The real estate market in the UAE has long been a key driver of economic growth. As property prices continue to rise and the demand for housing increases, the need for innovative solutions to simplify financing is more crucial than ever. Fintech UAE property financing is playing a pivotal role in transforming how individuals and investors approach property financing. The impact of technology advancement on the UAE real estate market is significant and in this case, the intersection of technology and finance is reshaping the industry. The technology offers faster, more accessible, and transparent solutions for property buyers and real estate investors.

The UAE has rapidly established itself as a leading hub for fintech startups in the MENA region.#startup #UAE #MENA #GITEXGlobal @GITEXTechWeek pic.twitter.com/nMO7iIpdsh

— وزارة المالية | الإمارات (@MOFUAE) October 14, 2021

In this article, we will explore how fintech is revolutionizing the property financing landscape in the UAE, its benefits, and the future potential of this technological shift.

What Is Fintech in Property Financing?

Fintech, or financial technology, refers to the use of technology to provide innovative financial services. In the context of UAE property financing, fintech encompasses the digital tools, platforms, and services that help streamline the mortgage and loan process for property buyers, real estate investors, and developers.

Historically, obtaining property financing in the UAE involved traditional banking institutions, lengthy paperwork, and multiple in-person meetings. Today, fintech platforms are simplifying the process by offering digital solutions that enhance accessibility, transparency, and efficiency. These platforms allow users to apply for loans, secure financing, and manage repayments all online.

How Fintech is Changing Property Financing in the UAE

Fintech is transforming the UAE property financing sector in several key ways. From improving the mortgage application process to providing alternative financing options, technology is reshaping how individuals and investors interact with real estate financing.

1. Streamlining Mortgage Applications

Traditionally, applying for a mortgage in the UAE could be a lengthy and complicated process. It often involved several meetings with bank representatives, multiple forms of documentation, and long waiting periods. With the rise of fintech UAE property financing, the mortgage application process has become much simpler.

-

Digital Application Forms

Many fintech platforms allow property buyers to complete mortgage applications entirely online. Users can upload documents, fill out forms, and submit their applications without leaving home. This reduces paperwork and speeds up the process.

-

Faster Approvals

With the help of algorithms and artificial intelligence (AI), fintech platforms can quickly assess applications, approve loans, and disburse funds. This reduces waiting times compared to traditional banks, where approval could take weeks.

-

Pre-Qualification Tools

Fintech platforms often provide pre-qualification tools that allow potential borrowers to check if they qualify for a mortgage before applying. This helps buyers make informed decisions and saves time by avoiding unnecessary applications.

By streamlining the mortgage application process, fintech solutions make it easier for potential homeowners and investors to access financing.

2. Enhanced Transparency

Transparency has always been a concern in traditional property financing systems. Fees, terms, and conditions were often unclear, leading to misunderstandings and disputes between borrowers and lenders. Fintech in UAE property financing aims to resolve this issue by providing clearer, more transparent financial products.

-

Clear Terms and Conditions

Many fintech platforms offer easy-to-read loan agreements, ensuring that borrowers fully understand the terms of the loan, including interest rates, repayment schedules, and associated fees.

-

No Hidden Fees

Unlike traditional banks, fintech companies often charge lower fees and ensure there are no hidden costs. This transparency gives borrowers peace of mind, knowing exactly what they will be paying.

-

Real-Time Information

Borrowers can access real-time updates on their loan applications, payment schedules, and remaining balances through user-friendly dashboards. This allows for better financial planning and decision-making.

By offering transparent financial products and services, fintech platforms build trust and ensure that borrowers have a clear understanding of the financing process.

3. Access to Alternative Financing Options

While traditional banks remain the dominant source of property financing, fintech platforms are introducing alternative methods of obtaining funds. These alternative financing options are often more flexible and accessible, providing opportunities for a broader range of buyers and investors.

-

Crowdfunding Platforms

Some fintech platforms allow property investors to pool their money together to fund real estate projects. Crowdfunding provides an alternative to traditional bank loans and allows individuals to invest in property with smaller amounts of capital.

-

Peer-to-Peer (P2P) Lending

P2P lending platforms connect borrowers directly with individual lenders, bypassing traditional banks. This model allows for more competitive interest rates and more flexible repayment terms. Investors can also earn returns on their capital by lending it to borrowers.

-

Islamic Financing Solutions

In the UAE, Islamic financing solutions have gained popularity, especially among investors seeking to align their investments with Islamic principles. Fintech platforms are introducing digital Islamic finance products that cater to this growing market, making property financing more inclusive.

These alternative financing methods provide more choices for property buyers and investors, making the financing process more accessible and customizable.

4. Improved Credit Scoring and Risk Assessment

In the past, traditional banks relied on credit scores based on historical data to assess the risk of a loan applicant. Fintech platforms, however, are taking a more holistic approach to credit scoring and risk assessment.

-

Alternative Data Sources

Fintech platforms often use alternative data sources, such as payment history for utilities, rental payments, and even social media activity, to assess an applicant’s creditworthiness. This provides a more accurate and inclusive credit assessment.

-

AI and Machine Learning

Fintech companies use AI and machine learning to analyze vast amounts of data quickly and accurately. This allows for better decision-making and more personalized loan offers. For example, the AI chatbot enhances the UAE real estate customer experience by assessing whether a borrower is likely to repay their loan based on their financial behavior.

