Table of Contents

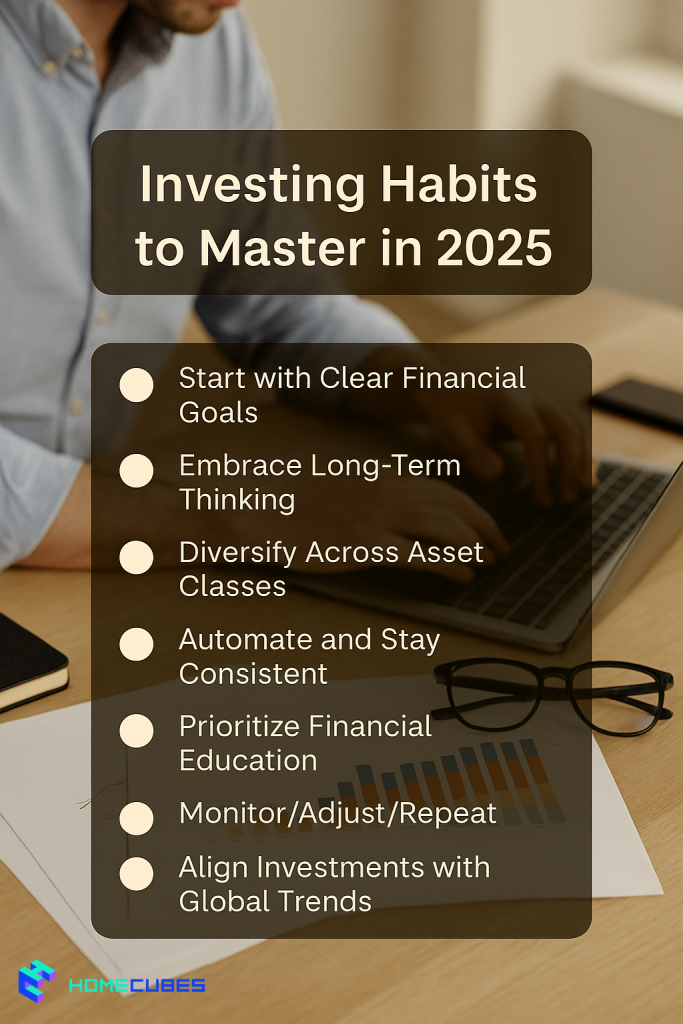

- Why Investing Habits Matter in 2025

- 1. Start with Clear Financial Goals

- 2. Embrace Long-Term Thinking

- 3. Diversify Across Asset Classes

- 4. Automate and Stay Consistent

- 5. Prioritize Financial Education

- 6. Monitor, Adjust, Repeat

- 7. Align Investments with Global Trends

- Risks to Watch Out For

- Conclusion: Build Discipline for Long-Term Gains

- Frequently Asked Questions (FAQ)

- Explore Real Estate Investment with Homecubes

Why Investing Habits Matter in 2025

The investment world is evolving at an unprecedented pace, shaped by global economic shifts, regulatory overhauls, emerging technologies, and a new generation of investors entering the market. In 2025, being a successful investor no longer depends solely on picking the right stock or timing the market just right. Instead, it hinges on adopting a set of disciplined, forward-looking investing habits that enable you to adapt, grow, and thrive—regardless of market conditions.

Whether you’re a seasoned investor or just starting your journey, mastering the right investing habits for 2025 can significantly impact your long-term financial security. With inflation fears, geopolitical tensions, digital asset volatility, and sustainable investing rising to the forefront, there’s an urgent need to rethink how we build and manage wealth.

Challenge yourself in 2025:

No random purchases that aren’t essential

No impulse buys over $200

No additional credit card debt that you don’t pay

No “Buy Now, Pay Later”

Plan big purchases

Boost savingsIt’s one year, get yourself back reset on a better financial path

— Vonn (@itsthewealth4me) November 14, 2024

If you’re looking to strengthen your portfolio in the face of uncertainty, align your goals with future-ready sectors, and build sustainable financial growth—start by mastering these investing habits for 2025.

1. Start with Clear Financial Goals

Smart investing begins with intentional planning. Investors should avoid vague goals like “build wealth” or “retire early” and instead define measurable, time-bound objectives.

