Table of Contents

- Introduction: Why Affordable Housing Matters in 2025

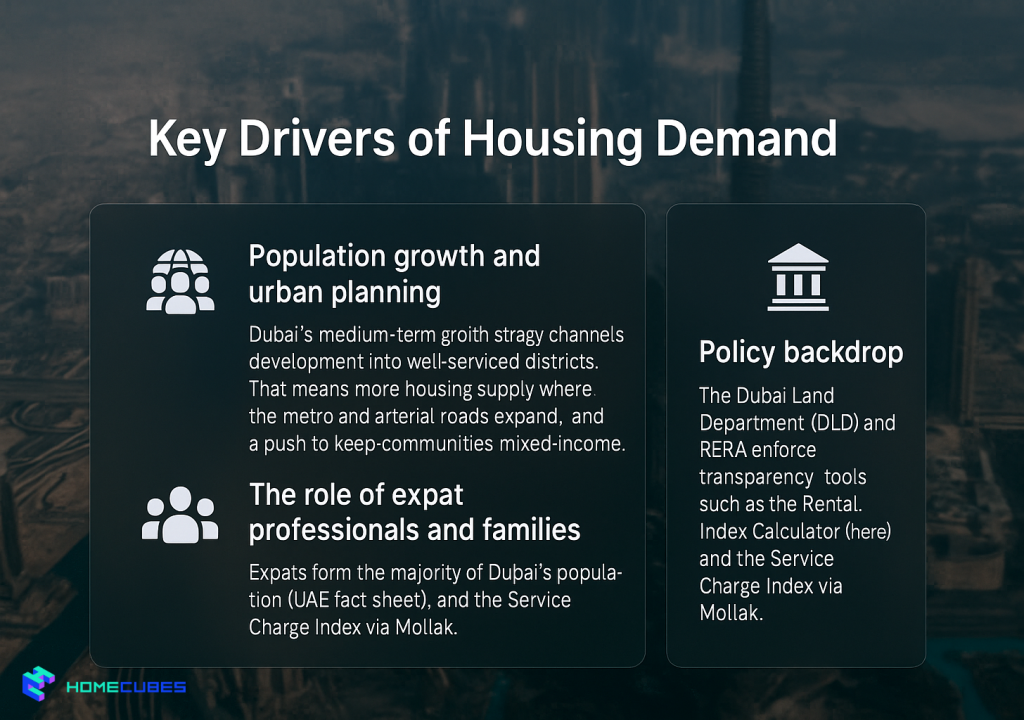

- Key Drivers of Demand

- Population growth and urban planning

- The role of expat professionals and families

- Policy backdrop

- Top Affordable Housing Areas in Dubai (2025)

- International City

- Al Furjan

- Dubai South

- Jumeirah Village Circle (JVC)

- Dubailand (selected communities)

- Discovery Gardens

- Dubai Silicon Oasis (DSO)

- Emerging areas to watch

- Price Trends and Rental Yields (What to Expect)

- Case Study: Choosing Between Three Affordable Areas

- Fees and Charges You Must Budget For

- Common Mistakes to Avoid

- Key Risks and How to Mitigate Them

- Outlook 2025–2030

- Final Thoughts

- FAQs

- Work with Homecubes (Expanded CTA)

Introduction: Why Affordable Housing Matters in 2025

Dubai keeps attracting global talent and capital, but one question dominates for end-users and prudent investors alike: where are the affordable housing areas in Dubai that still combine livability, transport links, and healthy rental yields?

I witnessed the signing of an agreement, focused on implementing a series of affordable housing projects, between RTA, Dubai Municipality, and Wasl Group. This initiative supports the Dubai 2040 Urban Master Plan and aligns with the city’s affordable housing policy. The first… pic.twitter.com/lzLd7XwNxC

— Hamdan bin Mohammed (@HamdanMohammed) May 20, 2025

Population growth and major infrastructure commitments are reshaping the city’s housing map. The Dubai 2040 Urban Master Plan prioritises balanced, connected communities with more green space and improved mobility (Dubai 2040 overview). On the transport side, Route 2020 extended the Red Line to Expo City, and the Blue Line, launched in 2025, adds 14 more stations (RTA news).

At the same time, the south of the city is accelerating thanks to the Al Maktoum International (DWC) expansion, reconfirmed through 2025 (Dubai Airports briefing).

For market context, consult the latest research snapshots: Knight Frank’s Destination Dubai 2025 and CBRE’s UAE Real Estate Market Review Q2 2025 (overview).

Key Drivers of Demand

Population growth and urban planning

Dubai’s medium-term growth strategy channels development into well-serviced districts. That means more housing supply where the metro and arterial roads expand, and a push to keep communities mixed-income.

The role of expat professionals and families

Expats form the majority of Dubai’s population (UAE fact sheet), and middle-income households drive strong demand for affordable housing.

Policy backdrop

The Dubai Land Department (DLD) and RERA enforce transparency tools such as the Rental Index Calculator (here) and the Service Charge Index via Mollak (here).

Top Affordable Housing Areas in Dubai (2025)

International City

- Budget appeal: Studios average AED 37k in 2025

- Who it suits: Singles and small families who want low rents and basic amenities.

Al Furjan

- Connectivity: Metro access via Route 2020.

- Profile: Family-friendly villas, townhouses, and apartments (Bayut guide).

Dubai South

- Catalyst: Jobs tied to Expo City and DWC (Dubai Airports).

- Communities: Emaar South is a popular sub-district (Bayut guide).

Jumeirah Village Circle (JVC)

- Why it works: Central, mid-market, with high rental liquidity.

- More info: JVC guide.

Dubailand (selected communities)

- Value: Larger units and green communities like Villanova (guide).