-

Faster Approval Decisions

With advanced algorithms in place, fintech platforms can approve or deny loan applications much faster than traditional banks. Applicants typically receive a decision in a matter of hours, rather than days or weeks.

This innovation in credit scoring and risk assessment increases access to financing for a wider pool of potential borrowers, including those who might not meet the stringent requirements of traditional banks.

5. Digital Payment Solutions and Easy Repayment

Once a property financing agreement is in place, fintech platforms continue to simplify the repayment process. Borrowers can easily manage their loans and make payments online.

-

Auto-Pay Features

Many fintech platforms offer auto-pay options, allowing borrowers to set up automatic payments for their mortgage loans. This ensures that payments are made on time and reduces the risk of missed payments.

-

Flexible Repayment Options

Some fintech platforms allow borrowers to choose from a range of repayment options, such as monthly, quarterly, or annual payments. This flexibility enables borrowers to select a payment schedule that suits their financial situation.

-

Instant Payments and Transfers

Fintech platforms often provide instant payment processing, allowing borrowers to make payments at any time, from anywhere. This convenience is a significant advantage for those who have busy schedules or live abroad.

These digital payment solutions not only make it easier for borrowers to manage their property loans but also ensure that repayments are made promptly and securely.

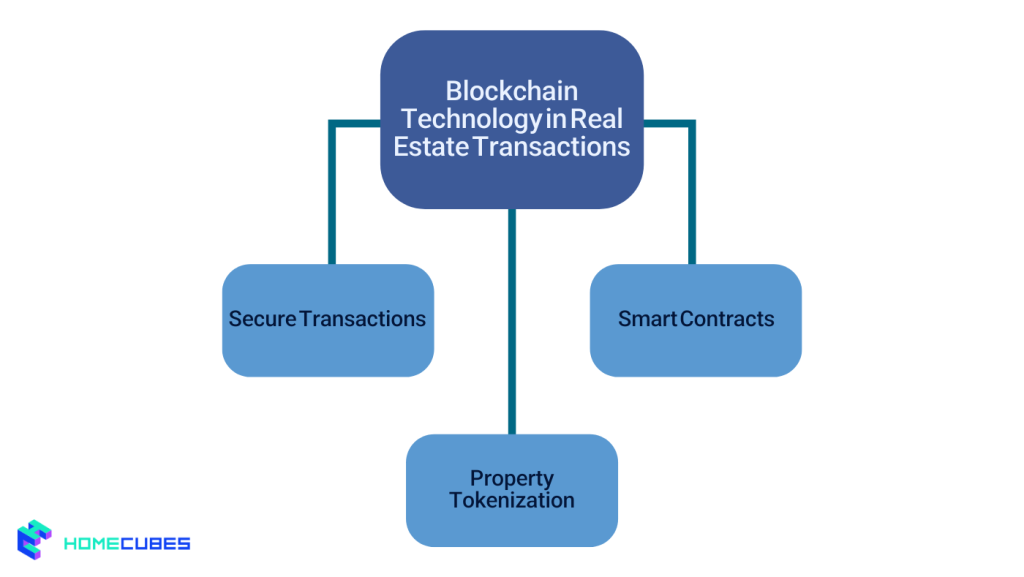

6. Blockchain Technology in Real Estate Transactions

Another significant innovation within fintech UAE property financing is the use of blockchain technology. Blockchain offers numerous benefits for real estate transactions, including enhanced security, transparency, and efficiency.

-

Secure Transactions

Blockchain technology provides a secure and transparent way to conduct real estate transactions. It ensures that property ownership is verified, and all related documents are stored securely. This reduces the risk of fraud and disputes.

-

Smart Contracts

Blockchain-based smart contracts automatically execute transactions when certain conditions are met. This eliminates the need for intermediaries, reducing costs and speeding up the transaction process.

-

Property Tokenization

Fintech platforms are also using blockchain to tokenize real estate, allowing investors to purchase shares of a property rather than the entire asset. This opens up property investment opportunities to a broader range of people.

Blockchain technology promises to revolutionize how real estate transactions are conducted, making them faster, more secure, and more efficient.

Future of Fintech in UAE Property Financing

The future of fintech UAE property financing looks promising. With the UAE government’s focus on becoming a global leader in technology and innovation, fintech will continue to play a key role in the real estate market. Future developments could include even more advanced AI tools for personalized loan offers, expanded use of blockchain technology, and the rise of new, disruptive financing models.

As fintech platforms continue to evolve, they will likely become a standard tool for property financing in the UAE, offering even more convenience, accessibility, and efficiency for both borrowers and investors.

Conclusion

Fintech UAE property financing is transforming the real estate market by making property financing more accessible, transparent, and efficient. Through the use of digital platforms, alternative financing options, and innovative technologies like blockchain, fintech is helping to simplify the property financing process for buyers, investors, and developers.

As the real estate sector in the UAE continues to grow and evolve, fintech will play an increasingly important role in ensuring that property financing remains convenient, secure, and efficient. With continued advancements in technology, the future of property financing in the UAE looks brighter than ever.

Homecubes has developed their property tokenization platform in full compliance with UAE regulation on asset tokenization focusing on the Dubai real estate market. Contact us at your earliest possible to take advantage of such a lucrative fractional investment opportunity in premium properties across Dubai.