When it comes to investing in property in the UAE, potential investors are often faced with a crucial question: Villas vs Apartments in the UAE. Both offer distinct advantages and come with their own set of challenges. Understanding the differences, benefits, and considerations for both will help investors make an informed decision based on their goals, needs, and the current market environment. This article explores the pros and cons of each investment type to determine which is the better option in the UAE.

The UAE Real Estate Market: An Overview

The UAE real estate boom is attracting global capital, as it has long been a favorite for both local and international investors. Over the years, Dubai and Abu Dhabi have emerged as global hotspots, attracting investors seeking strong returns. The country’s stable economy, strategic location, and modern infrastructure make it an ideal destination for property investments.

Best place to settle down – UAE and in particular Dubai

Buy a AED 2Mn (₹4.5Cr) property you are eligible for a golden visa.

Anyone over 55 yrs can avail a retirement visa if you invest AED 1 Mn in a property.

No crime most safe for women

Best in class infra and many more things— Arvind Datta (@datta_arvind) June 25, 2024

Villas and apartments remain two of the most sought-after types of real estate investments. However, each type offers different experiences, financial returns, and growth potential.

Key Factors Affecting Investment Decisions

Before diving into a comparison of villas and apartments, it’s important to consider several factors that affect real estate investments:

-

Location

The location of a property heavily influences its value and rental demand. Some investors may prioritize proximity to business hubs or luxury areas, which may lean toward apartment living. Villas, on the other hand, tend to thrive in suburban or more exclusive areas.

-

Market Trends

Understanding the current trends in supply and demand will help identify the type of property likely to appreciate more in the future.

-

Budget and Affordability

Villas typically require a larger initial investment, making them less accessible to a wide range of investors. Apartments often offer lower entry costs, appealing to those with a smaller budget.

-

Rental Yield

Many investors focus on rental yield, the return they can expect from renting out the property. Both villas and apartments can offer strong rental yields, but the specifics depend on location, size, and amenities.

-

Long-term Appreciation

The potential for property value appreciation over time is crucial. Some areas may see greater capital growth for villas, while others might see higher appreciation in apartments.

Villas in the UAE: Key Benefits and Drawbacks

Villas represent a luxurious and spacious housing option that appeals to both residents and investors looking for long-term capital appreciation.

[1] You buy a Villa, the land prices go up by 10%, your villa price goes up by 10%

This is simple.

[2] You buy a flat in a building (let’s say 10 apartments in that building; you have a proportionate share), the land prices go up by 10%.

Your apartment price appreciates by…

— Akshat Shrivastava (@Akshat_World) March 28, 2024

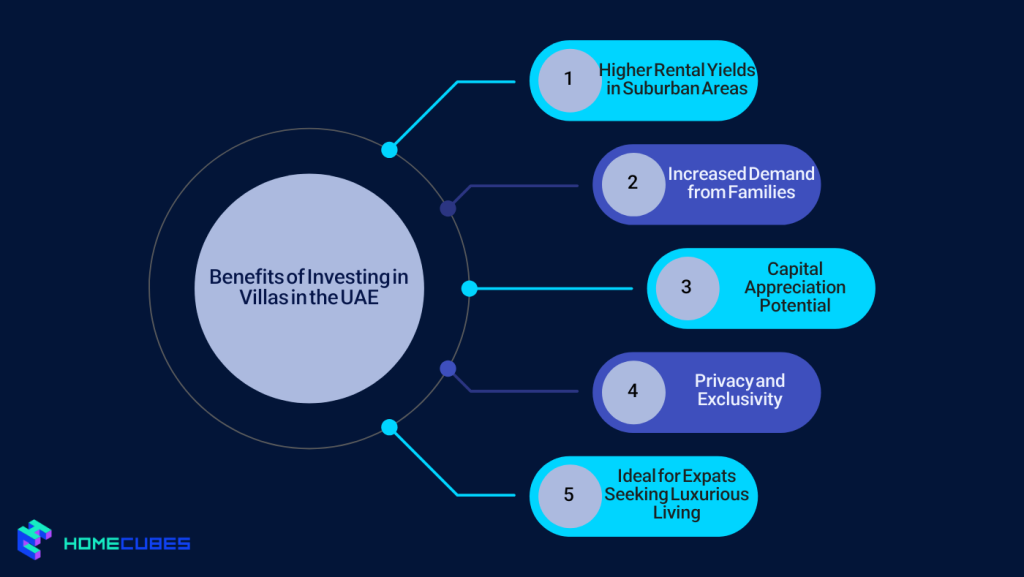

Benefits of Investing in Villas:

-

Higher Rental Yields in Suburban Areas

Villas, particularly in suburban areas such as Dubai Hills, Arabian Ranches, or the Palm Jumeirah, often attract affluent tenants seeking larger homes with gardens and private spaces. This demand results in higher rental returns, particularly in communities where lifestyle and exclusivity are highly valued.

-

Increased Demand from Families

Villas are often sought after by families who prioritize space, privacy, and a quiet neighborhood. As such, they tend to offer a stable rental market, particularly for those with children or people seeking long-term stays.

-

Capital Appreciation Potential

Due to their larger size and the fact they often sit on larger plots of land, villas have the potential for higher capital appreciation. They may see significant increases in value, especially in exclusive neighborhoods and areas with limited supply.

-

Privacy and Exclusivity

Villas provide the ultimate privacy. They often come with private gardens, pools, and more space, making them appealing for people looking for a serene, high-end living experience.

-

Ideal for Expats Seeking Luxurious Living

For expatriates and high-net-worth individuals, villas are often the preferred option. Dubai, for example, has several villa communities, like Jumeirah Golf Estates and Emirates Hills, that attract wealthy expats and investors.

Drawbacks of Investing in Villas:

-

Higher Initial Investment

Villas tend to have higher price tags than apartments, making them less accessible for smaller investors. The larger upfront cost can also mean more exposure to market risk if the demand dips.

-

Maintenance and Upkeep Costs

Villas often require more maintenance than apartments. The larger size of the property, private gardens, and pools can increase the cost of upkeep. This may eat into an investor’s profits, especially if rental demand is lower than expected.

-

Longer Vacancy Periods

Although villas are popular among families, their niche appeal can lead to longer vacancy periods, especially if the property is located in more suburban areas where demand is less consistent.

-

Limited Market Liquidity

Villas are more difficult to sell quickly, particularly in markets where the demand is less. Unlike apartments, which may appeal to a broader market, villas have a more limited pool of potential buyers.

Apartments in the UAE: Key Benefits and Drawbacks

Apartments are the most common type of real estate in the UAE, particularly in urban hubs such as Dubai and Abu Dhabi. They tend to attract a wide variety of renters and buyers, from young professionals to investors looking for higher rental yields.

