Table of Contents

- Introduction

- What Is a Property Mortgage in the UAE?

- Types of Property Mortgages in Dubai and Abu Dhabi

- Eligibility Criteria for UAE Property Mortgages

- Step-by-Step Process to Apply for a Mortgage

- Documents Required for Mortgage Approval

- Top Banks Offering Mortgages in Dubai and Abu Dhabi

- Mortgage Options for Non-Residents

- Sharia-Compliant (Islamic) Home Financing

- Refinancing Your Property in the UAE

- Case Study: A First-Time Buyer in Abu Dhabi

- Mistakes to Avoid When Applying for a Mortgage

- Fees and Charges Breakdown

- Frequently Asked Questions (FAQ)

- Understanding the Future of Mortgage Lending in the UAE

- Ready to Explore Tokenized Mortgages?

Introduction

Buying property in the UAE is an increasingly attractive prospect for both residents and foreign investors. However, due to high upfront costs, most buyers depend on mortgage financing to afford their dream homes or investment properties. Understanding the property mortgage Dubai, Abu Dhabi and generally UAE home financing laws, is critical for navigating the application process, evaluating costs, and securing the best interest rates.

This guide breaks down everything you need to know, from available mortgage types to step-by-step procedures on how to get a mortgage in the UAE, tailored for both residents and non-residents of the UAE.

What Is a Property Mortgage in the UAE?

Dubai’s mortgage market saw strong activity in Q1 2025 with a 4.76% uptick in transactions.

Total mortgage value rose by an impressive 32% between January and February.

It’s great that so many people want to get a foot on our Emirate’s property ladder.https://t.co/v7lQpv3rmg

— Amira Sajwani (@Amira_H_Sajwani) April 25, 2025

A property mortgage is a loan provided by a bank or financial institution that allows you to purchase real estate while repaying the amount borrowed over time, with interest. The UAE mortgage system is well-regulated by the Central Bank of the UAE, ensuring borrower protection and lender transparency.

🔗 Central Bank Mortgage Guidelines

Types of Property Mortgages in Dubai and Abu Dhabi

Here are the most common types:

1. Fixed-Rate Mortgages

- Interest rate remains unchanged for a specific period (usually 1–5 years)

- Ideal for those seeking predictable monthly payments

2. Variable-Rate Mortgages

- Rate fluctuates based on the bank’s base rate or EIBOR (Emirates Interbank Offered Rate)

- Can result in lower payments if interest rates drop

3. Offset Mortgages

- Your savings account is linked to the mortgage, reducing interest paid

- Less common but offered by a few banks

4. Interest-Only Mortgages

- Pay interest only for a defined initial period

- Riskier, typically for investors with short-term plans

5. Buyout Mortgages

- Offered to those who wish to transfer or refinance their existing mortgage with another bank

Eligibility Criteria for UAE Property Mortgages

To qualify for a mortgage in the UAE, you typically must meet these minimum requirements:

