Table of Contents

- Introduction

- Why Use Crypto for Property Transactions

- Core Cryptocurrency Property Challenges

- Risks and Mistakes to Avoid

- Case Study: A Real-World Crypto Property Deal

- Fees and Hidden Costs

- Mitigation Strategies and Best Practices

- Outlook for 2025 and Beyond

- FAQs

- Conclusion

- Final Thoughts & Homecubes CTA

Introduction

Cryptocurrencies have transformed global finance — and now they’re redefining real estate. Across Dubai, Singapore, and Miami, buyers are exploring digital assets for property purchases. The attraction lies in borderless payments, fast settlement, and blockchain transparency.

Yet beneath this excitement are significant cryptocurrency property challenges: regulatory uncertainty, volatility, tax exposure, and operational risk. Mismanaging any of them can turn an innovative transaction into an expensive error.

This guide examines every aspect of crypto-based property deals — the risks, real-world examples, legal frameworks, and emerging opportunities under Dubai’s evolving Virtual Assets Regulatory Authority (VARA) regime.

Why Use Crypto for Property Transactions

The real estate investment in the blockchain era is providing notable risks along with great opportunities and advantages for real estate investors around the globe. Here are the advantages investors can enjoy from investing in real estate through cryptocurrencies.

Borderless Transactions

Crypto payments eliminate many of the friction points in cross-border real-estate deals. Global investors can transfer value directly without relying on correspondent banks or costly intermediaries.

Transparency and Speed

Blockchain transactions are immutable and near-instant, providing verifiable settlement proofs for both buyers and sellers.

Tokenized Ownership

Fractionalized or tokenized real estate allows investors to own blockchain-recorded shares in property assets. Deloitte estimates tokenized property markets could exceed USD 4 trillion by 2035, though liquidity remains limited (Deloitte Insights).

Smart-Contract Automation

Escrow release, milestone payments, and compliance verification can be automated on-chain — but these digital clauses still need legal reinforcement in traditional contracts.

Core Cryptocurrency Property Challenges

Volatility and Price Instability

Crypto’s extreme price swings make valuation difficult. If ETH drops 15 % between signing and closing, one side loses instantly. Many developers therefore peg prices to fiat or use stablecoins to stabilize value.

Legal Ambiguity and Regulatory Complexity

Dubai allows crypto-funded purchases only through VARA-licensed intermediaries, which must convert tokens into dirhams before registration. Direct wallet-to-wallet transfers don’t confer legal ownership.

According to FinJuris, every compliant transaction must pass AML/KYC checks and route through a regulated broker (FinJuris Legal Blog).

Furthermore, VARA’s 2024–25 rulebook updates require strict governance and disclosure controls (Linklaters TechInsights).

Counterparty and Fraud Exposure

Crypto transfers are irreversible. Without licensed escrow, fraudulent brokers can disappear with funds. Always confirm titles, verify broker registration, and insist on notarized documentation.

Technical and Infrastructure Gaps

Loss of private keys, incompatible wallets, or lack of blockchain integration at registries can halt transfers. Until official property ledgers move on-chain, crypto functions only as payment, not ownership proof.

Tax and Compliance Complexity

Each crypto payment usually constitutes a taxable disposal. Investors must record exchange rates, cost bases, and timestamps. Errors invite audits or fines.

Market Liquidity Gaps

Tokenized-asset markets remain thin; most trade volumes are negligible. An arXiv study highlights low liquidity and long holding periods in RWA tokens (arXiv Research Paper). Sellers often accept discounts when converting tokens back to fiat.

Risks and Mistakes to Avoid

- Ignoring Volatility: Always define settlement currency and lock rates.

- Replacing Legal Work with Code: Smart contracts automate actions, not legal rights.

- Skipping Tax Planning: Capital-gains liabilities can erode profits.

- Neglecting Due Diligence: Verify VARA licensing and land-registry authenticity.

- Sending Funds Without Escrow: Licensed custodians prevent irreversible loss.

Case Study: A Real-World Crypto Property Deal

A Dubai investor purchased a penthouse in 2024 for USD 600 000 using ETH. Two weeks later, ETH fell 15 %, forcing additional payments. The broker converted crypto to AED with 3 % fees, and tax advisors flagged a capital-gains event.

Outcome: higher cost, regulatory delay, and reduced ROI.

Lesson: hybrid settlements and licensed conversion partners are essential.

Fees and Hidden Costs

| Fee Type | Description |

| Network (Gas) | High during congestion periods |

| Broker & Exchange | Hidden spreads on conversion |

| Smart-Contract Audit | Prevents exploits before deployment |

| Legal / Compliance | Dual-jurisdiction reviews |

| Tax / Accounting | Ongoing reporting and filings |

These overheads frequently offset any perceived savings from decentralization.

Mitigation Strategies and Best Practices

- Use Stablecoins or Pegged Models to neutralize volatility.

- Work with VARA-Licensed Brokers for legal and AML coverage.

- Mirror On-Chain and Off-Chain Contracts for enforceability.

- Hedge Exchange Rates via forward contracts or partial-fiat settlements.

- Plan Taxes Early with crypto-savvy accountants.

- Monitor UAE regulations on asset tokenization continuously — e.g., Mondaq’s analyses of VARA structures (Mondaq Legal Commentary).

