The real estate market in Dubai has consistently been a lucrative and sought-after sector for investors, both locally and internationally. With its rapidly growing economy, innovative infrastructure, and business-friendly environment, Dubai continues to attract real estate investors across the globe. In recent years, a new, ground-breaking financial product is emerging to reshape how property buyers and investors access capital: token-backed mortgages. This innovative approach merges traditional property financing with blockchain technology, providing more flexibility, liquidity, and transparency in real estate transactions. This guide will explore how token-backed mortgages are impacting Dubai’s real estate sector, their advantages, and the challenges they face.

What are Token-Backed Mortgages?

Token-backed mortgages represent a new form of property financing. In this form, utilization of blockchain technology can facilitate property loans through the issuance of digital tokens. These tokens represent ownership stakes in a tokenized tangible asset like real estate assets and are backed by the value of the property itself. Unlike traditional mortgages, which are secured through physical documentation and intermediaries like banks or financial institutions, token-backed mortgages leverage smart contracts and blockchain for greater efficiency and transparency.

Tokenized Mortgages WILL be launched on Ethereum!

It will PREVENT huge bubbles in RE because everything is TRANSPARENT with instant settlements.

1000x capital efficiency.

Today, Banks repackage your loan with many other loans in an MBS(Mortgage-Backed Security) that is sold on… pic.twitter.com/XfsJ5iq5Dg

— JC (@delzennejc) May 30, 2024

In a token-backed mortgage arrangement, a borrower can access a loan by putting up a real estate asset as collateral in the form of tokenized ownership. These tokens, which represent fractional ownership of the property, become on offer for investors. In return, the borrower receives funds from these investors to finance the mortgage, while the tokens are on the blockchain. This is how blockchain impacts the mortgage securitization in Dubai.

How Token-Backed Mortgages Are Transforming the Traditional Property Finance

Token-backed mortgages are transforming traditional property financing by leveraging blockchain technology to digitize real estate assets and facilitate fractional ownership. This innovation allows property owners to tokenize their real estate, turning it into tradable tokens that represent shares of the property’s value. Investors can sell, trade, or use these tokens as collateral, making property financing more accessible and liquid.

This shift disrupts traditional property financing by providing greater flexibility, reduced costs, and enhanced market access. Token-backed mortgages, as adopted more by Dubai investors, is poisoning Dubai as the leading position of blockchain innovation in real estate finance.

