Table of Contents

- Introduction

- What Real Estate Management Software Means in the UAE

- Why Property Owners and Investors Are Adopting It

- Features That Matter in the UAE Context

- Case Study: From Spreadsheets to Seamless Operations

- Risks and Challenges to Consider

- Mistakes to Avoid When Choosing a Platform

- Fees, Charges, and the True Cost of Adoption

- Best Practices for Maximizing ROI

- Market Outlook: The Future of Property Management Software in the UAE

- Final Thoughts

- Frequently Asked Questions (FAQs)

- Unlock Dubai’s Property Potential with Homecubes

Introduction

The UAE’s property market is surging, attracting global investors and billions in annual transactions. According to CBRE’s UAE Real Estate Market Review Q2 2025, residential rents in Dubai have grown by more than 20% year-on-year, with Abu Dhabi also recording robust leasing activity.

This growth comes with challenges: landlords and asset managers must manage thousands of leases, ensure compliance, respond to tenant requests, and maintain transparency for investors. Considering Proptech companies emerging in the UAE, manual processes no longer suffice. UAE real estate management software (REMS) is now a core tool for sustaining profitability and compliance.

As a realtor, house hunting for clients takes more than listings — it takes hours of research, filtering, and personalized touches.

With Manus AI, sales professionals can:

→ Search across platforms in seconds

→ Filter based on each client’s unique preferences

→ Instantly… pic.twitter.com/nR5mckUTy0— ManusAI (@ManusAI_HQ) July 22, 2025

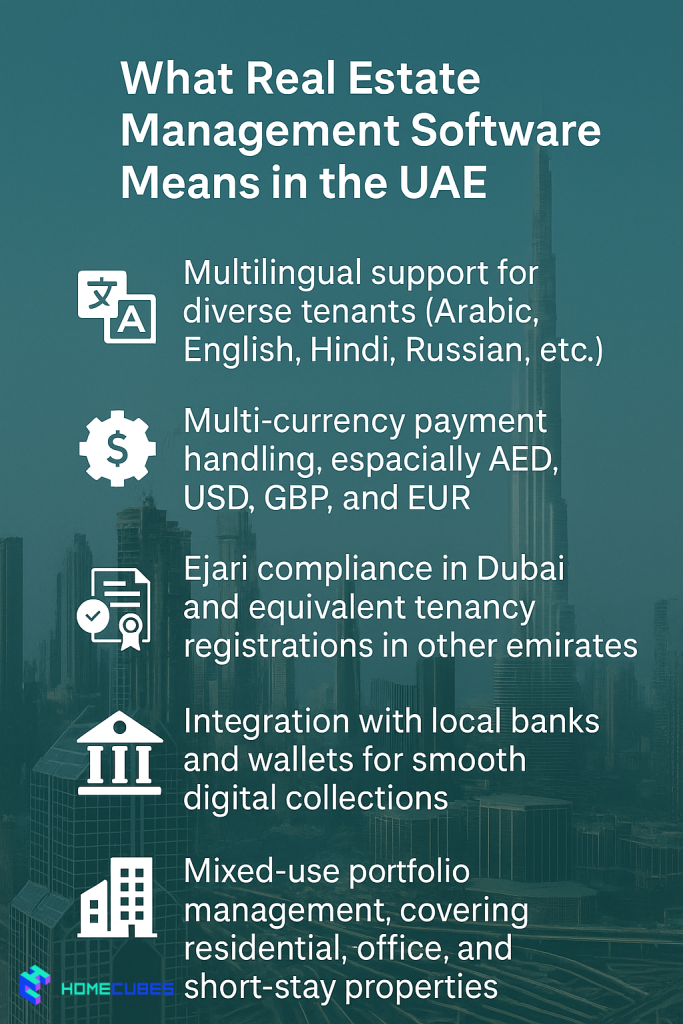

What Real Estate Management Software Means in the UAE

Globally, REMS automates tenant management, rent collection, and maintenance workflows. In the UAE, the requirements are more complex:

- Multilingual support for diverse tenants (Arabic, English, Hindi, Russian, etc.)

- Multi-currency payment handling, especially AED, USD, GBP, and EUR

- Ejari compliance in Dubai and equivalent tenancy registrations in other emirates

- Integration with local banks and wallets for smooth digital collections

- Mixed-use portfolio management, covering residential, office, and short-stay properties

With increasing regulation and international investor scrutiny, as well as AI utilization in UAE real estate, REMS in the UAE is about far more than efficiency—it’s about trust, compliance, and investor confidence.

Why Property Owners and Investors Are Adopting It

Market Expansion

As JLL’s UAE Living Market Dynamics Q2 2025 highlights, over 25,000 new residential units are expected to enter Dubai’s market this year. With supply rising, effective property management can be the difference between achieving healthy yields and prolonged vacancies.

Rental Dominance

Nearly 85% of Dubai residents rent. Landlords need automated workflows for renewals, deposits, and arrears to stay competitive.

Regulatory Demands

In Dubai, landlords must comply with the Ejari registration and renewal process. Non-compliance risks fines and disputes. Software can auto-generate tenancy packs aligned to DLD requirements.

Investor Transparency

International investors expect real-time reporting on returns, arrears, and occupancy. Dashboards within REMS provide instant oversight.

Efficiency Pressures

Deloitte’s Dubai Real Estate Predictions 2025 notes that operational efficiency is central to sustaining investor returns. Paper-based systems are increasingly uncompetitive.

