Introduction: Why Market Corrections Are Opportunities in Disguise

Market corrections can often send investors into panic mode. However, seasoned professionals understand that these temporary dips represent some of the most lucrative entry points into any asset class—including real estate. In the context of the UAE, a nation renowned for its dynamic property sector, market corrections don’t signal collapse—they hint at strategic repositioning.

As real estate prices adjust due to global or regional economic forces, investors have the rare chance to secure high-value assets below peak valuations. According to the Dubai Land Department, In 2024, Dubai’s real estate sector recorded a total of 226,000 transactions, amounting to AED 761 billion, marking a 36% growth in volume and a 20% increase in value compared to the previous year.

Real Estate prices in Dubai after a scorching rally of 70% in last 2 years seemed to have peaked and can see a correction in the next two years.

In the last 3 months I have been indicating Dubai RE prices were closer to peak levels and likely to top out. pic.twitter.com/aaQFanBSwF— Arvind Datta (@datta_arvind) April 15, 2025

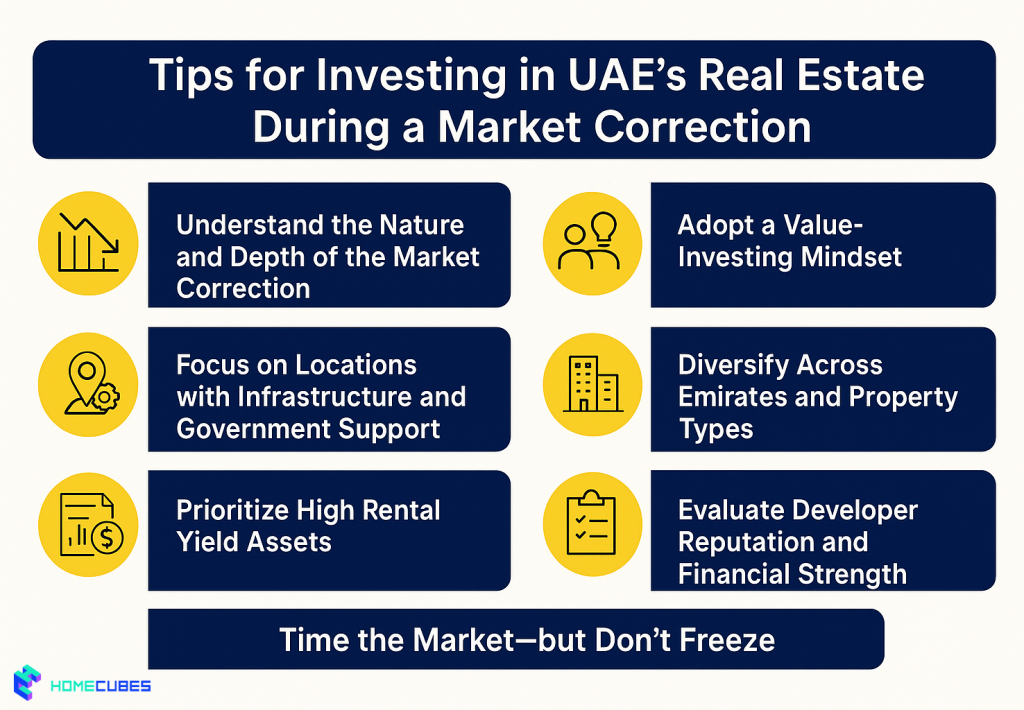

To capitalize on these windows of opportunity, here are seven data-backed, practical Market Correction Tips tailored to the UAE real estate market.

Tip 1: Understand the Nature and Depth of the Market Correction

Context is Everything

Not all corrections are created equal. Before investing, analyze whether the correction stems from temporary macroeconomic factors (e.g., global inflation, oil price shocks) or structural weaknesses in the market (e.g., oversupply in specific zones).

For instance, in 2020, property values dipped across many Emirates due to pandemic uncertainty, but quickly rebounded as economic recovery efforts took hold. Investors who understood the short-term nature of that correction secured high-performing assets at discounted rates.

Action Steps:

- Track indicators like property price indices from sources such as Bayut and transaction volumes

- Monitor mortgage trends and rental yields in target zones

- Assess geopolitical or regulatory changes affecting investor sentiment

Tip 2: Focus on Locations with Infrastructure and Government Support

Long-Term Fundamentals Trump Short-Term Volatility

Even during corrections, certain locations continue to attract interest due to infrastructure upgrades, free zone benefits, or government development plans. The UAE Vision 2031, for example, prioritizes smart city expansion and connectivity—making districts near metro lines, ports, or innovation hubs more resilient.

