The UAE real estate market has long been a beacon for investors looking to capitalize on one of the world’s most dynamic and lucrative property sectors. Whether it’s the soaring skyscrapers of Dubai, the luxury villas of Abu Dhabi that is emerging as a global real estate hotspot, or the ever-expanding infrastructure developments, the UAE offers numerous opportunities for real estate investment. However, despite its appeal, accessing the market can often be challenging, especially for smaller investors due to high capital requirements and complex regulatory frameworks.

This is where Decentralized Autonomous Organizations (DAOs) come into play. DAOs, powered by blockchain technology, are transforming industries worldwide, and real estate syndication in the UAE is no exception. Real estate syndication, a model where multiple investors pool their resources to invest in a single property or portfolio of properties, is evolving, and DAOs is about to become the driving force behind this transformation.

What Are DAOs and How Do They Work?

In this part of the interview, we focus on how Bricklayer DAO plans to achieve resilience and long-term success in the real estate market. 🧱#DAO #RWA pic.twitter.com/drI7LNQppg

— Bricklayer DAO (@BricklayerDao) September 17, 2024

A Decentralized Autonomous Organization (DAO) is a blockchain-based organization that operates through a set of smart contracts. Unlike traditional organizations, DAOs are not governed by a central authority. Instead, they rely on a decentralized model where decisions are made collectively by members through a democratic voting system. Each participant in a DAO holds tokens that represent their stake and voting power in the organization, and blockchain records every transaction or decision, ensuring transparency and accountability.

In the context of real estate syndication, DAOs allow a group of investors to pool their resources to collectively invest in a property or portfolio. The assets are tokenized, meaning each investor receives digital tokens representing fractional ownership in the property.

The use of smart contracts within DAOs automates many of the operational tasks, such as rent collection, property maintenance, and profit distribution, reducing the need for intermediaries.

Real Estate Syndication in the UAE: A Growing Market

Real estate syndication has become an attractive investment model in the UAE due to the country’s thriving property market and the UAE top real estate trends to watch in 2025. Syndication allows investors to pool their resources to acquire larger, income-generating properties without the high capital requirements typically associated with direct real estate ownership. By sharing the costs, risks, and rewards, syndication enables smaller investors to participate in high-value properties that would otherwise be out of their financial reach.

However, despite its benefits, traditional real estate syndication models come with several limitations. Investors often face high fees charged by syndicators and brokers, limited liquidity, and a lack of transparency in the management of the investments. These challenges have prompted a shift toward more innovative solutions, and DAOs are emerging as a potential game-changer in real estate syndication, particularly in the UAE.

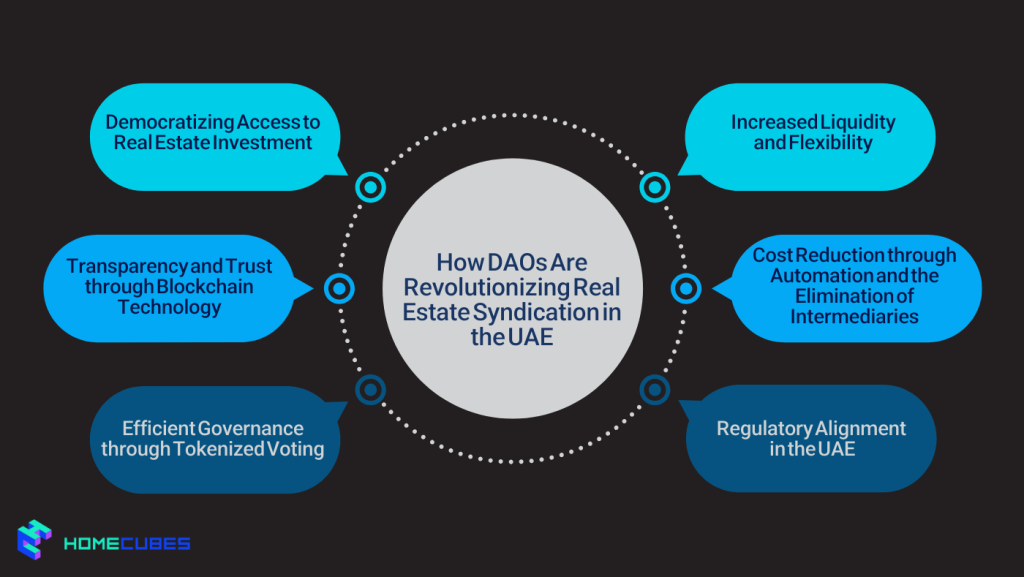

How DAOs Are Revolutionizing Real Estate Syndication in the UAE

1. Democratizing Access to Real Estate Investment

One of the most significant barriers to real estate investment in the UAE is the high capital requirement. To invest in prime properties in cities like Dubai and Abu Dhabi, investors typically need substantial upfront capital, making it difficult for smaller investors to enter the market. Real estate syndication partially addresses this issue by pooling resources from multiple investors, but it often still requires a significant investment per participant.

DAOs change this dynamic by offering fractional ownership through tokenization. In a DAO, real estate assets are divided into digital tokens, each representing a small portion of the property’s value. This enables individuals to invest small amounts, making real estate syndication more accessible to a broader audience.

