Dubai’s real estate market has long been a magnet for investors, thanks to its luxurious properties, thriving economy, and strategic location. However, the traditional methods of financing property purchases—through banks, loans, and mortgages—are often complex, time-consuming, and can involve significant fees. This has created barriers for many potential investors, especially those looking for quicker, more flexible financial solutions.

Enter crypto lending—a revolutionary financial model that allows individuals to borrow or lend cryptocurrencies as collateral for real estate investments. As blockchain technology and cryptocurrency continue to gain acceptance worldwide, Dubai is embracing crypto lending as a new way to finance property transactions, offering speed, flexibility, and lower costs compared to traditional methods.

In this article, we explore how crypto lending is transforming property financing in Dubai and why it represents the future of real estate transactions in the city.

What is Crypto Lending?

Crypto lending is a decentralized finance (DeFi) service that allows users to borrow or lend digital currencies. Unlike traditional banks, which typically rely on fiat money and credit checks, crypto lending platforms use cryptocurrencies like Bitcoin, Ethereum, and stable coins as collateral for loans.

#Bitcoin backed mortgages are happening now. https://t.co/Aczia3PV1l

— The Wolf Of All Streets (@scottmelker) April 28, 2022

Crypto lenders provide loans based on the value of the collateral that secures the property loan through cryptocurrency. Borrowers can access liquidity quickly, while lenders can earn interest on their digital assets. For property financing, crypto lending can be used to obtain loans for purchasing real estate, refinancing existing properties, or funding development projects.

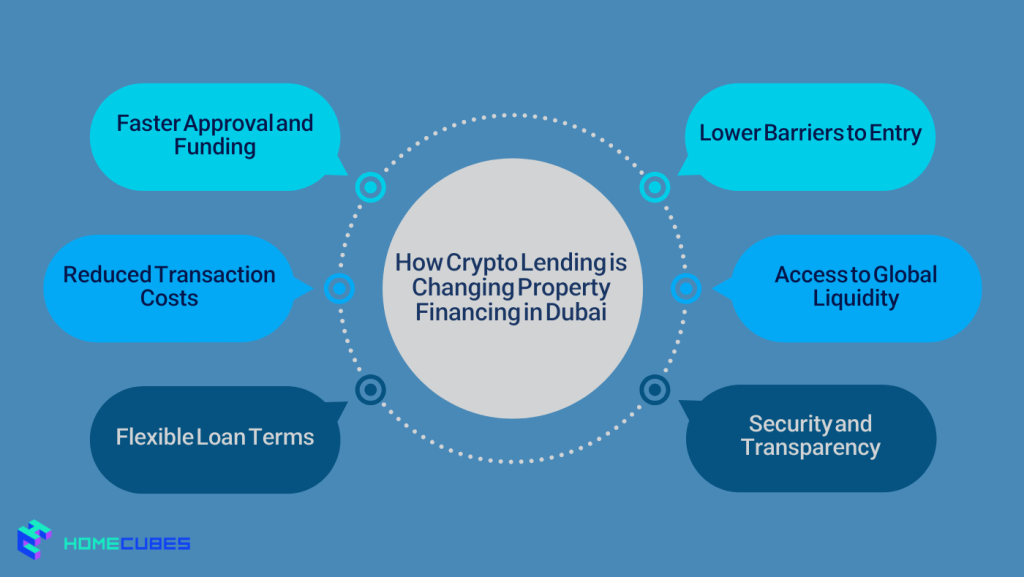

How Crypto Lending is Changing Property Financing in Dubai

Dubai is positioning itself as a global hub for crypto and blockchain innovation. The city’s adoption of crypto lending is already beginning to reshape how property transactions are financed, offering both local and international investors a faster, more efficient alternative to traditional methods.

1. Faster Approval and Funding

One of the most significant advantages of crypto lending is the speed of the approval process. Traditional bank loans for property purchases in Dubai can take weeks, sometimes even months, to process. The approval process involves paperwork, credit checks, income verification, and several rounds of documentation.

Generally speaking, crypto streamlines the property transactions in Dubai including property loan approval. Crypto lenders use automated systems to assess the collateral and determine loan terms, enabling borrowers to receive funds in as little as a few hours or days. This is a major advantage for property investors who need quick access to capital in a market as dynamic and fast-moving as Dubai’s.

This speed is particularly beneficial for investors looking to capitalize on time-sensitive opportunities, such as purchasing limited-edition developments or bidding on high-demand properties. Crypto lending offers a solution that bypasses the typical delays associated with traditional banks and financial institutions.

2. Lower Barriers to Entry

Traditional property financing often requires significant documentation, a solid credit score, and a large down payment. For many first-time buyers or international investors, these requirements can be difficult to meet.

