Table of Contents

- Introduction

- Understanding Off-Plan Property Purchases in Dubai

- Common Causes of Off-Plan Property Delays

- Legal Framework: Protections Under Dubai Law

- How to Respond to an Off-Plan Property Delay

- Dubai Land Department’s Role in Delays

- Contract Clauses and Developer Obligations

- Case Study: Delay in Handover of a Downtown Dubai Tower

- Mistakes to Avoid When Facing Delays

- Costs, Fees, and Financial Implications

- FAQs

- Conclusion

- Homecubes – Your Partner in Smart Property Decisions

Introduction

Dubai’s off-plan property market has attracted investors seeking early entry into high-growth developments. However, delays in handover have become a rising concern, potentially affecting ROI, rental plans, and personal moving timelines. Whether the delay is due to construction issues, regulatory changes, or financial setbacks on the developer’s side, investors must know their rights and legal recourse.

In this guide, we explore:

- The legal framework that governs off-plan property delays in Dubai.

- What actions buyers can take.

- How to protect your investment through DLD and RERA mechanisms.

Understanding Off-Plan Property Purchases in Dubai

Plot sales may be on the rise in Dubai, but this is still a niche segment in my opinion.

When it comes to end users, premium off-plan projects offer the best of both worlds.

If you do decide to build your own home, make sure you seek expert advice.https://t.co/lAeLUNRvOH

— Ali Sajwani (@Ali_H_Sajwani) May 14, 2025

Purchasing an off-plan property can be one of the top investment habits in 2025. It basically means buying real estate before it has been constructed or completed. In Dubai, off-plan properties are extremely popular among investors and end-users due to the potential for capital appreciation, flexible payment plans, and attractive pricing compared to ready properties.

Why Buy Off-Plan?

- Lower Entry Price

Developers usually offer significant discounts during the early phases of a project to incentivize buyers. This allows investors to enter the market at a lower cost than completed properties. - Flexible Payment Plans

Instead of paying the full amount upfront or securing a mortgage immediately, buyers can pay in installments linked to construction milestones. This eases cash flow pressures and makes high-value properties accessible to more buyers. - Capital Appreciation Potential

Since many off-plan projects take years to complete, the property value often increases by the time of handover due to market growth, urban development, or infrastructural improvements in the area. - Customization and Choice

Buyers sometimes have the opportunity to customize interiors, layouts, or finishes before completion, tailoring the property to their preferences.

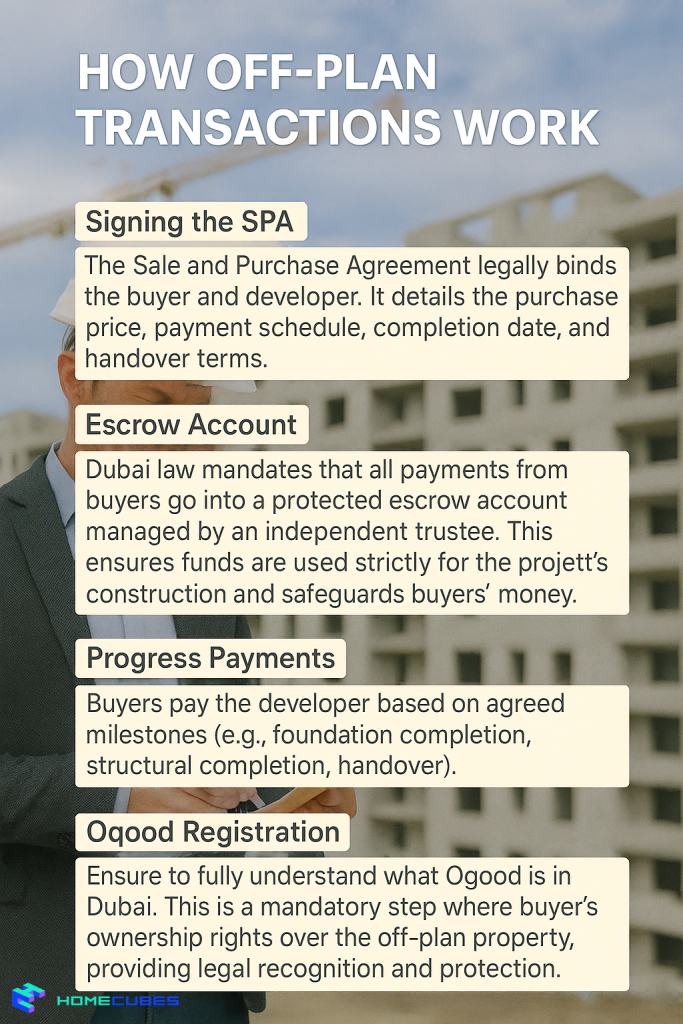

How Off-Plan Transactions Work

- Signing the SPA: The Sale and Purchase Agreement legally binds the buyer and developer. It details the purchase price, payment schedule, completion date, and handover terms.