Examples of smart goals for 2025:

- “Accumulate AED 200,000 in rental income in 5 years”

- “Earn 7% average annual return for child’s education fund”

- “Allocate 20% of portfolio to sustainable investments”

Clear goals guide your:

- Risk tolerance

- Time horizon

- Asset selection

- Exit strategy

Tools to try:

Goal-setting platforms like FinaMetrica or Moneyhub offer goal visualization and risk profiling features.

2. Embrace Long-Term Thinking

In the age of instant gratification, short-term trading and “hot tips” dominate social media. But enduring wealth creation often comes from compounding over years, not weeks.

Why long-term mindset matters:

- Reduces emotional decision-making

- Enables compounding returns

- Minimizes trading costs and taxes

Real-life example:

An investor who put AED 100,000 in the S&P 500 in 2003 and left it untouched for 20 years would now have over AED 550,000, assuming reinvested dividends and market growth—despite several global crises in between.

Consider adopting “sleep-well” investments—like index funds, Dubai real estate, or infrastructure projects—with built-in longevity.

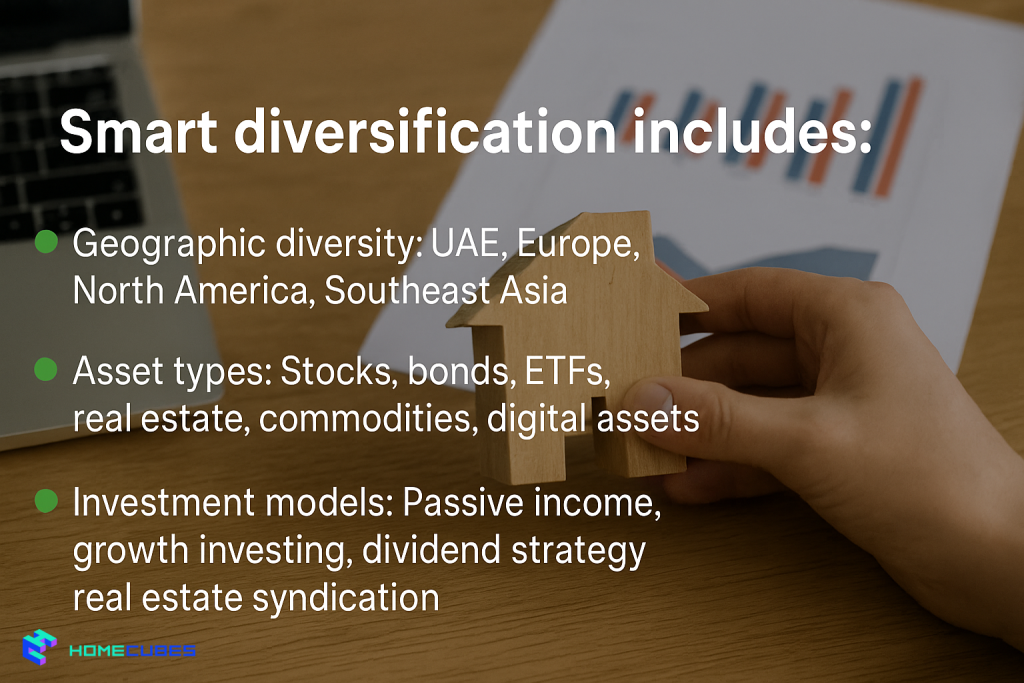

3. Diversify Across Asset Classes

2025 will continue to test single-asset portfolios. Over-concentration—especially in speculative sectors or regional markets—can be dangerous.

Smart diversification includes:

- Geographic diversity: UAE, Europe, North America, Southeast Asia

- Asset types: Stocks, bonds, ETFs, real estate, commodities, digital assets

- Investment models: Passive income, growth investing, dividend strategy, real estate syndication

Portfolio example:

| Asset Class | Allocation (%) |

| Global ETFs | 30% |

| UAE Real Estate | 25% |

| Bonds | 15% |

| Crypto Assets | 10% |

| REITs | 10% |

| Cash Reserves | 10% |

Regardless of investing in furnished vs unfurnished rentals in the UAE or choosing apartments vs penthouses in Dubai for investment purposes, diversification doesn’t guarantee profit—but it does reduce the risk of catastrophic loss.

4. Automate and Stay Consistent

Consistency wins over intensity. With automation, even average investors can achieve elite results—because emotions, timing mistakes, and forgetfulness are removed from the equation.

Automation tips:

- Set up monthly automatic transfers to investment accounts

- Use robo-advisors for rebalancing and risk alignment

- Reinvest dividends instead of withdrawing them

Top automation tools in 2025 include Sarwa for UAE residents, and global apps like Wealthfront or Betterment.