Discovery Gardens

- Budget: Studio rents around AED 50k in 2025.

- Why it’s popular: Mature greenery and metro proximity.

Dubai Silicon Oasis (DSO)

- Profile: Tech hub with competitive rents (DSO guide).

- Who it suits: Professionals and SMEs.

Emerging areas to watch

- Emaar South, Meydan, MBR City fringes — as supply grows, these may offer mid-market entry points.

Price Trends and Rental Yields (What to Expect)

CBRE’s Q2 2025 review notes steady rental growth across the city, with apartments seeing stronger demand than villas in many mid-market areas. Affordable districts like International City, Discovery Gardens, and JVC still deliver 6–8% yields, which outpaces global benchmarks in cities such as London (3–4%) or Singapore (2–3%).

For buyers, this means affordable units not only cost less upfront but also generate relatively higher income. For tenants, rents have risen but remain manageable compared to central luxury districts and that’s why affordable UAE real estate projects is rising in popularity .

Case Study: Choosing Between Three Affordable Areas

A family of three with AED 70k housing budget compared:

- International City: Lowest rents but denser clusters.

- JVC: Balanced affordability and modern amenities.

- Dubai Silicon Oasis: Commute-friendly and tech-oriented.

Outcome: They chose DSO for commute convenience and stable service charges.

Fees and Charges You Must Budget For

- DLD Transfer Fee: 4%.

- Mortgage Registration: 0.25% of loan value.

- Service Charges: Verified via RERA Service Charge Index.

- Ejari: AED 100 + fees.

Common Mistakes to Avoid

- Ignoring commute costs.

- Overlooking service charges.

- Buying off-plan without checking developer track record.

- Skipping Ejari registration.

Key Risks and How to Mitigate Them

Even in affordable housing, risks exist. Understanding them early helps mitigate surprises:

- Oversupply risk: Large-scale handovers in Dubai South and Dubailand can temporarily soften rents. Mitigation: Focus on completed, occupied buildings with proven tenant demand rather than speculative off-plan units.

- Quality variance: Affordable does not always mean consistent quality. Some projects cut corners on finishing. Mitigation: Inspect units physically, review developer track record, and confirm the building’s service charge history via Mollak.

- Fee creep: Service charges can increase if building management costs rise. Mitigation: Regularly check the RERA Service Charge Index and compare costs across communities.

- Transport dependency: Areas not yet served by metro or frequent buses can feel isolated. Mitigation: Map commutes carefully, and where possible, choose areas on or near expanding lines such as the Blue Line.

- Regulatory adjustments: Changes in tenancy laws or fee frameworks can affect affordability. Mitigation: Keep updated with DLD announcements and verify with official fee schedules before signing contracts.

Outlook 2025–2030

The Dubai 2040 Urban Master Plan ensures that affordable housing remains a priority. Between now and 2030, expect:

- Metro expansions to reshape demand, making suburbs like Al Furjan, Dubailand, and Dubai South more accessible.

- A population projected to exceed 4 million, sustaining steady demand for affordable rentals.

- Developers adding sustainable features — solar integration, energy-efficient designs, and community parks — even in mid-market projects.

- Growing participation from REITs and institutional investors in affordable housing due to its attractive yields.

Affordable housing is set to anchor Dubai’s broader urban strategy, ensuring inclusivity and long-term stability in the property market.

Final Thoughts

Affordable housing in Dubai is about more than low rent — it’s about securing stability and value in a fast-growing city. In 2025, districts such as International City, JVC, and Dubai South show that affordability can align with convenience, lifestyle, and investment returns.

For tenants, balancing commute, amenities, and budget is essential. For investors, focusing on yield stability and service charges will help maximize returns. With transparent tools from DLD and RERA, both groups can act with more confidence.

In short, affordable housing areas remain a smart entry point for anyone seeking a stake in Dubai’s dynamic real estate market.

FAQs

Which Dubai areas are cheapest in 2025?

International City and Discovery Gardens are still among the most budget-friendly. International City offers the lowest entry rents, while Discovery Gardens provides better green space and metro connectivity. Both remain strong choices for cost-conscious residents.

Is JVC in Dubai still affordable?

Yes. Prices in Jumeirah Village Circle have risen moderately, but it still delivers mid-market apartments and townhouses. Tenants benefit from Circle Mall, green areas, and central connectivity, while landlords enjoy strong rental demand.

Which Dubai areas offer best yields?

Dubai South and JVC lead with yields around 7–8%. Dubai South benefits from job growth tied to Expo and DWC, while JVC offers liquidity and consistent rental flows. These areas remain top picks for investors.

What does Ejari cost?

Ejari registration costs AED 100 plus small additional fees. Beyond cost, Ejari ensures contracts are legally enforceable, supports utility connections, and protects tenant and landlord rights — making it a non-negotiable step in any tenancy.

Unlock Dubai’s Property Potential with Homecubes

At Homecubes, our core focus is a property tokenization platform designed to make Dubai real estate—especially well-located, affordable areas—more accessible through compliant fractional ownership and transparent, data-driven workflows.

What we’re preparing to offer (post-approval):

- Compliance-first onboarding (KYC/KYB), clear disclosures, and investor dashboards.

- Fractional access to curated, income-producing properties with standardized reporting on rents, service charges, and net yields.

- Automated distributions and portfolio tracking to simplify ongoing management.

Status: Our VARA license application is submitted. We will launch platform services only after approval. Until then, we provide education, area shortlists, and cost/yield modeling to help you prepare a strategy in the most promising affordable housing areas in Dubai.

Want early guidance and readiness checklists? Talk to us here: Homecubes Contact Page.