Introduction: Sustainability Meets Investment

The UAE has established itself as a leader in sustainable innovation, pledging to reach net-zero emissions by 2050 and developing green building standards like Estidama and the Dubai Green Building Regulations. As a result, green real estate — properties built or retrofitted with environmental sustainability in mind — has emerged as a booming investment sector.

The UAE has set records in:

– solar, from the biggest single site power plant to a world leading desalination plant

– wind, creating wind farms that can operate in rough seas and at low speeds

– nuclear, with all four units of the Barakah Nuclear Power Plant fully operational pic.twitter.com/JUgLBgj1ZU

— Visegrád 24 (@visegrad24) January 15, 2025

However, despite the growing interest, not all investments in green properties are equally sound. Many investors unknowingly fall into avoidable traps, misreading the market or overestimating returns. In this guide, we explore 9 critical Green Real Estate Mistakes you must avoid when navigating the UAE’s eco-conscious property market.

1. Ignoring Certification Standards Like LEED and Estidama

One of the most common mistakes investors make is assuming a project is “green” just because it’s marketed as such.

Why It Matters

A project must comply with internationally or locally recognized green building standards like:

- LEED (Leadership in Energy and Environmental Design)

- Estidama Pearl Rating System (specific to Abu Dhabi)

- Dubai Green Building Regulations

Without these certifications, the environmental claims may be superficial, offering no real benefits in terms of utility savings or tenant demand.

What to Do Instead

Always verify whether a development has:

- A valid UAE green building certification

- Achieved at least LEED Silver or 2 Pearl rating

- Independent third-party environmental audits

It is always a good idea to equip yourself with relevant knowledge for making smart decisions. Obviously, it is impossible for all investors to have a detailed knowledge about the green building standards. However, it would be helpful to at least understand the steps to evaluate climate resilience in the UAE real estate market.

2. Overlooking Operation and Maintenance Costs

Even the greenest buildings can become inefficient without proper upkeep. Many investors only evaluate design-stage sustainability and neglect operational performance.

Common Issues

- Poor HVAC maintenance

- Aging smart systems that aren’t updated

- Lack of tenant education on energy-saving features

Investor Tip

Ask for:

- The building’s ongoing energy performance data

- Service contracts for sustainability systems (solar, greywater reuse, etc.)

- Property management’s green compliance experience

3. Misjudging Tenant Demand for Green Features

Even though the green and sustainability is probably among the trends that shape the UAE rental yield in 2025, it’s a mistake to assume that just because a property is sustainable, tenants will pay a premium for it.

Reality Check

Not all tenants understand or value environmental benefits — especially in budget-focused segments.

Best Practice

Focus on:

- Mixed-use or commercial assets with ESG-aligned tenants

- High-net-worth residential zones (like Downtown Dubai, Saadiyat Island)

- Educated investor pools or occupants more likely to value sustainability

4. Believing All Green Developments Are Profitable

Green doesn’t always mean lucrative. Some projects are poorly located, mismanaged, or overcapitalized on “eco” features that don’t translate to value.

Examples of Poor Green ROI

- Overly remote “eco-villas” with no amenities or transport links

- Projects that emphasize sustainability at the cost of livability

- Developments marketed heavily on green buzzwords but lacking demand

What You Should Do

Conduct full feasibility studies including:

- Market demand analysis

- Comparative rent/sale pricing for similar green and non-green assets

- Occupancy rates for certified buildings in the same zone

5. Failing to Align With UAE’s Green Investment Roadmap

UAE Vision 2031 and the National Green Growth Strategy outline specific areas targeted for sustainable development. Failing to align with these zones or asset types may result in missed incentives or lower future demand.

Current Government Focus Areas

- Masdar City (Abu Dhabi)

- Dubai South near Al Maktoum Airport

- Sharjah Sustainable City

- Ras Al Khaimah’s Energy Efficiency and Renewables Strategy 2040

Mistake to Avoid

Don’t invest in “green-themed” developments that lie outside government-supported infrastructure or policy zones — these areas may struggle with uptake or resale value.

Investor Advantage

Projects in alignment with government zones may be eligible for:

- Tax exemptions

- Green financing

- Priority permitting

You can explore policy alignment at UAE Ministry of Climate Change and Environment.

6. Underestimating the Role of Smart Technologies

Many investors think energy efficiency begins and ends with solar panels. In reality, smart automation is just as important for long-term energy savings.