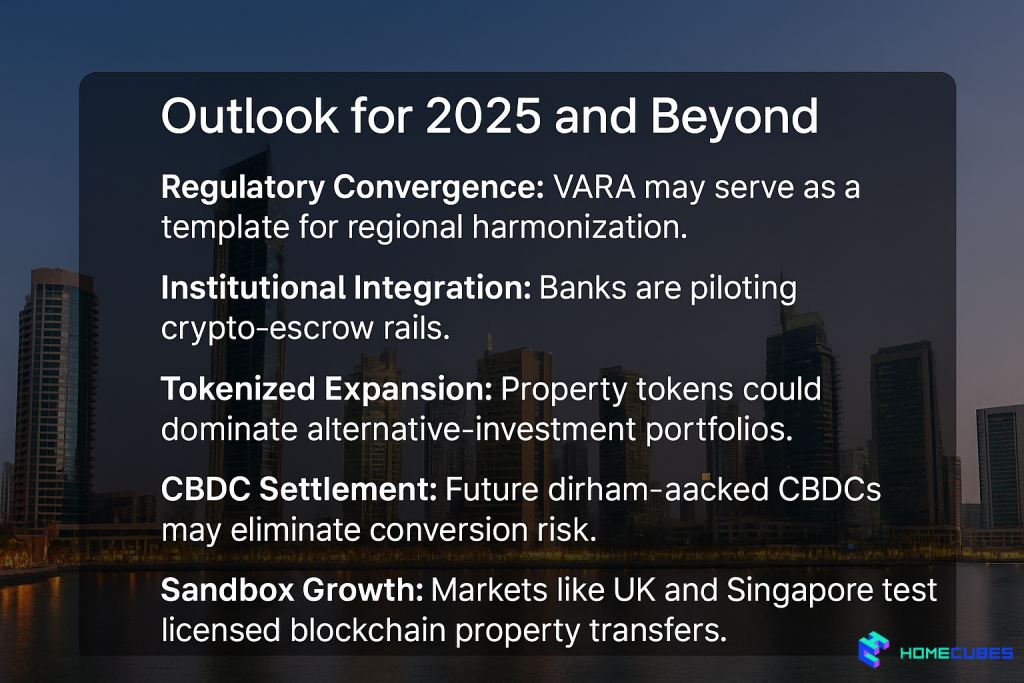

Outlook for 2025 and Beyond

- Regulatory Convergence: VARA may serve as a template for regional harmonization.

- Institutional Integration: Banks are piloting crypto-escrow rails.

- Tokenized Expansion: Property tokens could dominate alternative-investment portfolios.

- CBDC Settlement: Future dirham-backed CBDCs may eliminate conversion risk.

- Sandbox Growth: Markets like the UK and Singapore test licensed blockchain property transfers.

As maturity grows, today’s cryptocurrency property challenges will evolve into standardized protocols.

FAQs

Is it legal to buy property in Dubai using cryptocurrency, and what are the current VARA regulations?

Yes. Buyers must transact through a VARA-licensed intermediary that converts crypto into AED for Dubai Land Department settlement. Direct wallet transfers don’t create registrable ownership.

What documents and compliance checks are required before buying real estate with cryptocurrency in the UAE?

Expect KYC verification, source-of-funds proof, blockchain transaction logs, and compliance certification from the intermediary before crypto conversion and final registration.

How does paying for property with Bitcoin or Ethereum affect my taxes as an investor?

Crypto used for payment counts as a taxable disposal; capital-gains tax applies on any appreciation. Maintain timestamps and exchange-rate records, and consult a qualified tax specialist.

What happens if crypto prices fall between signing and closing a property purchase?

The party denominating the contract in crypto bears the loss. Mitigate risk with fiat-pegged pricing, stablecoins, or hybrid settlements.

Can I record property ownership directly on the blockchain, and is it recognized in the UAE?

Not yet. Official registration still occurs at the Dubai Land Department, though pilot projects exploring on-chain deeds are underway.

How can I securely transfer large crypto amounts for property purchases?

Use multi-signature wallets or licensed custodial escrow. Avoid P2P transfers or exchange wallets lacking contractual safeguards.

Which cryptocurrencies are accepted for real-estate transactions in Dubai, and which are most stable?

Primarily Bitcoin (BTC), Ethereum (ETH), and stablecoins (USDT/USDC). Preference goes to tokens audited and approved under regulatory oversight.

How will Dubai’s VARA framework and global crypto laws impact property purchases by 2026?

Expect tighter KYC/AML, standardized custody rules, and greater investor protection as global FATF-aligned policies spread.

Conclusion

Crypto brings innovation, transparency, and speed to real estate — but only for those who understand its risks. Investors who recognize and manage cryptocurrency property challenges can unlock new efficiencies while remaining compliant. Regulation is tightening, liquidity is improving, and professional standards are rising. The convergence of blockchain and property law will favor informed, well-advised participants.

Unlock Dubai’s Property Potential with Homecubes

At Homecubes, we help investors navigate this transformation responsibly. Once our VARA license is approved, we’ll enable compliant digital-asset participation in Dubai’s real-estate market.

Until then, our research and guides empower you to understand tokenization, regulation, and the realities of crypto-based property deals — so you can be ready when Dubai’s blockchain property era fully unfolds.

👉 Explore insights or connect with our team to stay informed and prepare for Dubai’s next property revolution.