5. Prioritize Financial Education

The most successful investors in 2025 will continuously learn—not just from books, but from podcasts, webinars, real-time analytics, and expert communities.

Topics worth mastering:

- Understanding real estate tokenization and PropTech

- Evaluating DeFi and blockchain trends

- Reading balance sheets and quarterly earnings

- Knowing tax implications in UAE and abroad

Educational resources to explore:

6. Monitor, Adjust, Repeat

Your 2025 financial plan should not be a “set and forget” model. Instead, build a quarterly review habit to evaluate:

- Investment performance vs. benchmarks

- Rebalancing needs (especially after major market moves)

- Any changes in personal goals or income

Habit tip: Set a recurring calendar reminder every 3 months to do a 60-minute “wealth check-up.”

Re-evaluation also includes:

- Trimming overperforming assets

- Reinforcing lagging sectors with growth potential

- Keeping your asset allocation in balance

7. Align Investments with Global Trends

Future-proof portfolios are built around forward-looking sectors and macro shifts.

Key 2025 trends to monitor:

- Green economy: Carbon credits, agri-tech real estate, sustainable REITs

- Digital assets: Security tokens, digital real estate

- UAE boom sectors: Industrial zones, smart cities, freehold expansions

Investors aligning with these trends can benefit from first-mover advantages and stronger demand over the next decade.

Explore platforms offering fractional access to trend-driven assets—such as tokenized real estate or ESG-focused ETFs.

Risks to Watch Out For

Even the best investing habits can be disrupted by external threats or internal missteps. In 2025, investors should watch for:

- Geopolitical shocks that can disrupt supply chains and market sentiment

- Regulatory risks, especially in crypto and DeFi sectors

- Overconfidence bias, leading to concentration or excessive leverage

- Lifestyle inflation, which quietly erodes available capital for investment

Developing strong habits will reduce risk, but nothing replaces vigilance and preparation.

Conclusion: Build Discipline for Long-Term Gains

In the ever-shifting landscape of global finance, success is rarely about chasing the latest trend or reacting to short-term noise. Instead, it comes from mastery of consistent, proven investing habits that align with both personal goals and macroeconomic realities. The year 2025 brings with it a blend of immense opportunity and unique risk—making disciplined behavior more critical than ever.

These seven investing habits serve as the bedrock for a resilient, adaptable investment strategy. Whether it’s setting crystal-clear goals, diversifying across asset classes, leveraging automation, or staying informed through ongoing education—each habit works synergistically to support long-term performance. More importantly, they help remove emotion and guesswork from the equation, replacing them with strategy, structure, and intent.

No matter your starting point or investment size, these habits are accessible, scalable, and deeply transformative. And as the UAE continues to lead in real estate innovation, digital asset regulation, and smart investment zones, there has never been a better time to align your behavior with the future of wealth creation.

Make 2025 the year you stop reacting—and start investing with purpose.

Frequently Asked Questions (FAQ)

What’s the best asset class for UAE investors in 2025?

Real estate remains a top choice, especially fractional ownership and properties in emerging zones. But digital assets and diversified ETFs are also growing in popularity.

Is crypto still a viable investment habit in 2025?

Yes, when treated as part of a diversified strategy. Regulatory clarity in the UAE (via VARA) makes it more viable than in many other countries.

How much should I automate in my investment process?

As much as possible—especially recurring deposits, portfolio rebalancing, and dividend reinvestment. Automation ensures you invest regularly, without emotional bias.

Are there tools to help track these investing habits?

Yes. Tools like YNAB, Sarwa, and Excel-based dashboards can help you track consistency, returns, and allocations.

How can I invest with less than $10,000?

Consider fractional real estate ownership, low-cost index funds, or REIT platforms. Platforms like Sarwa or property tokenization portals (once licensed) can offer access.

Explore Real Estate Investment with Homecubes

At Homecubes, we’re redefining how investors approach UAE real estate through technology and innovation. While we await regulatory approval for our real estate tokenization platform via the Virtual Assets Regulatory Authority (VARA), we’re actively working to create seamless access to fractional property ownership, especially in Dubai’s fast-growing investment zones.

If you’re preparing your portfolio for 2025 and beyond—and want to explore alternative property investments aligned with your smart habits—reach out to us here. Our team is happy to guide you through upcoming opportunities once our licensing is finalized.