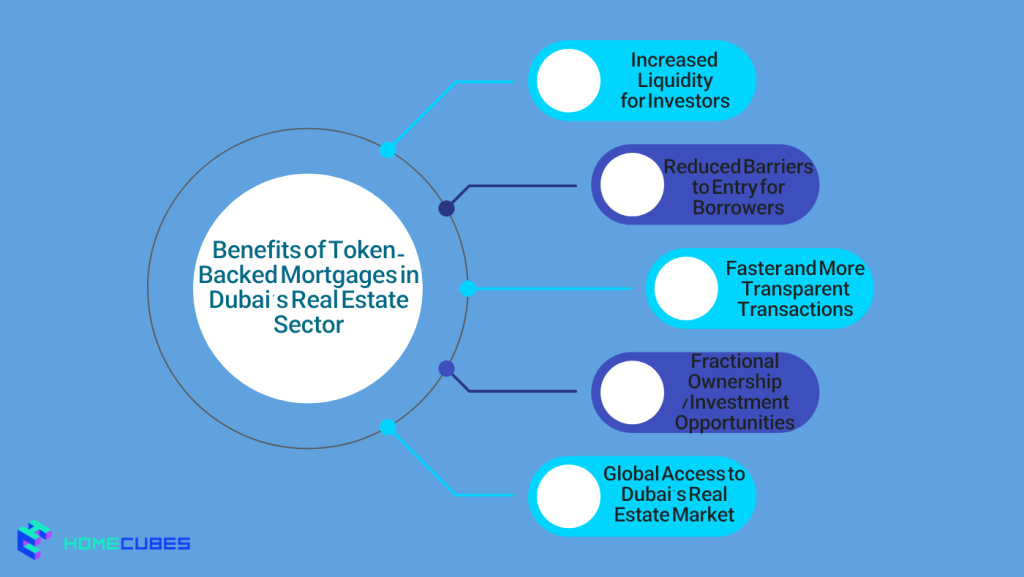

Benefits of Token-Backed Mortgages in Dubai’s Real Estate Sector

Token-backed mortgages bring several advantages to the Dubai real estate market, benefiting both property buyers and investors:

1. Increased Liquidity for Investors

One of the main advantages of token-backed mortgages is the enhanced liquidity they offer to investors. Traditional real estate investments, including mortgages, are typically illiquid, meaning investors need to hold their investments for extended periods. With tokenized mortgages, investors can buy and sell tokens on digital asset exchanges, providing them with the ability to exit investments or diversify their portfolios quickly.

2. Reduced Barriers to Entry for Borrowers

For many prospective buyers, obtaining a traditional mortgage in Dubai can be challenging, particularly for foreign investors or individuals without a strong credit history. Token-backed mortgages offer a more flexible method of obtaining financing. By utilizing blockchain in real estate and tokenization, borrowers can leverage their properties as collateral to secure funding, even without the need for traditional banks or financial institutions as intermediaries. This can make real estate investment more accessible to a wider range of buyers.

3. Faster and More Transparent Transactions

In a traditional mortgage arrangement, the loan approval process can be lengthy and paperwork-intensive. Token-backed mortgages, on the other hand, streamline this process. Smart contracts automate many aspects of the transaction, significantly reducing paperwork, administrative costs, and the time required to complete the loan process. Blockchain technology also ensures that the records of all aspects of the mortgage, such as payments, terms, and ownership changes, are secure, making the process more transparent and reducing the chances of disputes.

4. Fractional Ownership and Investment Opportunities

Tokenization allows for fractional ownership of real estate, meaning multiple investors can own a share of a property. With token-backed mortgages, the possibility of fractional ownership can be applicable for mortgage holders as well, enabling smaller investors to participate in high-value Dubai properties. This fractionalization allows for diversification and lower risk exposure for investors, while offering more accessible entry points for those who previously couldn’t afford full ownership.

5. Global Access to Dubai’s Real Estate Market

Dubai’s real estate market has always been a popular investment destination for international buyers. Token-backed mortgages further enhance this global accessibility by allowing investors from anywhere in the world to access Dubai’s property market through digital tokens. Traditional mortgages are often limited by regional banking regulations and currency exchange concerns, but blockchain technology eliminates these barriers, making it easier for foreign investors to purchase real estate in Dubai.