Through this fractional ownership model, DAOs democratize real estate investment, allowing small investors to gain exposure to lucrative real estate opportunities.

2. Increased Liquidity and Flexibility

Real estate investments are generally illiquid, meaning that it can take a long time to sell a property or share in a syndicate and convert the investment into cash.

DAOs solve this problem by tokenizing real estate assets. Tokenization allows investors to buy and sell fractional ownership interests on blockchain-based platforms, providing greater liquidity and flexibility. In a DAO, investors can trade their tokens with other members or on secondary markets, making it easier to liquidate their positions when needed. This increased liquidity is a crucial advantage in a fast-moving market like the UAE, where investors may need to quickly adjust their portfolios.

Additionally, the ability to trade tokens enhances the overall efficiency of the investment process. Investors can enter or exit a DAO without waiting for selling an entire property, significantly reducing the time and costs associated with traditional real estate transactions.

3. Transparency and Trust through Blockchain Technology

Transparency is a key issue in traditional real estate syndication. Investors often have limited visibility into the management and financial performance of the properties they invest in, which can lead to concerns over mismanagement, hidden fees, and other issues. In the UAE, where real estate transactions are highly regulated but can still be complex and opaque, transparency is crucial for building trust among investors.

DAOs provide a solution to this problem by utilizing blockchain technology. Blockchain records every transaction and decision within a DAO that are immutable, creating a transparent and auditable trail of actions. Property owners and investors can access real-time data on property performance, maintenance activities, and financial transactions, ensuring that all actions are transparent and verifiable.

This level of transparency fosters trust among investors, which is especially important in a market like the UAE, where high-value transactions require a high degree of accountability.

4. Cost Reduction through Automation and the Elimination of Intermediaries

In traditional real estate syndication, various intermediaries present, including brokers, agents, property managers, and legal professionals. Each of these intermediaries charges fees, which can significantly reduce the return on investment for syndicate members. Additionally, the process of managing real estate investments can be time-consuming and costly due to administrative overhead.

DAOs streamline this process by automating many of the functions that would typically require third-party intervention. Smart contracts handle tasks like rent collection, maintenance requests, and profit distribution automatically. This reduces the need for expensive intermediaries and makes the process more efficient, lowering operational costs for investors. In a high-cost market like Dubai, these savings can significantly improve the return on investment.

Moreover, because DAOs operate on blockchain technology, they inherently reduce administrative complexity. Investors can manage their investments, track performance, and vote on decisions without relying on external service providers, which further cuts down on fees and inefficiencies.

5. Efficient Governance through Tokenized Voting

In traditional real estate syndications, decision-making power is usually concentrated in the hands of a few key individuals or firms. This can lead to a lack of transparency in decision-making and may not always align with the interests of smaller investors. In contrast, DAOs empower all token holders to participate in governance decisions, ensuring that every investor has a say in how the property is managed and operated.

Within a DAO, governance is typically done through tokenized voting. Each token represents a vote, and members can use their tokens to vote on important decisions, such as approving property improvements, changes to rental policies, or the sale of assets. This decentralized approach ensures that all members have an equal opportunity to influence decisions, making real estate syndication more democratic and aligned with the interests of all stakeholders.

6. Regulatory Alignment in the UAE

The UAE has been proactive in embracing blockchain technology and creating a favorable regulatory environment for innovation. The Dubai Land Department, for example, has been experimenting with blockchain to simplify and secure real estate transactions. This progressive stance on blockchain adoption provides an ideal foundation for DAOs to flourish in the UAE’s real estate market.

As the legal framework for blockchain technology continues to evolve, DAOs can easily integrate with existing regulations, making it easier for investors to participate in tokenized real estate syndications while ensuring compliance with local laws. The UAE’s government is also focusing on creating an environment that supports financial technology (fintech) innovation, which bodes well for the future growth of DAOs in the real estate space.

The Future of DAOs in Real Estate Syndication in UAE

The potential for DAOs to transform real estate syndication in the UAE is enormous. As blockchain adoption grows and the regulatory environment becomes more supportive, DAOs will become an increasingly popular option for real estate investors looking to pool resources, reduce costs, and improve the efficiency of their investments.

In the future, we can expect to see more real estate syndications powered by DAOs in the UAE, providing smaller investors with the opportunity to diversify their portfolios and access high-quality real estate opportunities. The flexibility, transparency, and efficiency of DAOs will help unlock new possibilities for real estate syndication, driving innovation and making the UAE’s real estate market even more attractive to global investors.

Final Thoughts

DAOs represent the next big thing in real estate syndication in the UAE, offering a decentralized, transparent, and efficient alternative to traditional investment models. By enabling fractional ownership, increasing liquidity, and reducing costs, DAOs are democratizing access to the UAE’s lucrative real estate market and transforming how investors collaborate on property acquisitions.

As blockchain technology continues to mature and the UAE’s regulatory environment evolves, DAOs will play an increasingly pivotal role in reshaping the future of real estate syndication. DAOs are capable of offering an innovative and forward-thinking way for investors to participate in high-value real estate projects, unlocking new opportunities for growth and profitability.

Homecubes as the leading and licensed property tokenization platform inDubai has got a range of fractional ownership projects in the pipeline. Do not hesitate to contact us and make yourself available for such a lucrative fractional investment opportunity in the Dubai real estate market.