Table of Contents

-

Introduction: UAE’s Embrace of Crypto in Real Estate

-

What Is a Property Loan Using Cryptocurrency?

-

Blockchain as the Backbone of Crypto Property Loans

-

How Crypto Property Loans Work

-

Why Use Cryptocurrency for a Property Loan in UAE?

-

5.1 Faster Loan Processing

-

5.2 Easier Access for Crypto Holders

-

5.3 Avoiding Traditional Banking Barriers

-

-

Step-by-Step: How to Secure a Property Loan Using Cryptocurrency in the UAE

-

6.1 Choose a Crypto-Friendly Lender

-

6.2 Determine the Value of Your Cryptocurrency

-

6.3 Agree on Loan Terms

-

6.4 Sign the Agreement and Secure Collateral

-

6.5 Repay the Loan and Retrieve Your Crypto

-

-

Challenges in Crypto-Backed Property Loans

-

7.1 Regulatory Uncertainty

-

7.2 Volatility and Market Risks

-

-

Conclusion

-

Homecubes: Your Gateway to Fractional Property Investment in Dubai

The United Arab Emirates (UAE) has long been famous for its forward-thinking approach to technology and finance. As cryptocurrencies gain global traction, the UAE is positioning itself as a hub for innovative financial services, including the use of cryptocurrency to secure property loans. Traditional home loans in the UAE typically require a credit history, income proof, and a high credit score. However, the rise of cryptocurrency and blockchain technology is shifting the landscape. They are now allowing borrowers to use digital assets as collateral for property loans.

Bitcoin is by far the best collateral for lending: deep liquidity and robust security. Professional dollar lenders are thus financially incentivized to fund the bitcoin economy. https://t.co/f1UCHgqurz pic.twitter.com/hzSkpr4z02

— Tuur Demeester (@TuurDemeester) March 14, 2024

This article explores how you can secure a property loan using cryptocurrency in the UAE. The article will be focusing on the benefits, challenges, and the steps involved in the process.

What Is a Property Loan Using Cryptocurrency?

A property loan using cryptocurrency allows borrowers to leverage their digital assets, such as Bitcoin, Ethereum, or other cryptocurrencies, as collateral to secure a loan for purchasing real estate. This innovative lending model relies on blockchain technology that enhances UAE investors’ confidence by verifying transactions and protecting both the lender and borrower.

Blockchain as the Backbone of Crypto Property Loans

Blockchain technology, which underpins cryptocurrencies, is a decentralized and secure system that provides transparency and immutability to financial transactions. When using cryptocurrency as collateral, smart contracts automate the terms of the loan. These computer programs ensure that both parties fulfill their obligations before transferring the property. The lender can liquidate the cryptocurrency collateral if the borrower defaults, minimizing risk and ensuring that the transaction is secure.

How Crypto Property Loans Work

In a typical scenario, a borrower with cryptocurrency holdings approaches a lender offering crypto-backed property loans. The borrower submits the cryptocurrency to the lender as collateral. Based on the value of the collateral, the lender grants a loan in fiat currency. That would be for the property purchase only. The loan agreement will outline terms related to repayment, interest rates, and the circumstances under which the collateral can be liquidated.

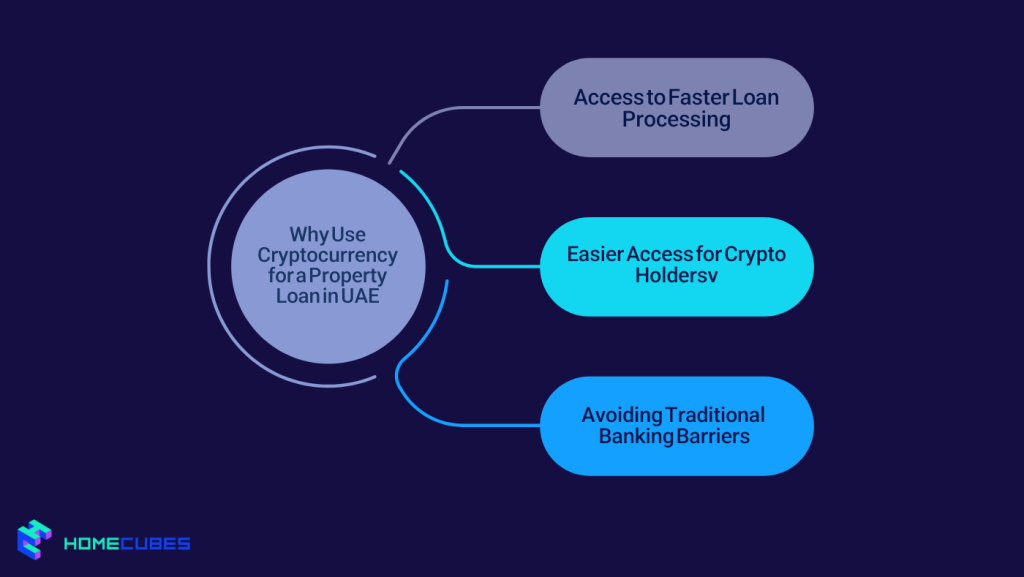

Why Use Cryptocurrency for a Property Loan in UAE?

