Table of Contents

- Introduction

- The Crypto–Real Estate Nexus in Dubai

- Why Dubai Developers Are Now Accepting Crypto

- Key Developers Accepting Crypto Payments

- DAMAC Properties

- RAK Properties

- Emaar Properties

- Legal and Regulatory Landscape

- Step-by-Step: How to Pay With Crypto

- Benefits of Paying in Cryptocurrency

- Risks and Mistakes to Avoid

- Fees and Tax Considerations

- Market Outlook 2025–2030

- Conclusion

- Frequently Asked Questions (FAQs)

- Homecubes Update

Introduction

Dubai continues to redefine the global real estate landscape — and 2025 marks a pivotal moment in merging blockchain innovation with property investment. A growing list of property developers accepting cryptocurrency in Dubai is giving international buyers unprecedented freedom to purchase premium assets directly with Bitcoin, Ethereum, or stablecoins.

For investors seeking both luxury and liquidity, Dubai’s alignment with regulated digital-asset frameworks under the Virtual Assets Regulatory Authority (VARA) makes it a safe and appealing environment. This guide explores the leading developers, the legal landscape, advantages, and risks — and how to complete a compliant, crypto-based property purchase in the UAE.

🇦🇪 INSIGHT: Dubai renters can now pay for apartments in $BTC.

Licensed platforms handle AED conversion, making crypto part of daily life. pic.twitter.com/SLW8EUZS5A

— Cointelegraph (@Cointelegraph) August 23, 2025

The Crypto–Real Estate Nexus in Dubai

Dubai’s Blockchain Strategy 2025 aims to digitize over half of government transactions — with real estate forming a critical part of this transformation. Through blockchain-enabled registration systems, the Dubai Land Department (DLD) is pioneering a transparent and efficient property ecosystem.

According to Knight Frank’s Q1-2025 Dubai Residential Market Review, residential prices rose by 11% year-on-year, supported by strong foreign demand and expanding investor demographics. Many of these buyers are digital-asset holders seeking long-term stability and global diversification.

This convergence of blockchain and real estate positions Dubai as the first major global hub where crypto, compliance, and luxury property coexist under clear regulatory supervision, making crypto the preferred payment method in Dubai property market, as going forward.

Why Dubai Developers Are Now Accepting Crypto

Expanding the Buyer Base

Developers in Dubai are tapping into the growing wealth of crypto investors who prefer decentralized finance over traditional banking.

A broader market review in Knight Frank’s Destination Dubai 2025 (PDF) highlights that global liquidity and cross-border investment demand remain robust, creating an ideal environment for crypto-enabled real estate.

Faster Settlement

Blockchain transactions can clear in minutes, eliminating the delays of cross-border bank transfers. This speed gives Dubai developers a competitive edge, especially in off-plan sales where timing is critical.

Strategic Branding

Accepting crypto demonstrates technological leadership. Developers that integrate blockchain solutions appeal to a younger generation of global investors who view digital assets as a standard investment medium.

Lower Entry Barriers for Global Buyers

Crypto acceptance reduces friction from exchange rates and bank intermediaries, opening Dubai’s property market to buyers across Europe, Asia, and the Americas — even those in regions with limited access to USD-based transactions.

Key Developers Accepting Crypto Payments

DAMAC Properties

DAMAC is among the first developers to officially embrace crypto payments. Buyers can settle property purchases using Bitcoin and Ethereum through regulated payment processors.

In January 2025, DAMAC signed a $1 billion tokenization deal with the MANTRA blockchain, marking a significant milestone for blockchain-based real estate. The partnership paves the way for fractional property ownership, tokenized assets, and secure on-chain transfers.

DAMAC’s move reflects Dubai’s ambition to bridge traditional real estate with decentralized financial infrastructure, transforming how luxury developments are financed and owned.

RAK Properties

RAK Properties has become one of the UAE’s most progressive developers regarding digital-asset payments.

As reported by Cointelegraph, the company now accepts Bitcoin (BTC), Ethereum (ETH), and Tether (USDT) for select premium projects. Transactions are processed via Hubpay, a VARA-licensed fintech gateway ensuring full AML and KYC compliance.

Further reinforcing this shift, Gulf News confirmed that overseas investors can now buy properties in Ras Al Khaimah using cryptocurrencies, setting a precedent for other developers in the UAE.

This dual verification — from both industry and mainstream sources — solidifies RAK Properties’ role as a pioneer in regulated crypto property transactions.

Emaar Properties

Emaar, the developer behind Downtown Dubai, Dubai Creek Harbour, and the Burj Khalifa, has consistently integrated blockchain into its ecosystem. It introduced its EMR token, a blockchain-based loyalty program, to incentivize residents and investors.

