The UAE’s real estate market has always attracted global investors with its dynamic growth and lucrative opportunities. Now, a new model is emerging that is reshaping the way people invest in property: DAO-managed properties. Decentralized Autonomous Organizations (DAOs) are leveraging blockchain technology to transform property management and ownership in the UAE. Hence, DAOs offer a more transparent, secure, and efficient way for investors. This article explores the key benefits of investing in DAO-managed properties in the UAE and why this innovative approach is gaining momentum.

🚀 Into the #DAOVERSE : Reshaping Blockchain with Social Mining V2 by @TheDAOLabs

The future of blockchain is community-driven! Here’s how #DAOLabs is empowering communities with innovation, transparency, and rewards. 🧵👇 pic.twitter.com/YG4jwGzSgt

— soliphilic (@Abdulgafar3310) January 21, 2025

What Are DAO-Managed Properties?

A DAO (Decentralized Autonomous Organization) is a blockchain-based organization that operates without centralized leadership, where decisions are made through a consensus mechanism. In the context of real estate, DAO-managed properties refer to properties where the ownership and management decisions are made collectively by a group of investors who participate in the DAO. These investors are typically token holders who vote on important decisions, such as property acquisitions, management strategies, and profit distribution.

DAO-managed properties take advantage of the transparency, security, and automation provided by blockchain technology, offering a more streamlined and democratic alternative to traditional property investment methods.

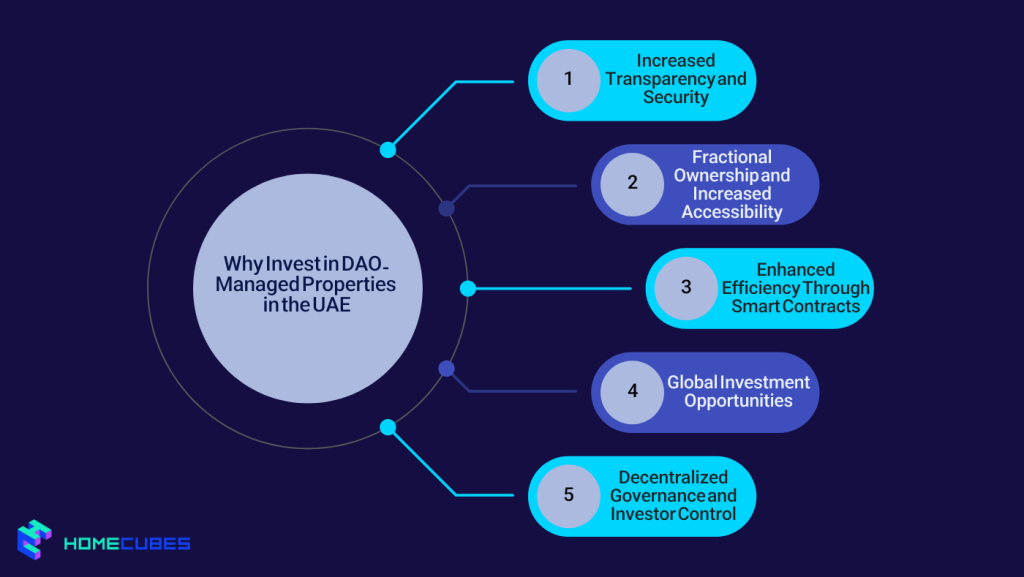

Why Invest in DAO-Managed Properties in the UAE?

1. Increased Transparency and Security

Transparency is a significant concern for traditional real estate investments, where investors often rely on third parties for information about property management, finances, and transactions. DAO-managed properties, on the other hand, operate on a blockchain, which provides full visibility into every decision and transaction made by the organization. Blockchain securely records all transactions and ownership details. That would make it easy for investors to verify the status of their investments in real-time.

The decentralized nature of DAOs also reduces the risk of fraud and mismanagement. Without a central authority, all decisions are made collectively, and smart contracts automatically enforce agreed-upon actions. That would be ensuring of all investors; interests protection.

- Blockchain Transparency: Blockchain records every action and transaction. That would ensure transparency and traceability.

- Security and Trust: Decentralization eliminates the risk of fraudulent activities and enhances security for all parties involved.

2. Fractional Ownership and Increased Accessibility

One of the most appealing aspects of DAO-managed properties is the ability to invest in fractional ownership. Traditional real estate investments often require large capital commitments, which can be a barrier for many potential investors. DAO-managed properties, however, allow investors to purchase tokens representing fractional ownership of a property, thus lowering the entry threshold for real estate investments.

This tokenization of assets also makes it easier to buy, sell, or transfer ownership of real estate. Investors can liquidate their shares or purchase additional tokens with ease, providing more flexibility and access to capital. As a result, DAO-managed properties democratize access to high-value real estate assets. That’s why the role of DAO in tokenization real estate for small investors in the UAE is significant by enabling them to participate in the UAE’s thriving property market.