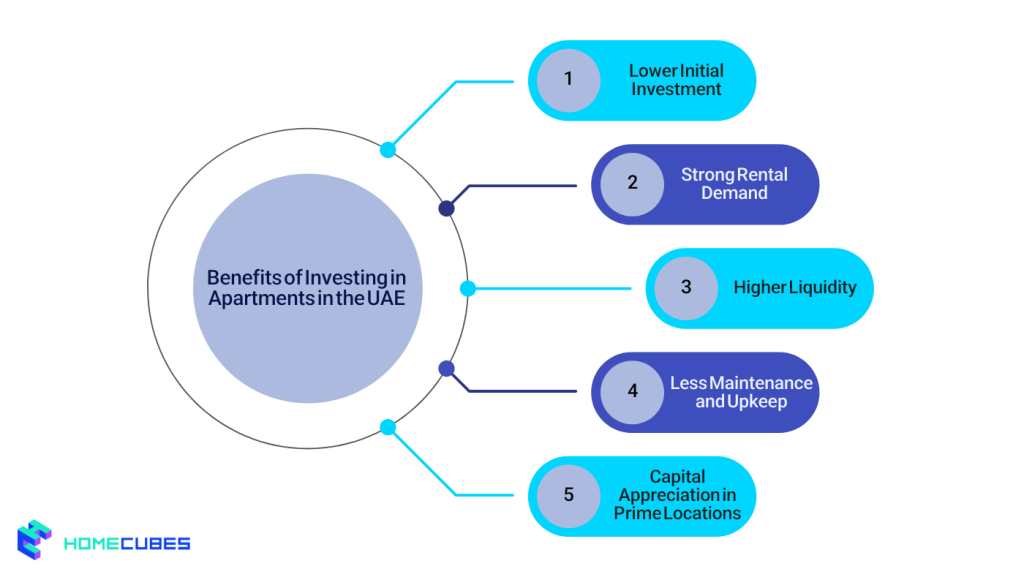

Benefits of Investing in Apartments:

-

Lower Initial Investment

Apartments are typically more affordable than villas. This lower initial cost allows for more flexibility in terms of investment size and potential returns. Investors with smaller budgets may prefer to invest in apartments rather than villas due to the more accessible price point.

-

Strong Rental Demand

The lifestyle trends are driving demand for apartments in the UAE, so Apartments tend to attract a broad range of tenants, including young professionals, small families, and expatriates working in the UAE. Areas such as Downtown Dubai, Dubai Marina, and Business Bay are highly sought after for apartment rentals, ensuring relatively consistent rental demand.

-

Higher Liquidity

The market for apartments is generally more liquid than that for villas. The larger pool of potential buyers and tenants, especially in high-demand areas, makes it easier to sell or rent an apartment quickly.

-

Less Maintenance and Upkeep

One of the biggest advantages of owning an apartment is the lower maintenance cost. With fewer square meters to manage, apartment owners typically incur fewer maintenance costs than villa owners. This is especially true in well-managed buildings with facilities like gyms and swimming pools.

-

Capital Appreciation in Prime Locations

Apartments in prime locations often experience strong capital appreciation. Areas like Downtown Dubai, DIFC, and Dubai Marina see significant price increases due to their proximity to business districts and the overall demand for urban living.

Drawbacks of Investing in Apartments:

-

Smaller Space and Less Privacy

Apartments generally offer less space than villas, which can be a significant downside for families or individuals seeking privacy. The lack of private gardens or outdoor spaces can be a deterrent for some renters or buyers.

-

Higher Service Fees

Apartments, particularly in luxury buildings, come with service charges, which can be higher than expected. These charges often cover maintenance of common areas, building security, and other facilities. Investors should factor these fees into their profit calculations.

-

Potential for Lower Rental Yields in Certain Areas

While apartments generally offer stable rental yields, the returns can be lower in areas where supply is high, or in less desirable locations. Investors need to carefully consider the area’s rental market before purchasing.

-

Dependence on Market Saturation

The market for apartments can be highly competitive, especially in areas with numerous new developments. This can lead to oversupply and a reduction in rental rates, which can affect the investor’s returns.

Which Is the Better Investment: Villas vs Apartments in the UAE?

Ultimately, the decision to invest in villas or apartments in the UAE depends on several factors, including budget, target market, location, and long-term investment strategy.

- Villas are an excellent option for investors looking for high capital appreciation and long-term stability, particularly in suburban or luxury areas. They offer higher rental yields and greater privacy but come with higher costs and longer vacancy periods.

- Apartments, on the other hand, are a more accessible investment for those with a smaller budget or a preference for liquidity. They tend to be in high demand in central locations, making them a good choice for investors seeking consistent rental income and easier resale opportunities.

Conclusion

For those focused on long-term growth and exclusivity, villas may be the better option. But if the goal is quick rental income and easier management, apartments may be more suitable.

In conclusion, both villas and apartments have their place in the UAE market. By analyzing personal investment goals and market conditions, investors can make a well-informed decision between villas vs apartments UAE.

Homecubes has developed their property tokenization platform in full compliance with UAE regulation on asset tokenization focusing on the Dubai real estate market. Contact us at your earliest possible to take advantage of such a lucrative fractional investment opportunity in premium properties across Dubai.