Crypto lending, on the other hand, is based on digital assets as collateral, rather than credit scores or traditional financial records. Borrowers with substantial holdings in cryptocurrency can use their assets to secure a loan, regardless of their credit history. This opens the door to real estate financing for individuals who may not qualify for conventional loans.

In Dubai, where foreign investors play a significant role in the property market, crypto lending allows international buyers to participate more easily. They no longer have to worry about navigating the local banking system or meeting high down payment requirements. Instead, they can secure financing using their crypto holdings, whether from assets they’ve accumulated locally or from abroad.

3. Reduced Transaction Costs

Traditional property financing often comes with hidden fees, including administrative fees, processing costs, and closing charges. These costs can add up quickly and make property transactions more expensive.

Crypto lending platforms typically have lower operational costs compared to traditional banks, as they don’t rely on physical branches or a large workforce. This translates into lower fees for borrowers. In many cases, the only costs associated with a crypto loan are the interest and platform fees, which are generally more transparent and affordable than the costs associated with traditional loans.

For investors and property developers in Dubai, this reduction in costs can make a significant difference to overall returns, particularly for large-scale transactions. It can also help make property financing more accessible to a wider range of investors, including those with smaller capital reserves.

4. Access to Global Liquidity

Crypto lending platforms operate on a global scale, providing borrowers access to liquidity from anywhere in the world. Investors in Dubai’s real estate market can secure loans from crypto lenders based in different countries, which opens up more opportunities for both local and international property investors.

For foreign investors, crypto lending removes the need for local financial intermediaries or cross-border banking. They can use their cryptocurrency holdings to obtain a loan for property purchases in Dubai without having to deal with the complexities of international money transfers, foreign exchange rates, or local lending laws.

This global access to liquidity makes it easier for Dubai to attract international capital and allows local investors to diversify their sources of financing. It also helps to stabilize the property market by creating a broader pool of investors, making the market less reliant on traditional banks and local investors alone.

5. Flexible Loan Terms

Traditional real estate loans come with rigid repayment schedules and high penalties for early repayment. Crypto lending, however, often offers more flexible terms. Many crypto lending platforms allow borrowers to negotiate loan terms, including interest rates, repayment schedules, and loan durations. This flexibility allows property investors to better match their financing needs with their investment strategies.

Additionally, crypto loans often don’t have prepayment penalties. This is an advantage for investors who may want to refinance or pay off their loans early once they’ve achieved higher returns on their investments. In a dynamic market like Dubai’s, where property values can fluctuate, the flexibility offered by crypto lending platforms is a major benefit for investors seeking to maximize their returns.

6. Security and Transparency

One of the key benefits of crypto lending is the transparency and security provided by blockchain technology. All transactions are recorded on an immutable public ledger, which ensures transparency and traceability. Borrowers can easily track their loan terms, repayment status, and collateral.

Blockchain’s security features also help protect both borrowers and lenders. Smart contracts automatically enforce the terms of the loan, ensuring that both parties meet their obligations. If a borrower fails to repay the loan, the collateral is automatically liquidated to repay the lender, minimizing the risk for both parties.

For property investors in Dubai, this level of security offers peace of mind, especially when dealing with large sums of money or cross-border transactions.

How Dubai is Adopting Crypto Lending

Dubai has been quick to embrace blockchain technology and cryptocurrency, with the Dubai Blockchain Strategy aiming to make the city a global leader in blockchain innovation by 2025. This open-minded approach has created a favorable environment for crypto lending platforms to flourish.

Dubai’s Dubai International Financial Centre (DIFC) has also launched initiatives to regulate and support the growth of blockchain-based finance. This regulatory clarity provides a solid foundation for crypto lending platforms to operate securely within Dubai’s financial ecosystem, attracting both local and international investors.

Several fintech companies and crypto platforms in Dubai are already offering crypto-backed loans for real estate purchases. As the crypto market matures and more investors embrace digital currencies, crypto lending will likely become an even more integral part of property financing in the city.

Bottomline

Crypto lending is transforming property financing in Dubai by offering faster, more flexible, and cost-effective solutions for both local and international investors. By leveraging blockchain technology and cryptocurrency, crypto lending removes the barriers that have traditionally hindered access to Dubai’s real estate market. With lower fees, faster approval times, and flexible terms, it provides a new way for investors to secure funding for property purchases and development projects.

As Dubai continues to embrace innovation, crypto lending is likely to play an increasingly important role in the future of property financing.

For investors looking to take advantage of Dubai’s dynamic real estate market, Homecubes has prepared a licensed sophisticated real estate tokenization platform in Dubai. Contact us with confidence to take advantage of the opportunity to invest fractionally in premium properties in Dubai’s prime locations.