While Emaar’s acceptance of direct crypto payments remains limited to select luxury projects, its experimentation with blockchain loyalty systems and settlement models indicates steady movement toward a digital-first future in property financing.

Legal and Regulatory Landscape

Dubai’s real estate-crypto framework is defined by transparency and oversight.

The Virtual Assets Regulatory Authority (VARA) supervises all digital-asset transactions involving licensed developers and payment gateways. Every crypto-funded real estate purchase must pass standard KYC and AML checks, ensuring compliance with both local and FATF standards.

The Dubai Land Department (DLD), meanwhile, continues to oversee title registration, escrow management, and contract validation — even for blockchain-settled transactions.

Regulatory momentum continues to build. Gulf News reported that Dubai is actively considering formal frameworks to permit tokenized real estate transactions using digital currencies by the end of 2025, signaling a clear trajectory toward mainstream adoption.

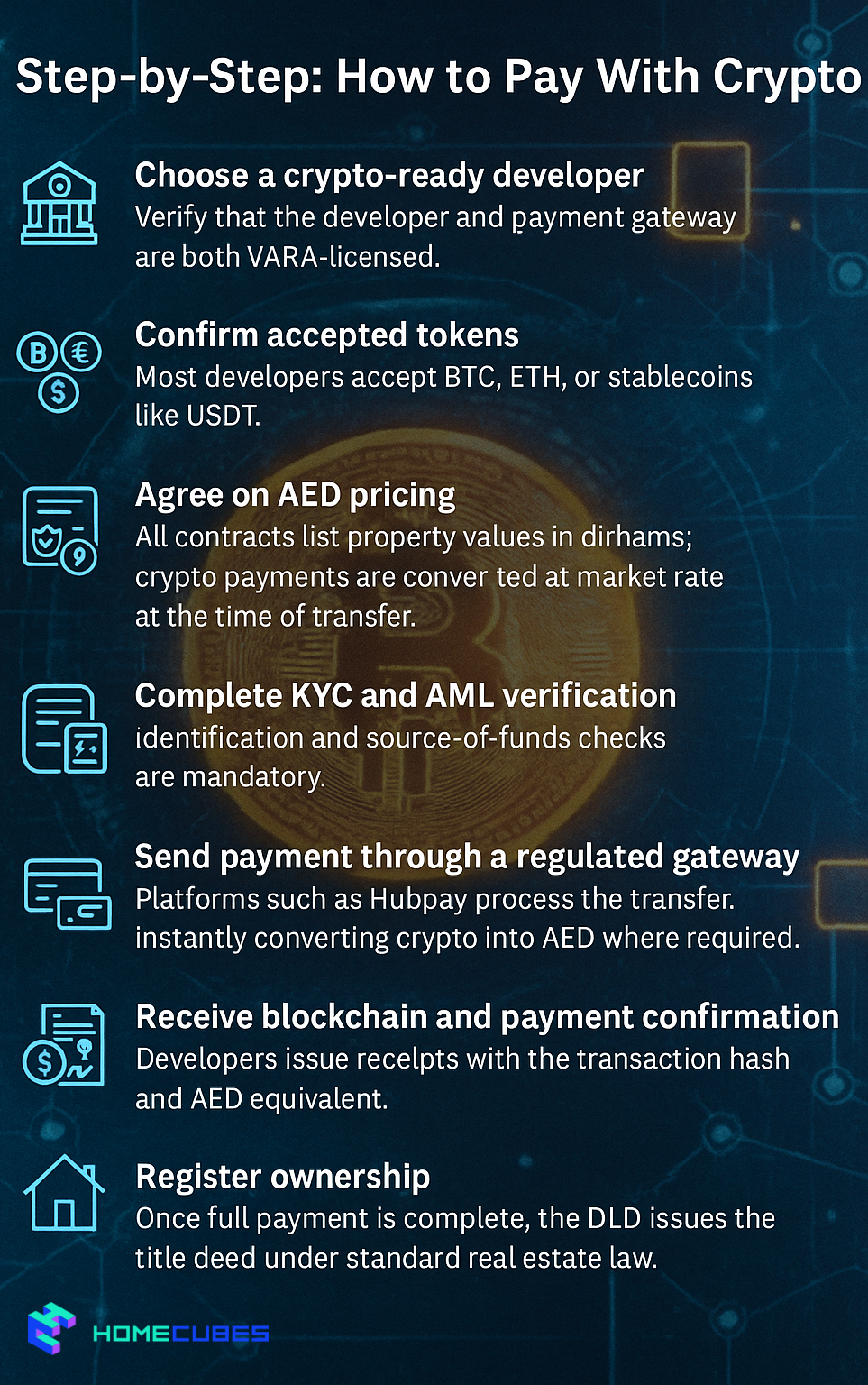

Step-by-Step: How to Pay With Crypto

Choose a crypto-ready developer

Verify that the developer and payment gateway are both VARA-licensed.

