passive Income – smart contracts automate rental payouts with minimal friction.

Risks and Challenges

- Market Volatility – Fitch Ratings via Reuters warns of possible double-digit declines due to supply pressures.

- Liquidity Issues – secondary markets may lack enough buyers.

- Evolving Laws – regulations are still being refined, creating uncertainty.

- Platform Reliability – tech flaws or weak governance could harm investors.

- Over-optimism – assuming guaranteed profits can lead to poor decisions.

Mistakes to Avoid

- Failing to verify licensing with VARA or DFSA.

- Ignoring small but impactful fees.

- Investing all funds in one property.

- Expecting immediate liquidity.

- Neglecting to track policy updates.

Fees and Charges

- SmartCrowd: entry fee 1.5%, annual admin 0.5%, exit fee 2.5%.

- Stake: acquisition fee 1.5%, annual admin 0.5%.

Fees reduce net returns, so investors must calculate carefully before committing.

Case Study: Investing in Downtown Dubai

Investor Profile: Sarah, a 40-year-old professional from the UK.

Investment: AED 25,000 into a AED 2.5m apartment via Stake.

Outcome:

- Earned ~6% rental yield (AED 1,500 annually).

- Property value rose by 7% in a year, boosting token value.

- When attempting to resell, it took 4 weeks to find a buyer, highlighting liquidity risks.

This case shows how fractional ownership provides yield and appreciation but demands patience on exits.

Future Outlook for Fractional Platforms

- Regulatory Clarity – VARA’s licensing will raise confidence.

- CBDC Integration – PwC’s CBDC & Stablecoin Overview 2023 highlights settlement models that could integrate with tokenized property.

- Institutional Entry – REITs and funds may tokenize portfolios.

- Green Property Tokenization – aligned with Dubai 2040 Master Plan.

- Cross-border Growth – Dubai is poised to attract even more global investors seeking exposure to stable, high-yield real estate.

FAQs

- Is fractional real estate ownership legal in Dubai?

Yes. Co-ownership is legal, and tokenized models are under active regulatory rollout by VARA and DLD. - What is the minimum investment amount?

AED 500 with SmartCrowd, AED 2,000 with Stake. - Do investors earn rental income?

Yes, rental yields are distributed proportionally to investment shares. - Can foreigners participate?

Yes, foreign nationals can invest in freehold zones through these platforms. - How liquid are tokens?

Liquidity varies. Exits can take weeks, depending on buyer demand. - What fees apply?

Entry (1.5–2%), annual admin (0.5%), and exit fees (up to 2.5%). - Which areas are best for investment?

Downtown Dubai, Palm Jumeirah, Business Bay, and Dubai Marina. - What are the risks?

Market volatility, evolving laws, liquidity delays, and over-reliance on platforms. - How are taxes handled?

Dubai does not charge income or capital gains tax. Foreign investors should review home-country obligations. - Why Dubai?

Dubai combines high yields, rapid growth, global investor demand, and progressive regulation.

Final Thoughts

Fractional ownership is transforming how investors access Dubai’s property market. With smaller entry points, strong yields, and blockchain-backed transparency, these platforms open doors once reserved for the ultra-wealthy.

Challenges remain — especially around liquidity and evolving regulations — but choosing a licensed and trusted fractional real estate ownership platform in Dubai can help mitigate risks while capturing the city’s immense potential.

Homecubes: Your Future Partner in Tokenized Real Estate

At Homecubes, we’re developing a secure, transparent platform for Dubai’s fractional property investments.

⚠️ Important: Homecubes has applied for its VARA license. Our services will launch once approval is granted, ensuring compliance and investor protection.