Table of Contents

- Introduction

- What Is the Mollak System?

- Regulatory Framework and DLD Oversight

- Key Features of the Mollak System

- Who Uses Mollak and Why It Matters

- Benefits for Property Owners and Investors

- Registration Process for Jointly Owned Properties

- Mollak for Property Managers and OA Companies

- Step-by-Step: How Mollak Streamlines Service Charges

- Integration with Dubai REST and Other Platforms

- Case Study: Successful Implementation in a Mixed-Use Tower

- Common Mistakes to Avoid When Using Mollak

- Fees and Charges Associated with Mollak

- Frequently Asked Questions

- Conclusion

- Partner with Homecubes for Smarter Ownership Solutions

Introduction

Jointly owned properties in Dubai—such as apartment buildings, gated communities, and mixed-use towers—require transparent and efficient financial governance. To ensure accountability, service charge transparency, and owner rights, to play its constructive role in Dubai’s real estate market, Dubai’s Real Estate Regulatory Agency (RERA) introduced the Mollak System.

The Mollak System Dubai is a centralized, digital platform developed to regulate the budgeting, auditing, and management of shared property service fees. Whether you are a homeowner, property investor, or Owners Association (OA) manager, understanding how Mollak works is essential for compliance and financial clarity in Dubai’s competitive real estate market.

This guide walks you through the platform’s structure, benefits, and practical use cases—offering insights to help you manage your property ownership smarter and legally sound.

What Is the Mollak System?

Are you worried about service fees when investing in Dubai real estate? They are regulated! Dubai’s Mollak system prevents overcharging, and whilst future fees can’t be predicted, today’s rates offer guidance#DubaiRealEstate #MollakSystem #ServiceFees #PropertyInvestment pic.twitter.com/8tumks3ORS

— Steven Leckie (@StevenLeckie) March 31, 2025

Mollak (Arabic for “owners”) is a digital system introduced by RERA under the Dubai Land Department (DLD) to manage all aspects of jointly owned property service charge billing and governance.

Launched in 2019, the system addresses widespread concerns about:

- Unregulated service charges

- Lack of transparency from property management companies

- Poorly maintained owner accounts

Mollak replaces fragmented manual processes with a unified online system where:

- Owners Associations register

- Budgets are submitted and approved

- Service charges are reviewed and audited

- Owners receive clear invoices

- Payments are tracked and enforced

Core Goals of Mollak:

- Transparency in shared expenses

- Fair and government-approved budgeting

- Compliance with jointly owned property laws

- Data-driven financial accountability

Regulatory Framework and DLD Oversight

The legal foundation of the Mollak System stems from:

- Law No. (6) of 2019 on Jointly Owned Real Property

- Executive Resolution No. (6) of 2010

- RERA Circulars regulating OA activities and escrow account mandates

Mollak ensures:

- All jointly owned properties register their Owners Association

- RERA’s approval on all service charge budgets.

- OA managers deposit funds in RERA-monitored escrow accounts

DLD and RERA regularly audit the financials and practices of these associations through Mollak.

RERA new regulations impact home buyers in Dubai, so you must make sure to be aware of all changes on the regulations and instructions, when buying a property in Dubai.

Key Features of the Mollak System

| Feature | Description |

| Budget Submission | OA companies must submit detailed budgets annually for RERA approval |

| Escrow Integration | All funds are held in RERA-monitored escrow accounts, not in private company accounts |

| Owner Dashboard | Owners view real-time statements, service charge invoices, and payment history |

| Auditing | Annual audits are mandatory and submitted through the platform |

| Dispute Resolution | Owners can challenge service charges or report mismanagement directly via the system |

Who Uses Mollak and Why It Matters

Stakeholders who interact with Mollak include:

- Property Owners: Monitor charges, track payments, and review OA governance

- Owners Associations (OA): Submit budgets, manage funds, and maintain compliance

- Property Managers: Handle operational costs transparently and ensure reporting

- Auditors and Consultants: Review financials and verify RERA standards

The Mollak System is mandatory for any jointly owned property registered in Dubai—especially multi-unit developments.