- Escrow Account: Dubai law mandates that all payments from buyers go into a protected escrow account managed by an independent trustee. This ensures funds are used strictly for the project’s construction and safeguards buyers’ money.

- Progress Payments: Buyers pay the developer based on agreed milestones (e.g., foundation completion, structural completion, handover).

- Oqood Registration: Ensure to fully understand what Oqood is in Dubai. This is a mandatory step where the buyer’s ownership rights over the off-plan property are registered with the Dubai Land Department, providing legal recognition and protection.

Risks Involved

While off-plan investments offer advantages, they come with risks — construction delays being the most significant. Off-plan property Delays in Dubai can arise from economic downturns, labor shortages, regulatory changes, or even developer mismanagement. Since the buyer’s funds are tied up in a project not yet physically existing, delayed handover directly impacts financial planning and may cause additional expenses like rent or mortgage payments on other properties.

Handover Process

When construction nears completion, the developer schedules the handover, where the buyer:

- Receives the completion certificate from the municipality.

- Conducts a final inspection of the unit.

- Signs the handover agreement, confirming acceptance.

- Receives the keys and officially takes possession.

Any delay in this process beyond the contractually promised date constitutes an off-plan property delay, triggering potential buyer remedies.

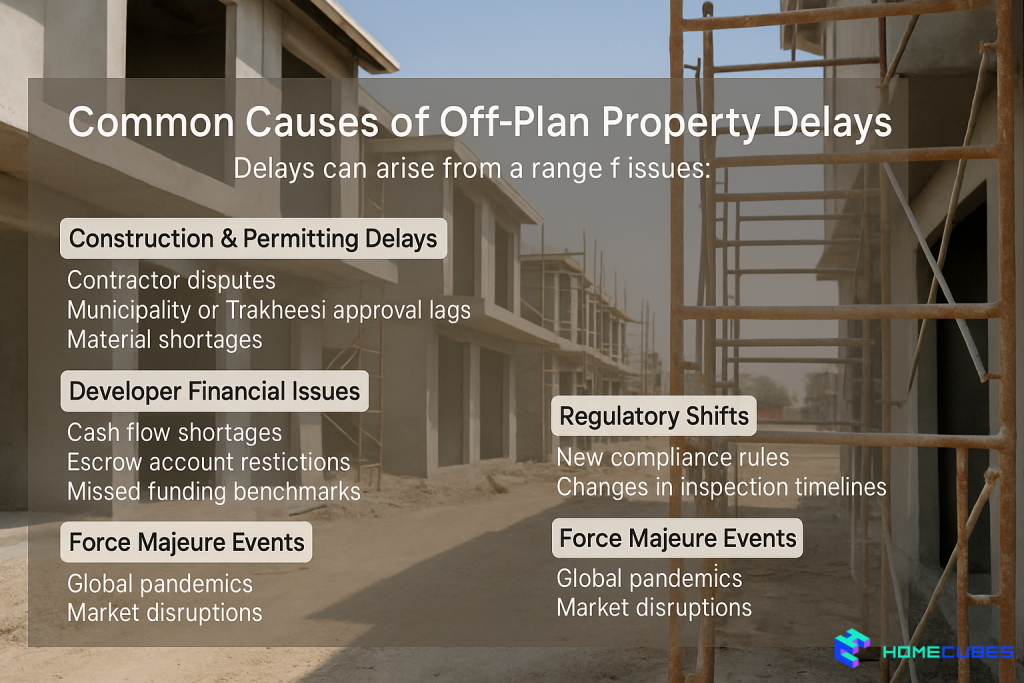

Common Causes of Off-Plan Property Delays in Dubai

Delays can arise from a range of issues:

Construction & Permitting Delays

- Contractor disputes

- Municipality or Trakheesi approval lags

- Material shortages

Developer Financial Issues

- Cash flow shortages

- Escrow account restrictions

- Missed funding benchmarks

Regulatory Shifts

- New compliance rules

- Changes in inspection timelines

Force Majeure Events

- Global pandemics

- Market disruptions

Legal Framework: Protections Under Dubai Law

Dubai’s Law No. 13 of 2008, amended by Law No. 19 of 2017, places strict guidelines on developers, including:

- Mandatory escrow accounts

- Completion milestones overseen by RERA

- Authority for project cancellation and buyer refunds via DLD

Buyers are also protected under consumer rights and property dispute laws enforced by Dubai Courts and the Rental Dispute Settlement Centre (RDSC).

How to Respond to an Off-Plan Property Delay

- Check Your SPA( Sales and Purchase Agreement): Look for clauses on delays, penalties, and cancellation terms.

- Contact Developer: Ask for written updates and renegotiation if applicable.

