The real estate sector in the United Arab Emirates (UAE) has long been a cornerstone of its economy, attracting both local and international investors. With the rise of blockchain technology in real estate, tokenized tangible assets and decentralized finance (DeFi), Decentralized Autonomous Organizations (DAOs) are emerging as transformative forces in this space. DAOs, which operate on smart contracts and are governed by community consensus rather than centralized authorities, are reshaping how real estate decisions are made, funded, and managed in the UAE.

Understanding DAOs

1/ Crypto Dictionary 📚

What is a DAO? 🏛️

A DAO, or Decentralized Autonomous Organization, is an entity governed by rules encoded as smart contracts on a blockchain. DAOs operate without central authority, distributing decision-making power among members. pic.twitter.com/aoqaOaVQjm

— Vestra (@Vestra_DAO) September 23, 2024

DAOs are organizations that utilize blockchain technology to facilitate decision-making and operations without a traditional hierarchical structure. They are run by code and governed by their members, who typically hold tokens that grant them voting rights. This decentralized nature promotes transparency, accountability, and collective decision-making, making DAOs particularly appealing for industries like real estate, where trust and collaboration are paramount.

The UAE Real Estate Landscape

The UAE’s real estate market is characterized by its diversity, featuring luxury developments, commercial spaces, and affordable housing projects. The government has implemented various initiatives to attract foreign investment, including freehold property ownership for expatriates and significant infrastructure developments. However, traditional real estate transactions often involve lengthy processes, high transaction costs, and a lack of transparency. This is where DAOs in UAE real estate decision making can play a pivotal role.

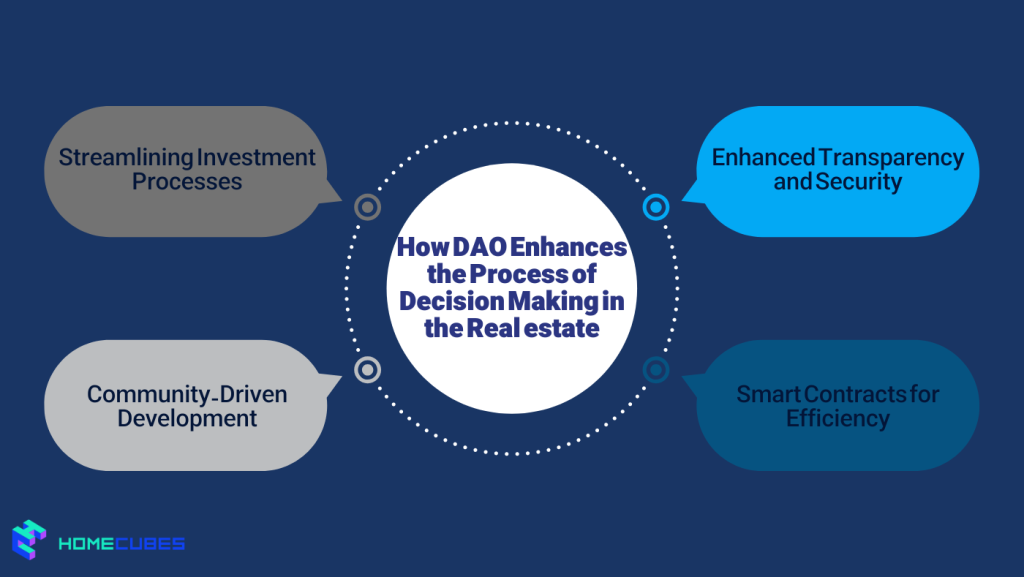

Streamlining Investment Processes

One of the most significant advantages of DAOs in real estate is their ability to streamline investment processes. In traditional real estate, raising capital often requires extensive due diligence, negotiations, and the involvement of multiple intermediaries. DAOs eliminate many of these barriers through blockchain technology, enabling fractional ownership and tokenization of real estate in the UAE.