Benefits for Property Owners and Investors

🧾 Financial Clarity

Every invoice, charge, and budget item is visible to all owners.

🛡️ Investor Confidence

Buyers prefer properties under Mollak governance due to reduced risk of hidden liabilities.

🔍 Audited Oversight

RERA ensures OAs operate within budget and avoid overcharging.

📱 Digital Convenience

Everything from dispute submission to payment is doable online.

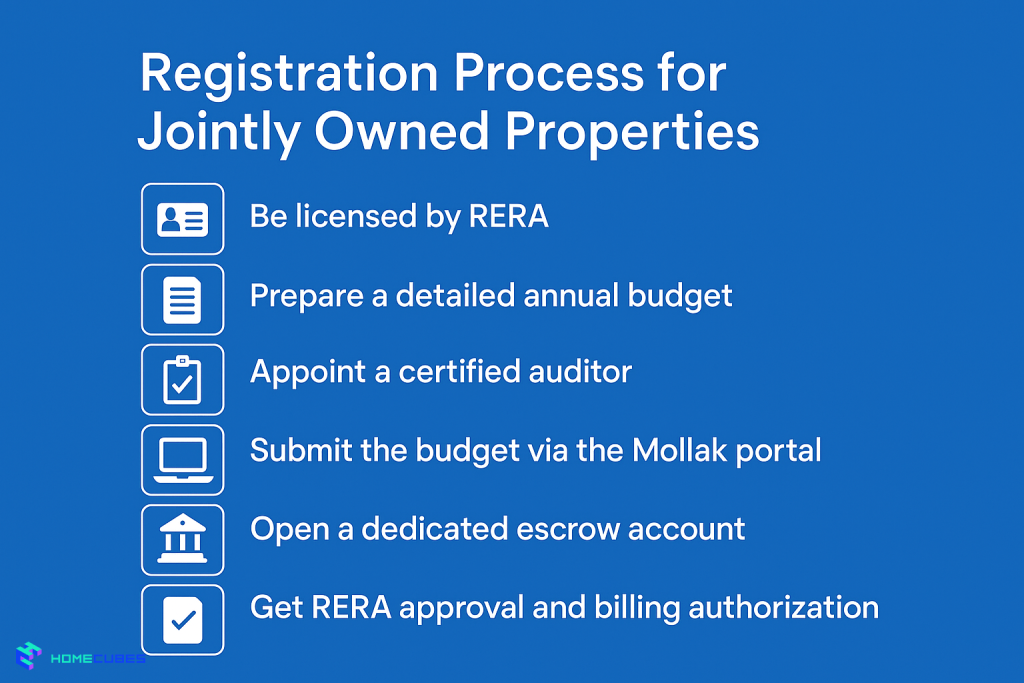

Registration Process for Jointly Owned Properties

To register under the Mollak System, the Owners Association must:

- Be licensed by RERA

- Prepare a detailed annual budget

- Appoint a certified auditor

- Submit the budget via the Mollak portal

- Open a dedicated escrow account

- Get RERA approval and billing authorization

Once approved, owners receive e-notifications and can log in to view their property’s financial status.

Mollak for Property Managers and OA Companies

Property management firms and OA companies must be:

- RERA-certified

- Digitally integrated with Mollak

- Transparent in budget reporting

They must also:

- Submit quarterly financial updates

- Handle owner payment reminders

- Resolve disputes fairly and promptly

Step-by-Step: How Mollak Streamlines Service Charges

- Budget Preparation

OA submits annual expenses (maintenance, cleaning, security, insurance) - RERA Review & Approval

Budget is either approved, adjusted, or rejected - Invoicing via Mollak

Each owner gets a detailed breakdown of costs by unit size - Escrow Deposit

All payments are sent directly to a RERA escrow account - Spending and Monitoring

Property managers request fund releases for approved expenses - Audits and Reporting

Annual audit reports are submitted for review and retention

Integration with Dubai REST and Other Platforms

Mollak works seamlessly with other DLD digital platforms:

- Dubai REST App: View ownership records, service charges, and OA info

- Oqood: Due to the rising popularity of off-plan properties in Dubai, Oqood was introduced to connect Mollak with off-plan property status

- Trakheesi: Ensures all involved professionals are licensed

This integration promotes a single-window system for all property stakeholders in Dubai, so make sure to go through a comprehensive introduction to the Dubai REST app, in order to make things easier during your investment/property purchase journey.