- Lower Entry Barriers: Fractional ownership allows investors to participate with smaller capital contributions.

- Liquidity: Investors can easily buy or sell their tokens, providing greater flexibility and easier exit options.

3. Enhanced Efficiency Through Smart Contracts

DAO-managed properties leverage smart contracts. They are self-executing agreements programmed to automatically fulfil contract terms when predefined conditions are met. In the context of property management, smart contracts can handle tasks such as rent collection, property maintenance, and profit distribution without requiring human intervention.

For example, when tenants pay the rent, smart contracts can automatically distribute the revenue to investors based on their ownership share, ensuring a seamless and transparent process. This reduces administrative costs, eliminates errors, and accelerates processes, creating a more efficient and streamlined real estate investment experience.

- Automation: Smart contracts reduce the need for intermediaries and automate administrative processes.

- Faster Transactions: The automation of tasks such as rent collection and profit distribution speeds up real estate investment processes.

4. Global Investment Opportunities

DAO-managed properties are inherently borderless. Since DAOs operate on blockchain networks, investors from around the world can easily participate in property investments in the UAE, regardless of their location. This opens up the UAE’s real estate market to a global pool of investors, creating a more diverse and dynamic investment ecosystem.

For international investors, DAO-managed properties eliminate the challenges of currency exchange, international banking systems, and complex regulations. By investing in tokenized properties, they can participate in the UAE’s real estate market with ease and benefit from the country’s stable economic and political environment.

- Global Accessibility: Investors from anywhere in the world can participate in DAO-managed property investments in the UAE.

- Elimination of Cross-Border Barriers: Blockchain technology eliminates the challenges of currency conversion and international regulations.

5. Decentralized Governance and Investor Control

Unlike traditional property investment models, where management decisions are made by a centralized authority or company, DAO-managed properties give investors a direct say in the decision-making process. Through voting rights, token holders have the power to participate in key decisions such as property acquisitions, rent prices, and distribution of profits.Hence, DAO empowers property owners in Dubai through collective decision making.

This decentralized governance structure ensures that all investors have an equal voice in managing the property. This would create a more democratic investment environment. Investors can feel more confident in the management of their assets, knowing that decision making process happens collectively and in their best interests.

- Investor Empowerment: Token holders have voting rights, allowing them to influence key property management decisions.

- Decentralized Control: Decision-making is shared among all investors, ensuring fair and transparent management.

The Future of DAO-Managed Properties in the UAE

1. Wider Adoption of Blockchain in Real Estate

As blockchain technology continues to evolve, it is expected that more real estate developers and property managers in the UAE will embrace DAO models to manage their properties. The advantages of increased transparency, reduced costs, and decentralized governance make DAO-managed properties an attractive option for both investors and developers. As a result, the UAE is likely to see broader adoption of DAO-managed real estate models across both residential and commercial properties.

- Expansion of DAO-Managed Properties: More developers will explore DAO models for property management and ownership.

- Mainstream Blockchain Adoption: Blockchain technology will play a central role in the future of real estate investment in the UAE.

2. Regulatory Frameworks for DAO Investments

The UAE is known for its forward-thinking approach to technology and finance, and regulatory frameworks for DAO investments are expected to follow suit. As more DAO-managed properties emerge, the government may introduce clearer regulations to ensure the legality and security of these investments, fostering investor confidence and encouraging growth in the sector.

- Clearer Regulations: The UAE government may develop specific guidelines for DAO-managed real estate investments.

- Legal Recognition of DAO Models: As DAOs gain momentum, regulatory clarity will provide a solid foundation for their widespread adoption.

Challenges of DAO-Managed Properties

While the benefits of DAO-managed properties are clear, challenges remain in terms of legal recognition, technical adoption, and market education. The concept of decentralized ownership may take time to gain full acceptance, and the legal framework around DAOs is still evolving.

- Regulatory Uncertainty: The legal landscape for DAO-managed properties in the UAE is still developing.

- Technological Barriers: The widespread adoption of blockchain and DAO models may require significant investment in technology and education.

Bottomline

Investing in DAO-managed properties in the UAE offers significant advantages in terms of transparency, security, fractional ownership, and global accessibility. By leveraging blockchain technology and decentralized governance, DAO-managed properties provide a more efficient and democratic alternative to traditional real estate investments. As the concept gains momentum and regulatory frameworks evolve, DAO-managed properties are set to become a mainstream investment vehicle, opening up exciting new opportunities for both local and international investors in the UAE’s thriving real estate market.

Homecubes has designed their real estate fractional ownership platform in full compliance with UAE regulation on asset tokenization. Feel free to contact us for further information on our lucrative fractional real estate investment opportunities in the Dubai real estate market.