For example, a DAO can create a digital platform where members can pool their resources to invest in a specific property. By tokenizing the property, each member holds a share that represents their investment, allowing for easier buying, selling, and trading of these shares. This democratizes access to real estate investment, allowing smaller investors to participate in projects that were previously out of reach.

Enhanced Transparency and Security

Transparency is a critical issue in the real estate market. Traditional transactions can be opaque, with buyers and sellers often unaware of the true value or potential risks associated with a property.The blockchain impact on real estate transparency is significant. DAOs operate on blockchain technology, which provides an immutable and transparent record of all transactions. This ensures that all stakeholders have access to the same information, reducing the likelihood of fraud and disputes.

In the UAE, where real estate prices can fluctuate significantly, this transparency is particularly beneficial. Investors can make informed decisions based on real-time data and analytics, ultimately leading to more stable and confident investment environments. DAO improves the process of decision-making in real estate by enhancing transparency.

Community-Driven Development

DAOs also facilitate community-driven real estate development. Instead of decisions being made solely by developers or investors, community members can participate in the planning and execution of projects. This can lead to developments that better reflect the needs and desires of the community, enhancing the overall quality of life.

For instance, a DAO focused on residential developments could allow residents to vote on amenities, design elements, and even zoning changes. This not only empowers local communities but also fosters a sense of ownership and pride among residents, potentially increasing property values. By engaging the whole community, DAO enhances the process of decision-making in the UAE real estate sector.

Smart Contracts for Efficiency

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. In the context of real estate, smart contracts can automate various processes, such as property transfers, rental agreements, and payment systems. This reduces the need for intermediaries like real estate agents and lawyers, significantly lowering transaction costs and speeding up processes.

In the UAE, where time is often of the essence in real estate transactions, the efficiency offered by smart contracts can be a game changer. For example, a smart contract could automatically release funds once specific conditions are met, such as the completion of a property inspection, thereby expediting the closing process. As such, DAO makes decision-making in real estate more efficient by using smart contrasts rather than intermediaries.

Regulatory Challenges and Opportunities

While DAOs in real estate in the UAE present numerous advantages, their integration into the UAE’s real estate sector is not without challenges. The regulatory environment is still evolving, and authorities must establish clear guidelines to govern the use of DAOs in real estate. However, the UAE government has shown a willingness to embrace innovation, as seen with initiatives like the Dubai Blockchain Strategy.

By collaborating with DAOs, regulators can create a framework that ensures consumer protection while fostering innovation. This could involve setting standards for transparency, security, and governance that align with the unique characteristics of the UAE market.

Future Trends: Tokenization of Real Estate

Tokenization is poised to revolutionize the real estate market in the UAE. By converting physical properties into digital tokens, real estate are tradable on blockchain platforms, opening up new avenues for investment. This could lead to increased liquidity in the real estate market, allowing investors to buy and sell shares in properties more easily.

Moreover, tokenization can enable innovative financing models, such as Real Estate Investment Trusts (REITs) operated by DAOs to enable better decision-making. These community-driven REITs could offer dividends to token holders based on the performance of the underlying assets, providing a passive income stream while fostering a sense of community among investors.

Conclusion

Utilization of DAOs in Dubai real estate as well as the UAE, is reshaping the real estate decision-making landscape by enhancing transparency, efficiency, and community involvement. As the market continues to evolve, the integration of DAOs and blockchain technology promises to create a more inclusive and innovative real estate environment. While challenges remain, the potential benefits for investors, developers, and communities alike are significant. As the UAE embraces this new paradigm, it stands to set a global example of how technology can transform traditional industries for the better.

Homecubes, as the leading real estate tokenization platform focusing in the UAE real estate market, is about to launch their exciting property tokenization projects in full compliance with UAE officials. If you are seeking fractional ownership investment opportunities in Dubai, you are more than welcome to contact us for further information and investment direction.