The UAE’s dynamic financial environment, coupled with its increasing cryptocurrency adoption, has created an opportunity for individuals to use digital assets in ways that were not possible just a few years ago. There are several reasons why using cryptocurrency for securing a property loan in the UAE can be an attractive option for borrowers.

1. Access to Faster Loan Processing

Traditional property loans often involve lengthy approval processes, including credit checks, income verification, and extensive documentation. With cryptocurrency-backed loans, the process is typically faster because the collateral is directly held in a digital wallet, and the transaction is recorded on the blockchain.

Blockchain transactions are processed in real-time. Besides, the use of smart contracts means that once the terms of the loan are agreed upon, the collateral is secured almost immediately. This eliminates delays related to paperwork and third-party involvement, allowing borrowers to access their property loans more quickly.

2. Easier Access for Crypto Holders

One of the significant advantages of using cryptocurrency as collateral is that it allows crypto holders to access property loans without needing to liquidate their assets. Instead of selling their digital currencies, borrowers can use them to secure a loan. That would enable them to retain ownership of their crypto portfolio while still gaining access to the funds needed to purchase property.

Many crypto investors are reluctant to sell their assets due to potential future price appreciation. By using cryptocurrency as collateral, they can secure the funds they need without parting with their investments, which could increase in value over time.

3. Avoiding Traditional Banking Barriers

For individuals who may not have a traditional credit history or who face barriers in securing loans through conventional means, cryptocurrency-backed property loans provide an alternative route. Since cryptocurrency secures the loan, traditional credit scores and income verification are often less relevant.

This opens the door for non-traditional borrowers, such as expatriates or individuals new to the UAE, who may not have an established credit record in the country but hold significant cryptocurrency assets. By using their crypto holdings as collateral, they can access property loans without the typical banking hurdles.

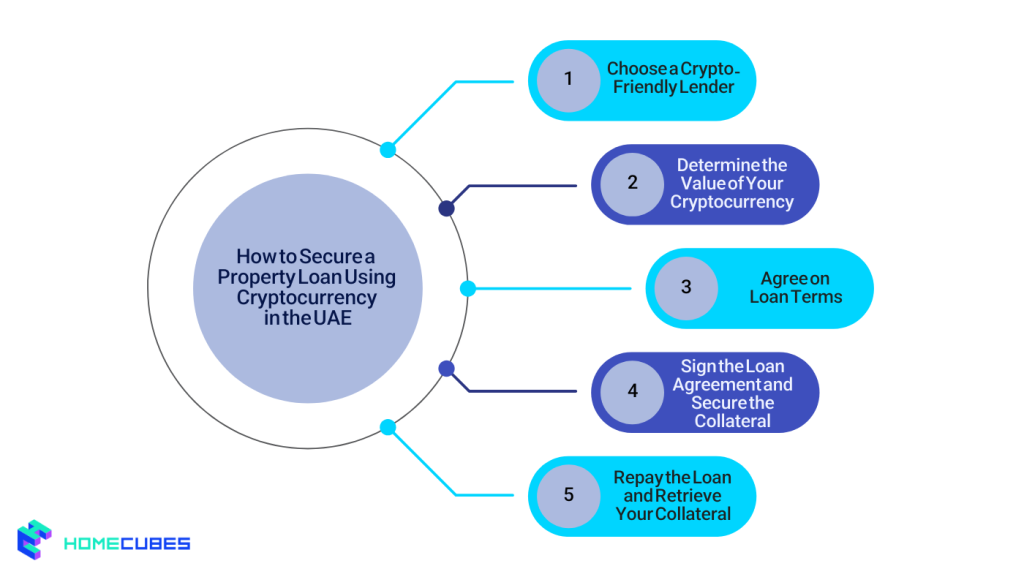

How to Secure a Property Loan Using Cryptocurrency in the UAE

Securing a property loan using cryptocurrency in the UAE involves several key steps. That would be from choosing the right lender to completing the transaction. Here’s a step-by-step guide on how to secure a property loan using your digital assets.

1. Choose a Crypto-Friendly Lender

Not all lenders in the UAE accept cryptocurrency as collateral for property loans. Hence,the first step is to find a crypto-friendly lender. Several financial institutions, blockchain-based lenders, and digital asset firms in the UAE are starting to offer cryptocurrency-backed property loans. Researching and selecting a lender that accepts crypto collateral and offers competitive loan terms is crucial.

Several fintech platforms and banks in the UAE are adopting blockchain technology to facilitate cryptocurrency-backed loans. These platforms offer a seamless process where borrowers can pledge their crypto assets and receive loans in fiat currency. Ensure the lender has a good track record in the crypto industry and is regulated under UAE financial laws.