Features That Matter in the UAE Context

Listings and Marketing

- Syndication with portals like Bayut, Property Finder, Dubizzle

- Floorplans, 360° tours, and video listings

- Automated lead management and follow-ups

Tenant and Lease Management

- Templates aligned with Dubai Land Department’s Rules & Regulations

- Automated reminders for renewals and deposits

- Centralized tenant communication logs

Rent Collection and Payments

- Integration with UAE banking APIs and wallets

- Auto-generated receipts and arrears management

- Reconciliation with accounting modules

Maintenance and Service Requests

- Ticketing portals for tenants

- Vendor assignment with SLA timers

- Preventive maintenance scheduling

Financial Reporting

- Unit and portfolio-level profitability dashboards

- Budget vs. actual variance analysis

- Exportable, audit-ready financial reports

Document and Compliance Management

- Secure storage with encryption and access controls

- Digital signatures and version control

- Automated compliance packs for renewals

Building Standards Integration

Advanced software increasingly integrates data aligned to the Dubai Building Code, ensuring landlords meet design and safety requirements.

Case Study: From Spreadsheets to Seamless Operations

Profile: A Dubai landlord managing 120 units in Marina and JVC.

Challenges:

- Late cheque payments

- Missed renewals → avoidable vacancies

- Maintenance requests scattered on WhatsApp

- No clear P&L at the unit level

Solution: Implemented a UAE-focused REMS with digital rent collection, automated renewals, and maintenance ticketing.

Results after 6 months:

- 90% of rent paid digitally, reducing arrears

- Vacancy reduced by 15% thanks to timely renewal alerts

- Maintenance SLA compliance improved by 35%

- Monthly reporting cycle shortened by one week

Risks and Challenges to Consider

- Regulatory drift: tenancy requirements evolve; vendors must update regularly.

- Cybersecurity threats: sensitive data requires encryption and strong access controls.

- Tenant resistance: adoption may be slow without proper training.

- Vendor lock-in: ensure contracts allow data portability.

- Bad data migration: poor legacy data compromises future reporting.

Mistakes to Avoid When Choosing a Platform

- Opting for generic global software without UAE compliance features

- Ignoring integration with local banks and payment gateways

- Over-customizing, leading to complexity and delays

- Under-investing in staff and tenant training

- Accepting vague SLAs without performance remedies

Fees, Charges, and the True Cost of Adoption

- Subscriptions: AED 15–50 per unit monthly

- Setup/migration: onboarding and data cleanup fees

- Transaction charges: payment gateway deductions

- Customization: fees for bespoke workflows and reporting

- Support: premium support packages for faster response

- Hidden costs: export fees or vendor-imposed upgrades

Smart landlords request transparent breakdowns and cap renewal increases.

Best Practices for Maximizing ROI

- Pilot with 10–20% of units before full rollout

- Train staff, tenants, and vendors with guides and tutorials

- Automate high-friction tasks like arrears follow-ups and renewals

- Schedule quarterly vendor reviews for compliance updates

- Use dashboards to identify underperforming units and divest strategically

Market Outlook: The Future of Property Management Software in the UAE

By 2030, the UAE market will see:

- AI tools for predictive maintenance and vacancy risk scoring

- Blockchain contracts for tamper-proof leasing

- IoT sensors for energy and safety optimization

- Tokenized fractional ownership, enabling broader investor participation

As CBRE’s UAE Real Estate Market Review Q2 2025 confirms, technology adoption will play a decisive role in yield preservation as the market becomes more competitive.

Final Thoughts

UAE real estate is firmly moving into a digital-first phase. For landlords and investors, adopting real estate management software is no longer just about convenience — it’s about protecting revenue, ensuring compliance, and staying competitive in a fast-growing market.

With thousands of new units entering supply, stricter regulations, and rising expectations from global investors, software-driven operations give landlords a decisive edge. The benefits are clear: smoother tenant experiences, stronger cash flow through timely collections, and audit-ready compliance that reduces legal risks.

Those who embrace these tools now will not only preserve yields but also build credibility with tenants and international partners. Those who wait risk inefficiency, financial penalties, and losing ground in an increasingly professionalized property landscape.

Frequently Asked Questions (FAQs)

Is REMS integrated with Ejari?

Yes, leading platforms automate contract templates and workflows aligned to Ejari submissions.

Can it support both long-term and short-stay rentals?

Yes, advanced systems handle calendars, cleaning, and turnover tasks alongside annual lease tracking.

Is tenant and investor data secure?

Reputable vendors use encryption, redundancy, and compliance with international standards.

Is REMS useful for small landlords?

Yes, even portfolios under 10 units benefit from automated rent collection and renewal alerts.

How long does deployment take?

Smaller portfolios can be implemented in 6–10 weeks; larger, mixed portfolios may require more.

Unlock Dubai’s Property Potential with Homecubes

At Homecubes, we’re building a platform designed for landlords and investors who want smarter, simpler, and more transparent property operations in the UAE.

- Automated tenant and lease management

- Digital rent collection and financial reporting

- Blockchain-ready architecture for fractional ownership

- Regulatory workflows aligned to UAE tenancy requirements

⚠️ Regulatory note: Homecubes has applied for a VARA license to operate a real estate tokenization platform in Dubai. Our services will launch once this license is approved, ensuring compliance and investor protection.

📩 Explore the future of real estate management with us. Contact Homecubes today.