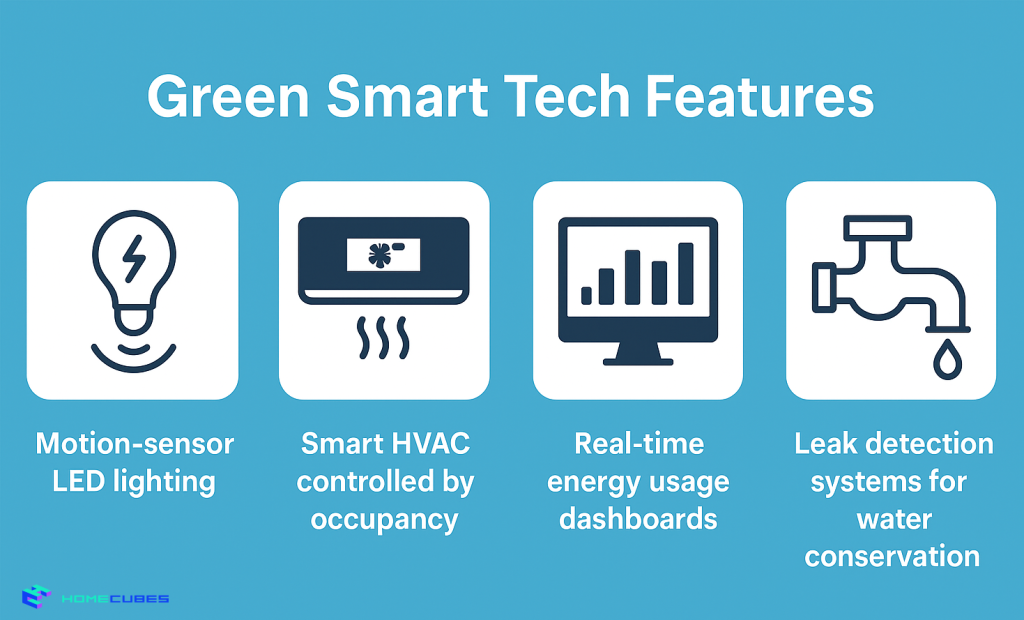

Green Smart Tech Features

- Motion-sensor LED lighting

- Smart HVAC controlled by occupancy

- Real-time energy usage dashboards

- Leak detection systems for water conservation

Mistake to Avoid

Assuming a building is “green enough” without evaluating its smart integration and energy monitoring capabilities.

7. Ignoring Retrofit Opportunities

Most investors focus only on newly built green-certified buildings, but there’s massive opportunity in retrofitting existing stock.

Why Retrofit Investments Are Smart

- Higher returns per dirham spent (due to lower entry price)

- Access to UAE’s retrofit incentives (Dubai Supreme Council of Energy)

- Fast-tracked permitting in some emirates

What to Avoid

- Assuming old buildings can’t be profitable

- Ignoring carbon savings of retrofits (important for ESG investors)

8. Missing Out on Green Financing Options

UAE banks and funds offer special products for green investments — and many investors don’t leverage them.

Available Green Financial Instruments

- Green mortgages with lower interest rates

- Sustainability-linked loans for developers

- Green Sukuk (Islamic bonds) issued to fund ESG projects

Example: In 2023, Mashreq Bank launched its Green Home Finance Program, offering a 0.25% discount on interest rates.

Mistake to Avoid

Relying on conventional financing and missing these incentives.

9. Overlooking Resale and Exit Strategy

Sustainability doesn’t automatically guarantee higher resale value. If the property lacks brand name, location advantage, or community integration — even green assets can underperform.

Exit Strategy Considerations

- Is the area appreciating overall?

- Is there a track record of green resales in the community?

- Can the building’s green features be independently audited during resale?

Smart Exit Planning

- Work with RERA-certified agents who specialize in ESG assets

- Request a Green Building Passport (a growing trend in UAE)

- Time your exit to coincide with policy shifts or COP events in the UAE

Summary Table: Mistakes and How to Avoid Them

| Mistake | What to Avoid | Smart Action |

| 1. Ignoring certification | Trusting marketing over proof | Demand LEED/Estidama |

| 2. Overlooking maintenance | Relying on initial design only | Review O&M plans |

| 3. Misjudging tenant demand | Assuming green = higher rent | Target ESG-aligned markets |

| 4. Assuming all are profitable | Believing eco = ROI | Do full feasibility analysis |

| 5. Misaligning with UAE strategy | Investing outside policy zones | Focus on government-backed areas |

| 6. Overlooking smart tech | Ignoring automation | Evaluate smart systems |

| 7. Skipping retrofits | Avoiding older stock | Explore retrofit incentives |

| 8. Missing financing tools | Paying full interest rates | Use green finance products |

| 9. No exit plan | Holding too long or selling wrong | Use ESG-aligned exit strategies |

Conclusion: Smarter Green Investing Starts with Better Research

The UAE’s green real estate market holds vast potential — but only for those who enter with eyes open. From due diligence on certification to understanding government policies and leveraging smart financing, avoiding these Green Real Estate Mistakes is key to sustainable — and profitable — investing.

By steering clear of hype, aligning with regulatory frameworks, and choosing wisely between new builds and retrofits, investors can secure long-term gains while contributing to the UAE’s climate goals.

Homecubes: Preparing for the Future of Sustainable Real Estate Investment

At Homecubes, we’re building a tokenized investment platform designed to bring fractional access to assets — including green-certified properties in the UAE. While we are not currently offering services, we’re in the process of securing our real estate tokenization platform license from VARA (Dubai’s Virtual Assets Regulatory Authority).

Our mission is to enable a secure, transparent, and ESG-compliant way to invest in sustainable properties — one token at a time.

📩 Want to be the first to know when we launch?

Contact us here to join our early interest list.