Case Study: Successful Implementation in a Mixed-Use Tower

Location: Jumeirah Village Circle (JVC)

Building: 30-floor residential-commercial tower

Issue: Tenants complained about inconsistent service charges, late repairs, and lack of transparency

Action Taken:

- OA registered on Mollak

- Budget submitted and revised under RERA

- Escrow account implemented

- Service vendors selected through audit-approved bidding

Result:

- 27% drop in owner complaints

- Timely maintenance

- Transparent billing led to 95% service fee collection rate within 6 months

Common Mistakes to Avoid When Using Mollak

- Failing to Register OA Properly: Without registration, properties are non-compliant

- Skipping Budget Reviews: Leads to RERA rejection and processing delays

- Misuse of Escrow Funds: Results in penalties and OA suspension

- Owner Communication Gaps: Leads to late payments and disputes

- Delaying Annual Audits: Mandatory audit delays freeze budget approvals

- Outdated Contact Info: Owners won’t receive digital notifications or payment links

Fees and Charges Associated with Mollak

| Service | Fee Estimate |

| Budget Submission | Free (included in OA license) |

| Service Charge Registration | 0.25% of total budget |

| Escrow Account Setup | AED 500–1000 (bank dependent) |

| Auditor Fees | AED 3000–8000 annually |

| Owner Access & Use | Free |

| Penalties for Non-Compliance | Varies based on issue |

Confirm current rates via DLD’s Mollak Portal

Frequently Asked Questions

How much are Mollak service charges and fees?

Mollak itself does not set service charges; instead, Owners Associations propose annual budgets that must be approved by RERA through the Mollak system. Service charges typically range from AED 3 to AED 30 per square foot annually, depending on the property type, location, and amenities. Additionally, Mollak registration incurs a 0.25% fee on the total approved service charge budget, paid by the Owners Association. Owners can verify exact fees through the DLD’s Service Charge Index.

Is Mollak mandatory for all properties?

Yes, any jointly owned property must be registered under Mollak to ensure service charge transparency.

How can owners access Mollak?

Through the Dubai REST mobile app, using their Emirates ID or title deed details.

What if my property is not on Mollak?

You may file a complaint with RERA, or request your OA to complete registration.

Can owners dispute service charges?

Yes. Owners may raise disputes directly via Mollak, which then RERA reviews them.

Is Mollak linked to the title deed or Ejari?

It links to both, ensuring each registered owner or tenant is traceable for billing and compliance.

Does Mollak apply to villas in gated communities?

Yes, if the development has shared services like security, landscaping, or maintenance.

Can I view unpaid balances or historical invoices?

Yes, all statements and invoices are recorded in your Mollak account dashboard.

Conclusion

The Mollak System Dubai is a landmark shift toward greater accountability, digital transformation, and owner empowerment in Dubai’s real estate sector. It ensures that service charges are fair, approved, and transparent—helping investors and residents alike enjoy peace of mind.

Whether you’re a first-time buyer in a joint development or a seasoned investor, staying compliant with Mollak requirements is no longer optional—it’s essential.

Partner with Homecubes for Smarter Ownership Solutions

At Homecubes, we’re focused on guiding owners through the evolving legal and digital landscape of Dubai real estate. While our tokenized real estate platform is currently pending final VARA approval, our team continues to offer resources, education, and expert insights on systems like Mollak.

🔍 Thinking of buying into a jointly owned property?

📄 Unsure how Mollak affects your co-ownership or division agreements?

Let us walk you through legal structuring, service fee expectations, and long-term value protection.

👉 Contact Homecubes — your future in compliant, smart real estate starts here.