Confirm accepted tokens

Most developers accept BTC, ETH, or stablecoins like USDT.

Agree on AED pricing

All contracts list property values in dirhams; crypto payments are converted at market rate at the time of transfer.

Complete KYC and AML verification

Identification and source-of-funds checks are mandatory.

Send payment through a regulated gateway

Platforms such as Hubpay process the transfer, instantly converting crypto into AED where required.

Receive blockchain and payment confirmation

Developers issue receipts with the transaction hash and AED equivalent.

Register ownership

Once full payment is complete, the DLD issues the title deed under standard real estate law.

Benefits of Paying in Cryptocurrency

- Global Reach: Enables seamless cross-border investment without bank restrictions.

- Instant Settlement: Blockchain payments complete in minutes.

- Lower Fees: Reduces dependence on intermediaries and banking costs.

- Full Transparency: Every transaction is immutably recorded on-chain.

- Portfolio Diversification: Converts volatile crypto holdings into stable real estate assets.

- Enhanced Market Access: Crypto opens Dubai property to investors from traditionally underbanked regions.

Risks and Mistakes to Avoid

Crypto Volatility

Because crypto values can fluctuate rapidly, ensure that your contract specifies the exchange rate used for AED conversion.

Partial Acceptance

Some developers only accept crypto for deposits or specific milestones. Clarify the policy before transferring funds.

Unlicensed Payment Providers

Always confirm that your payment processor is regulated by VARA. Using unlicensed intermediaries risks loss or legal issues.

Tax Implications Abroad

While Dubai imposes no property tax, converting or spending crypto may trigger taxable events in your home country. Seek professional advice.

Inadequate Documentation

Every crypto transaction must have a matching invoice and payment confirmation with date, rate, and blockchain hash to prevent disputes.

Fees and Tax Considerations

- Payment Gateway Fees: 1%–3%, depending on the currency and transaction volume.

- DLD Registration Fee: Fixed at 4% of property value, payable in AED.

- Exchange Slippage: Slight differences between quoted and execution prices may occur.

- Maintenance and Service Fees: Typically charged in fiat even if the purchase used crypto.

- International Taxation: Depending on residency, disposing of crypto for property may be subject to capital gains rules.

Market Outlook 2025–2030

Dubai’s integration of blockchain and real estate is expected to accelerate over the next five years. Analysts forecast that up to 10% of property transactions in Dubai could involve digital assets by 2030, driven by regulation, tokenization, and global investor appetite.

Knight Frank’s 2025 data shows steady annual growth in luxury property demand, fueled by long-term visa reforms, foreign business relocations, and an expanding pool of crypto-native investors.

This outlook reinforces Dubai’s vision to become the world’s leading crypto-friendly property market, blending innovation, transparency, and accessibility.

Conclusion

The emergence of property developers accepting cryptocurrency in Dubai reflects the emirate’s commitment to technological advancement, investor flexibility, and global inclusion. With robust oversight by VARA and DLD, Dubai has built one of the safest environments for crypto-backed property purchases.

Leading developers such as DAMAC, Emaar, and RAK Properties have proven that blockchain and luxury real estate can coexist seamlessly. However, investors must still perform due diligence, confirm regulatory licenses, and ensure transparent pricing before proceeding with any crypto-based transaction.

As 2025 unfolds, Dubai’s real estate ecosystem is poised to transform from a traditional investment destination into a tokenized global asset hub.

Frequently Asked Questions (FAQs)

Q1. Is it legal to buy property in Dubai using cryptocurrency?

Yes. Developers licensed by VARA can legally accept crypto payments through regulated gateways.

Q2. Which developers in Dubai currently accept cryptocurrency payments?

DAMAC Properties, Emaar Properties (select projects), and RAK Properties have all integrated crypto payment systems.

Q3. What are the main costs of crypto transactions, when buying property in Dubai?

Gateway and conversion fees typically range between 1% and 3%.

Q4. Can I qualify for Dubai’s Golden Visa by buying property with crypto?

Yes. The key factor is the AED-equivalent value of the property (minimum AED 2 million).

Q5. What cryptocurrencies are accepted to buy property in Dubai?

Bitcoin (BTC), Ethereum (ETH), and stablecoins such as USDT are the most common.

Homecubes Update

Homecubes is building a fractional real estate platform designed to make Dubai property ownership accessible, compliant, and blockchain-driven.

We have officially applied for our VARA license, and our services will launch upon regulatory approval to ensure maximum compliance and investor safety.

Our mission is to make real estate tokenization in Dubai transparent, secure, and globally accessible.

🔗 Join our waiting list today: https://homecubes.io/contact-us/