Introduction

Residency by investment has become a defining trend of the 2020s. Governments worldwide are offering residency or citizenship to attract capital, talent, and innovation. Among the most discussed programs in 2025 are the UAE Golden Visa and the U.S. Gold Card.

The UAE’s scheme has been live since 2019, welcoming thousands of entrepreneurs, investors, and professionals. The U.S. “Gold Card,” meanwhile, was announced in early 2025 by President Trump as a new $5 million investor residency path. But unlike the UAE Golden Visa, it is still at proposal stage and not yet written into USCIS regulations.

This article compares UAE Golden Visa vs U.S. Gold Card, alongside the existing U.S. EB-5 program, to give global investors a clear view of opportunities, challenges, and costs in 2025.

Table of Contents

- What Is the UAE Golden Visa?

- What Is the US Gold Card? (2025 Proposal)

- EB-5: The Current US Investor Visa

- Eligibility Requirements Compared

- Investment Thresholds and Fees

- Lifestyle and Family Benefits

- Residency Stability and Long-Term Security

- Taxation and Financial Implications

- Case Study: Investor Choosing Between UAE and US

- Fees and Charges Explained

- Mistakes to Avoid in Residency Planning

- Risks and Challenges in 2025

- Which Option Suits Global Investors Best?

- FAQs

- Final Thoughts

- Building the Future with Homecubes

What Is the UAE Golden Visa?

Launched in 2019, the UAE Golden Visa provides renewable 5- or 10-year residency for investors, entrepreneurs, professionals, and exceptional talents.

Benefits include:

- No need for a local sponsor.

- Residency for family (spouse, children up to age 25, sometimes parents).

- Permission to own mainland companies.

- Access to Dubai’s thriving real estate and financial markets.

According to CBRE’s UAE Real Estate Market Review Q1 2024, residential prices in Dubai rose 20.7% year-on-year, highlighting the city’s continuing appeal to Golden Visa investors (CBRE).

What Is the US Gold Card? (2025 Proposal)

🚨 The United States has introduced a new ‘gold card’ visa programme requiring a $5 million investment, replacing the EB-5 visa. pic.twitter.com/SLFANXfi5w

— Indian Tech & Infra (@IndianTechGuide) February 26, 2025

In February–March 2025, President Trump announced a new “U.S. Gold Card” program requiring a $5 million investment. The idea is to provide high-net-worth individuals with a fast-track to U.S. residency, positioning it as a competitor to global Golden Visa programs.

As of September 2025:

- It remains a proposal, not an official USCIS visa category.

- No regulations, forms, or USCIS application pathways have been published.

- Media reports suggest it may replace or supersede EB-5, but details are pending.

This means global investors should treat the U.S. Gold Card as announced, not enacted.

EB-5: The Current US Investor Visa

Until the Gold Card is formalized, the EB-5 Immigrant Investor Visa remains the U.S.’s official route for investment residency:

- $1,050,000 standard minimum investment.

- $800,000 for Targeted Employment Areas (TEAs) or infrastructure projects.

- Must create or preserve 10 full-time U.S. jobs.

These requirements are published and enforced by USCIS (USCIS EB-5 Program).

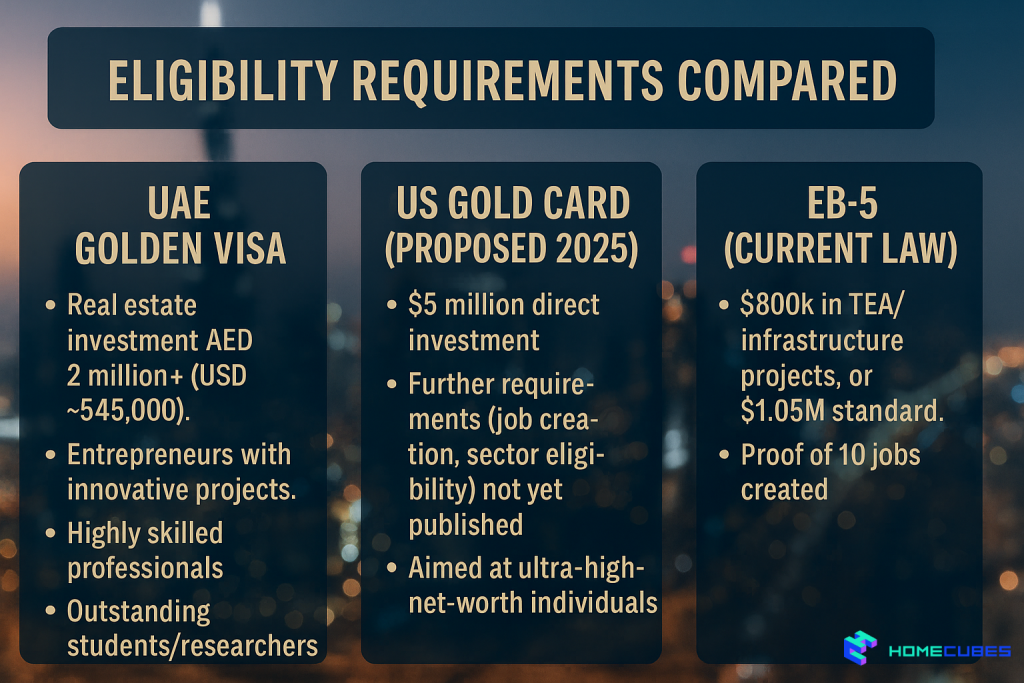

Eligibility Requirements Compared

UAE Golden Visa

- Real estate investment AED 2 million+ (USD ~545,000).