Hotspot Examples:

- Dubai South: Proximity to Al Maktoum Airport and Expo City

- Masdar City: Abu Dhabi’s sustainable development zone

- Sharjah Research Technology and Innovation Park (SRTIP): A rising star for innovation-linked residential and commercial demand

Market Correction Tips:

- Don’t abandon high-growth areas just because of temporary pricing dips

- Analyze upcoming infrastructure projects on official municipality portals

Tip 3: Prioritize High Rental Yield Assets

Income Generation Cushions Volatility

One of the safest ways to navigate a market correction is to focus on rental yield performance by understanding trends shaping UAE real estate rental yields in 2025. During downturns, rental income becomes an essential hedge against stagnant or declining asset prices.

According to Asteco’s Q1 2024 Market Report, average rental yields in Dubai remain above 6%, with certain mid-income segments even higher.

Best Asset Types During Corrections:

- Short-term rental apartments in high-tourism zones

- Staff accommodation in labor-dense industrial hubs

- Warehouse and logistics properties in response to e-commerce growth

Tip:

Evaluate net returns after service charges and vacancy periods to ensure positive cash flow.

Tip 4: Adopt a Value-Investing Mindset

Buy Low, Hold Smart

A market correction is a textbook opportunity for value investing—acquiring quality assets at a discount with the intention of holding long-term. Focus on properties whose intrinsic value exceeds their temporary market price.

Look for:

- Motivated sellers or distressed developers offering limited-time deals

- Properties with strong historical price growth but temporary price dips

- Units with renovation or repositioning potential

Tools:

Use property comparison features on Property Finder and Dubizzle to take the steps to assess UAE real estate for long-term appreciation and identify underpriced listings in key areas.

Tip 5: Diversify Across Emirates and Property Types

Avoid Overexposure to One Segment

Corrections don’t hit every region equally. While prime areas like Downtown Dubai may recover quickly, emerging zones in Ajman or Ras Al Khaimah might take longer or present better entry points.

Likewise, diversifying into mixed-use, industrial, or co-living properties can balance a residential-heavy portfolio.

Suggested Diversification Strategies:

- Mix ready-to-move-in and off-plan projects

- Combine luxury, mid-market, and affordable housing

- Include commercial units in logistics corridors like JAFZA or DIP

Market Correction Tips:

Use REITs or micro-investment platforms to access fractional shares in diverse properties without heavy capital commitment.

Tip 6: Evaluate Developer Reputation and Financial Strength

Not All Discounts Are Worth It

During corrections, many developers offer heavy incentives—extended payment plans, waived service charges, or rent guarantees. But always verify the financial stability and track record of developers before committing.

Vetting Checklist:

- Review delivery history on previous projects

- Search for developer ratings on RERA’s portal

- Confirm escrow accounts and regulatory approvals are in place

Poorly funded developers may delay or abandon projects if conditions worsen. Stick with entities that can weather the downturn.

Tip 7: Time the Market—but Don’t Freeze

Avoid Paralysis by Analysis

One of the most overlooked Market Correction Tips is psychological: many investors wait too long for the “perfect bottom” and miss the recovery. While timing matters, successful investment relies more on buying well-priced assets with solid fundamentals rather than perfectly timing the dip.

Suggested Approach:

- Set entry price targets but remain flexible

- Build positions in phases (e.g., 60% now, 40% later)

- Use price alerts on trusted property portals

Remember: opportunity cost can be higher than short-term paper losses.

Bonus Tip: Leverage Smart Financing

Use Corrections to Renegotiate Terms

With demand slowing during a correction, banks and lenders often become more flexible. Use this to your advantage by securing:

- Lower interest rates

- Longer payment holidays

- Reduced down payments

Work with brokers or mortgage advisors experienced in UAE’s banking ecosystem to optimize terms based on your risk profile.

Final Thoughts: Navigating UAE’s Property Cycle with Confidence

The UAE’s real estate market has consistently demonstrated cyclical resilience. From the 2009 global financial crisis to the COVID-19 downturn, it has emerged stronger each time—fueled by strong governance, economic diversification, and investor-friendly policies.

By applying these Market Correction Tips, investors can not only protect capital but also unlock significant upside potential. Whether through undervalued assets, high-yield rentals, or strategic diversification, the current correction cycle—like many before it—offers a window for wealth creation.

📣 Interested in Fractional Ownership During the Correction Phase?

Homecubes is currently in the process of obtaining its regulatory license from VARA to offer digital real estate investment options across Dubai and the UAE. Once licensed, our platform will allow fractional ownership in vetted, income-generating properties—ideal for navigating market corrections with lower capital exposure.

🔗 Contact our team to be notified when our services go live, and stay ahead of the curve in UAE’s real estate market.