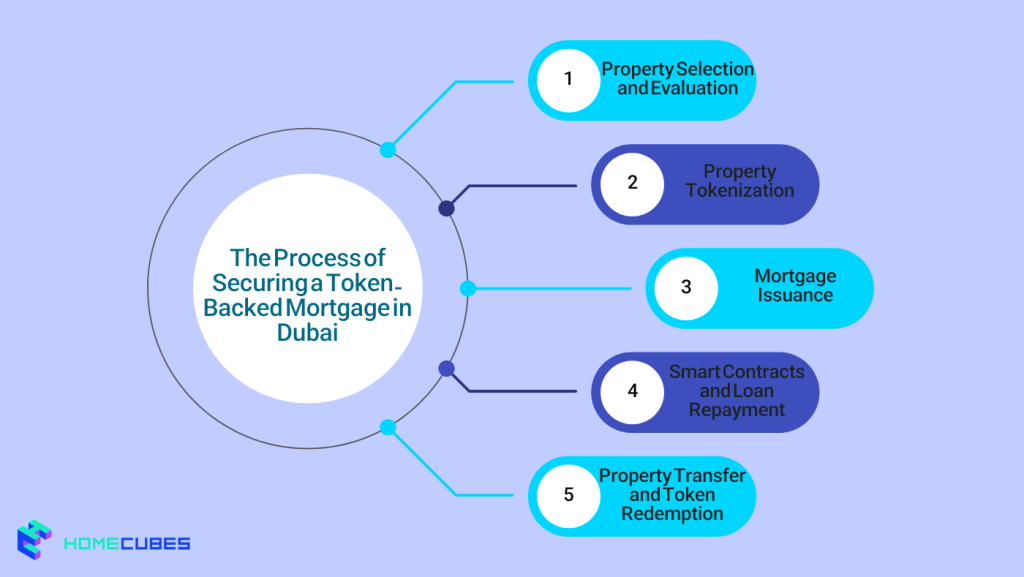

The Process of Securing a Token-Backed Mortgage in Dubai

Securing a token-backed mortgage in Dubai involves several steps, which combine both traditional real estate procedures with blockchain technology. Below are the key steps:

1. Property Selection and Evaluation

Before applying for a token-backed mortgage, borrowers must first select a property that is eligible for tokenization. The next step will be the property evaluation to determine its market value and the amount of financing to secure against it. Real estate valuation firms assess the property to ensure that the tokens accurately reflect the fair value of the property.

2. Tokenization of the Property

After the property evaluation, the tokenization process starts by creating digital tokens that represent fractional ownership. These tokens are backed by the value of the real estate, ensuring that they are equivalent to a portion of the property’s value. Blockchain platforms will be in charge to take care of minting and issuing the tokens, making them available for investment.

3. Issuance of the Mortgage

The borrower issues a mortgage backed by the tokenized property. Investors can purchase these tokens, effectively lending money to the borrower in exchange for a portion of ownership. Smart contracts securely keep and store the mortgage terms, including interest rates, repayment schedules, and token ownership rights.

4. Smart Contracts and Loan Repayment

After selling the tokens and issuance of the loan, the borrower must adhere to the repayment schedule specified in the smart contract. Payments made by the borrower are automatically tracked and distributed to token holders according to their stake in the property. The smart contract ensures the automatic execution of the terms and protection of all parties.

5. Property Transfer and Token Redemption

Upon full repayment of the mortgage, or if the property is sold or refinanced, the tokens are redeemed, and ownership is transferred to the investor or buyer. The entire transaction process is recorded on the blockchain, ensuring full transparency and accuracy.

Challenges and Considerations of Token-Backed Mortgages

While token-backed mortgages present several advantages, there are challenges and considerations to keep in mind:

- Regulatory Uncertainty: The regulatory framework for tokenized assets and mortgages in Dubai is still evolving. Dubai’s government has shown a willingness to embrace blockchain technology, but more clarity is essential regarding how token-backed mortgages fit into existing real estate laws and regulations.

- Market Adoption: Token-backed mortgages are still a relatively new concept in Dubai’s real estate sector. Widespread adoption will depend on investor education, trust in blockchain technology, and the development of user-friendly platforms for securing tokenized loans.

- Technology Risks: While blockchain provides security, the technology is still relatively new and evolving. Risks such as platform security vulnerabilities, smart contract bugs, and cybersecurity threats need to be addressed to ensure the integrity of token-backed mortgages.

Final Words

Token-backed mortgages are a transformative development in Dubai’s real estate market, providing a more flexible, efficient, and transparent way for borrowers to secure funding and for investors to access property assets. The combination of blockchain technology, tokenization, and smart contracts enables faster transactions, greater liquidity, and more accessible investment opportunities. While challenges remain, particularly in terms of regulatory clarity and market adoption, token-backed mortgages have the potential to reshape Dubai’s real estate landscape, attracting both local and international investors to this innovative financing model.

In such a dynamic environment, Homecubes is at the final stages of launching their property tokenization platform in Dubai. Contact us with confidence for further information on our lucrative fractional investment opportunities in the Dubai real estate market.