- Entrepreneurs with innovative projects.

- Highly skilled professionals.

- Outstanding students/researchers.

US Gold Card (Proposed 2025)

- $5 million direct investment.

- Further requirements (job creation, sector eligibility) not yet published.

- Aimed at ultra-high-net-worth individuals.

EB-5 (Current Law)

- $800k in TEA/infrastructure projects, or $1.05M standard.

- Proof of 10 jobs created. (USCIS EB-5)

Investment Thresholds and Fees

- UAE Golden Visa: AED 2M property (~USD 545,000). Fees around USD 3–5k.

- US Gold Card (Proposal): USD 5 million. Details on fees pending.

- EB-5: USD 800k–1.05M + USCIS/attorney fees of USD 10–20k.

Lifestyle and Family Benefits

UAE Golden Visa

- Tax-free income.

- Residency for the entire family.

- Safe, global hub lifestyle.

US Gold Card (Proposed)

- Would likely include family sponsorship, but terms not released.

- U.S. residency rights with pathway to Green Card possible, pending policy.

EB-5

- Includes spouse and unmarried children under 21.

- Pathway to permanent residency.

Residency Stability and Long-Term Security

- UAE: Renewable 5- or 10-year residency, not citizenship.

- US Gold Card: Unknown; not yet codified.

- EB-5: Direct path to Green Card, then U.S. citizenship after 5 years.

Taxation and Financial Implications

- UAE: 0% personal income tax, 0% capital gains.

- US (Gold Card/EB-5): Federal + state taxes apply, with top brackets up to 37% in 2025 (IRS).

Case Study: Investor Choosing Between UAE and US

Scenario: A 42-year-old entrepreneur with USD 6 million.

- Option A – UAE Golden Visa

- Invests AED 2.5M in Downtown Dubai.

- Gains 10-year renewable residency.

- Retains tax-free status and can expand into Web3 startups.

- Option B – U.S. Gold Card (Proposed)

- Invests USD 5M in U.S. qualifying assets (details pending).

- Gains potential fast-track residency once the program is active.

- Subject to global taxation.

- Option C – EB-5

- Invests USD 800k in TEA project.

- Waits through USCIS processing for conditional residency.

- Eventually applies for Green Card and citizenship.

Fees and Charges Explained

- UAE Golden Visa: AED 2,800–3,800 per applicant.

- U.S. Gold Card: To be announced.

- EB-5: USCIS I-526E filing ($3,675) + attorney fees + admin charges.

Mistakes to Avoid in Residency Planning

- Believing the U.S. Gold Card is already available.

- Ignoring taxation differences (UAE = 0%, U.S. = global).

- Failing to budget for hidden costs (legal, processing, dependents).

- Choosing without aligning with lifestyle or family priorities.

Risks and Challenges in 2025

- UAE: Regulatory tightening (e.g., VARA oversight of tokenization).

- US Gold Card: Still a proposal; investors cannot yet apply.

- EB-5: Long backlogs and strict compliance requirements.

Which Option Suits Global Investors Best?

- For speed, affordability, and tax efficiency: UAE Golden Visa.

- For long-term citizenship in a major economy: EB-5 (current law).

- For ultra-wealthy investors: Gold Cards may become attractive, but only once regulations are live.

FAQs

- Is the U.S. Gold Card available now?

No — it has been announced but not enacted. - What is the minimum UAE Golden Visa investment?

AED 2 million in property (~USD 545,000). - How does EB-5 differ from Gold Card?

EB-5 is live law (USD 800k+ job creation). Gold Card is proposed at USD 5M. - Do U.S. Gold Card or EB-5 holders pay global tax?

Yes, all U.S. residents are taxed globally. - Does the UAE Golden Visa give citizenship?

No, only long-term renewable residency.

Final Thoughts

The UAE Golden Visa vs US Gold Card debate shows two very different directions. The UAE offers a proven, cost-efficient, tax-friendly residency path, while the U.S. proposal raises the bar with a $5M requirement — but is still not live. For most global investors in 2025, the UAE Golden Visa or EB-5 remain the only concrete, actionable options.

Building the Future with Homecubes

At Homecubes, we help investors use their Golden Visa pathway to enter Dubai’s booming property market through fractional ownership. Our platform will soon allow investors to buy shares of properties at low entry points, making Dubai real estate accessible to all.

We are currently awaiting approval of our VARA license for real estate tokenization. Once approved, Homecubes will provide secure, transparent, and innovative property investment opportunities to align with Dubai’s global leadership in smart property markets.

👉 Begin your journey today: Contact Homecubes.