2. Determine the Value of Your Cryptocurrency

The next step is to determine the value of the cryptocurrency you plan to use as collateral. Lenders typically evaluate the value of the crypto based on the current market rate, taking into account any fluctuations in value. Keep in mind that crypto markets can be volatile, so you may need to over-collateralize if the value of your assets fluctuates significantly.

The lender may apply a loan-to-value (LTV) ratio, which determines how much you can borrow relative to the value of your cryptocurrency. For example, if the LTV ratio is 50%, you could borrow up to 50% of the value of your crypto assets. In volatile markets, lenders may be more conservative with their LTV ratios to minimize their risk.

3. Agree on Loan Terms

Once you have chosen a lender and established the value of your cryptocurrency, you’ll need to agree on the terms of the loan. This includes the loan amount, interest rate, repayment schedule, and duration of the loan. The lender will also outline what happens if the value of the collateral decreases or if you fail to repay the loan.

It’s essential to understand the collateral liquidation terms before committing to the loan. If the value of your cryptocurrency drops below a certain threshold, the lender may liquidate your crypto assets to cover the loan amount. Ensure you are comfortable with these terms before proceeding.

4. Sign the Loan Agreement and Secure the Collateral

Once the loan terms are finalized, you will sign a loan agreement and transfer the cryptocurrency to a secure wallet controlled by the lender. The lender will place your cryptocurrency in a digital escrow account to ensure it is held as collateral for the loan. Upon confirmation, the lender will release the loan amount, typically in fiat currency, to your bank account.

The use of smart contracts ensures that all aspects of the loan, including the transfer of cryptocurrency and the release of funds, are executed automatically once terms are met. This reduces human error and ensures a secure, transparent process.

5. Repay the Loan and Retrieve Your Collateral

As with any loan, you must repay the principal amount along with interest according to the agreed-upon terms. Upon successful repayment, your cryptocurrency collateral will be returned to you. If you default on the loan, the lender has the right to liquidate your crypto assets to cover the outstanding amount.

To avoid the liquidation of your assets, it’s crucial to stay on top of your repayments and ensure the value of your cryptocurrency collateral remains sufficient. Lenders typically offer flexibility in repayment schedules, but it’s essential to discuss these options with your lender upfront.

Challenges in Securing Property Loans Using Cryptocurrency in UAE

While securing a property loan using cryptocurrency offers numerous benefits, there are challenges that borrowers should consider.

1. Regulatory Uncertainty

The UAE has taken steps to regulate cryptocurrency activities, but the UAE legal framework for buying property with cryptocurrency and crypto-backed property loans is still evolving. Lenders and borrowers must stay informed about regulations surrounding digital assets and ensure compliance with local financial laws.

As the use of cryptocurrency in finance grows, regulators in the UAE are likely to develop clearer guidelines on the use of digital assets for property transactions. It’s important to work with lenders who are professional in these evolving regulations.

2. Volatility and Market Fluctuations

Cryptocurrency is highly volatile, which can impact the value of your collateral and the loan-to-value ratio. If the market value of your crypto holdings drops suddenly, you may be required to top up your collateral or face the risk of liquidation.

To mitigate the risks associated with volatility, some borrowers opt to use stablecoins or diversify their crypto holdings. Discussing strategies with your lender to manage these fluctuations can help reduce potential risks.

Conclusion

Securing a property loan using cryptocurrency in the UAE is a growing trend that provides numerous advantages, including faster processing, access to capital without selling digital assets, and greater flexibility for non-traditional borrowers. While challenges like regulatory uncertainty and volatility remain, the UAE’s progressive stance on cryptocurrency adoption creates an ideal environment for these innovative loan structures.

By choosing the right lender, understanding the terms of the loan, and carefully managing the risks associated with cryptocurrency volatility, borrowers can unlock new opportunities for property ownership in the UAE.

Homecubes as a licensed property tokenization platform focusing on the Dubai real estate market has got a range of fractional ownership projects in the pipeline. Contact us confidently for further information on our lucrative fractional investment opportunity in the Dubai real estate market.

Frequently Asked Questions (FAQs)

1. Can I buy a house in Dubai using only cryptocurrency?

No, you cannot directly buy property using only cryptocurrency under current UAE regulations. However, you can use crypto as collateral to secure a fiat-based property loan through crypto-friendly lenders.

2. Is it safe to use cryptocurrency as collateral for a property loan in the UAE?

Yes, when done through regulated lenders and smart contracts, it can be secure. However, borrowers should be aware of market volatility and choose reputable, licensed platforms.

3. What types of cryptocurrency can be used to secure a property loan in Dubai?

Typically, highly liquid cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and stablecoins like USDT or USDC are accepted by most crypto-friendly lenders.

4. What happens if the value of my crypto drops after securing the loan?

If the value of your crypto collateral falls below the lender’s required threshold, you may be asked to add more collateral or face asset liquidation to cover the loan.

5. Are there any UAE laws specifically governing crypto-backed property loans?

The UAE is evolving its legal framework around crypto finance. While entities like VARA and DIFC offer guidance, clear, specific laws around crypto-collateralized property loans are still developing.