- File with RERA: Use the Dubai REST App or visit the DLD.

- Seek Legal Action: Engage a real estate lawyer or escalate to courts/arbitration panels.

Dubai Land Department’s Role in Delays

The DLD offers:

- Project tracking via the Project Status Portal

- Oversight on Oqood registrations

- Escrow management for buyer protection

- Authority to fine or blacklist non-compliant developers

Contract Clauses and Developer Obligations

Contracts typically include:

- Grace periods (6–12 months)

- Penalty clauses (up to 10% annual interest on paid amounts)

- Refund rights only in extreme breach or project cancellation

Always consult a legal expert to interpret these terms and validate enforceability.

Case Study: Delay in Handover of a Downtown Dubai Tower

Project: Skyline Residences

Initial Handover: Q4 2022

Status in 2025: Only 65% complete

Response:

- Buyers formed a legal action group

- Complaint filed with DLD

- Developer fined, handover pushed to Q2 2026

- Some compensation granted via rent-free periods

Mistakes to Avoid When Facing Delays

- ❌ Ignoring grace periods in SPA

❌ Delaying formal complaints

❌ Failing to check project status via DLD

❌ Verbal-only communication with the developer

❌ Investing in developers without proven track records

Costs, Fees, and Financial Implications

| Item | Estimated Cost (AED) |

| Legal Consultation | 2,000–10,000 |

| Filing RERA Complaint | 500–2,000 |

| Arbitration/Mediation | 5,000+ |

| Interest During Delay | Based on mortgage |

| Compensation | 5–10% per year of delay |

FAQs

How long can a project be delayed legally?

Most SPAs (Sales and Purchase Agreements) allow developers a grace period of 6 to 12 months after the promised handover date. If the delay exceeds this window and is not due to justifiable force majeure (like a pandemic or natural disaster), buyers may initiate legal action or seek compensation. RERA considers delays beyond this timeframe a potential breach, especially if there’s a lack of communication or transparency from the developer.

Can I cancel my contract and get a refund?

Yes, under specific conditions:

- If the delay exceeds contractual or RERA-accepted thresholds.

- If RERA cancels the project for non-compliance or insolvency.

- If you’ve served a legal notice and no remedial action was taken.

In such cases, you may recover funds through the project’s escrow account. However, refunds can take time depending on the case complexity and the availability of funds.

How do I file a complaint?

You can submit a complaint via:

- Dubai REST App: Fast, paperless submission.

- DLD Customer Happiness Centers: Walk-in service with case tracking.

- Written submission to RERA: Recommended if you’re attaching detailed documentation or legal arguments.

Complaints should include: SPA copies, payment receipts, developer correspondence, photos (if applicable), and a timeline of events. RERA may investigate, summon the developer, and mediate a resolution.

What if the developer files bankruptcy?

If your developer goes bankrupt, RERA steps in to safeguard investors by:

- Suspending disbursements from the escrow account.

- Attempting to assign the project to another developer.

- Initiating liquidation procedures where necessary.

In this case, your primary protection comes from escrow security. You’ll need to prove your payments and agreement status to claim reimbursement or a new unit from a transferred project.

Can I resell my delayed off-plan unit?

Generally, yes — unless your SPA restricts resale prior to a certain percentage of payment or developer consent. But you should be aware:

- Buyers will likely negotiate a lower price due to uncertainty.

- You’ll incur DLD registration and transfer fees.

- The developer may charge an administration fee for NOC (No Objection Certificate).

Resale is a possible exit strategy, but it’s best done with guidance from a real estate advisor or legal expert to ensure compliance and value protection.

Conclusion

Off-plan property delay in Dubai can be frustrating, financially straining, and emotionally draining — especially for first-time investors or end-users planning to move in. However, the emirate’s well-established regulatory infrastructure, particularly the roles of RERA and the Dubai Land Department, offers buyers solid pathways to seek clarity, compensation, or even contract termination when delays are excessive.

Whether it’s a minor delay or a years-long postponement, the key lies in being informed, vigilant, and proactive. By thoroughly reviewing your sales contract, maintaining communication with the developer, and exploring both amicable and legal remedies, you can effectively navigate handover delays and protect your investment.

The Dubai property market remains one of the most lucrative and transparent in the region — and with the right support, you can ensure your investment yields the returns and outcomes you planned for.

Homecubes – Your Partner in Smart Property Decisions

At Homecubes, we focus on the intersection of real estate, blockchain, and legal-tech in Dubai. While we are not a law firm, we support investors with insights on navigating off-plan property challenges and work with licensed experts when legal action is required.

We’re also in the process of obtaining our VARA license, which will enable us to offer specialized services in tokenized real estate and digital property solutions.

📩 Have an off-plan delay issue?

Let’s review your options together.

🔗 Contact Homecubes – Trusted guidance for the future of property.