| Criteria | Resident | Non-Resident |

| Minimum Age | 21 years | 21 years |

| Income | AED 15,000/month | AED 25,000/month or equivalent |

| Credit Score | 580+ (AECB) | International banking history required |

| Down Payment | 20–25% | 25–35% |

| Loan Tenure | Up to 25 years | Up to 20 years |

🔗 Check your AECB Credit Score

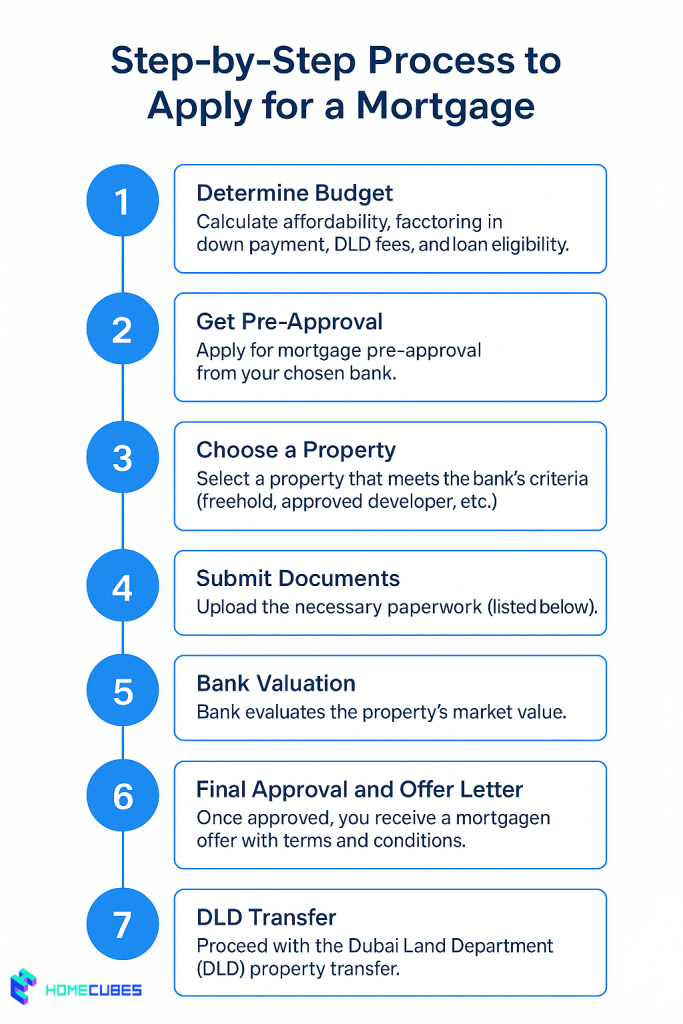

Step-by-Step Process to Apply for a Mortgage

- Determine Budget

Calculate affordability, factoring in down payment, DLD fees, and loan eligibility. - Get Pre-Approval

Apply for mortgage pre-approval from your chosen bank. - Choose a Property

Select a property that meets the bank’s criteria (freehold, approved developer, etc.) - Submit Documents

Upload the necessary paperwork (listed below). - Bank Valuation

Bank evaluates the property’s market value. - Final Approval and Offer Letter

Once approved, you receive a mortgage offer with terms and conditions. - DLD Transfer

Proceed with the Dubai Land Department (DLD) property transfer.

🔗 DLD Mortgage Registration Guide

Documents Required for Mortgage Approval

- Valid Emirates ID and passport

- Salary certificate (or trade license for self-employed)

- Bank statements (3–6 months)

- Property documents (sales agreement, title deed)

- Proof of down payment

- Pre-approval letter (if applicable)

Top Banks Offering Mortgages in Dubai and Abu Dhabi

- Emirates NBD – Flexible plans, excellent for residents

- HSBC UAE – Strong support for expats and non-residents

- Mashreq – Competitive rates and offset mortgage options

- FAB (First Abu Dhabi Bank) – Reliable for long-term buyers

- Abu Dhabi Islamic Bank (ADIB) – Sharia-compliant options

Mortgage Options for Non-Residents

Non-residents can obtain a mortgage for properties in designated freehold zones, but the conditions are stricter:

- Higher down payment (minimum 25–35%)

- Shorter loan terms (10–15 years typical)

- Income must be provable via international statements

- Property must be approved by the bank

🔗 Bayut Guide to Non-Resident Mortgages

Sharia-Compliant (Islamic) Home Financing

Sharia-compliant mortgages are profit-based, not interest-based. These are commonly structured as:

- Ijara – The bank buys the property and leases it to you

- Murabaha – The bank buys and resells to you at a marked-up price

Offered by:

- Dubai Islamic Bank (DIB)

- Abu Dhabi Islamic Bank (ADIB)

These are ideal for buyers seeking halal investment structures.

Refinancing Your Property in the UAE

Refinancing lets you switch to a better rate or adjust your repayment term. Common reasons include:

- Lowering interest cost

- Unlocking home equity

- Converting from fixed to variable (or vice versa)

Before refinancing, ensure the new bank covers:

- Transfer fees

- Settlement of existing mortgage

- Early settlement fees (~1%)

Case Study: A First-Time Buyer in Abu Dhabi

Profile: Sara, a 32-year-old marketing executive

Goal: Buy a 1BR apartment in Al Reem Island

Monthly Salary: AED 18,000

Bank Chosen: First Abu Dhabi Bank (FAB)

Process:

- Obtained pre-approval for AED 1M loan

- Purchased AED 1.3M unit with 23% down payment

- Paid AED 52,000 in related fees

- Completed in 45 days from offer to transfer

Outcome: Fixed rate of 3.8% for 5 years, no penalties for early closure after 3 years.

Mistakes to Avoid When Applying for a Mortgage

- Not checking your credit score early

- Skipping pre-approval and wasting time on ineligible properties

- Overlooking total cost (insurance, DLD fees, service charges)

- Not comparing bank offers side by side

- Assuming expats and residents have identical eligibility

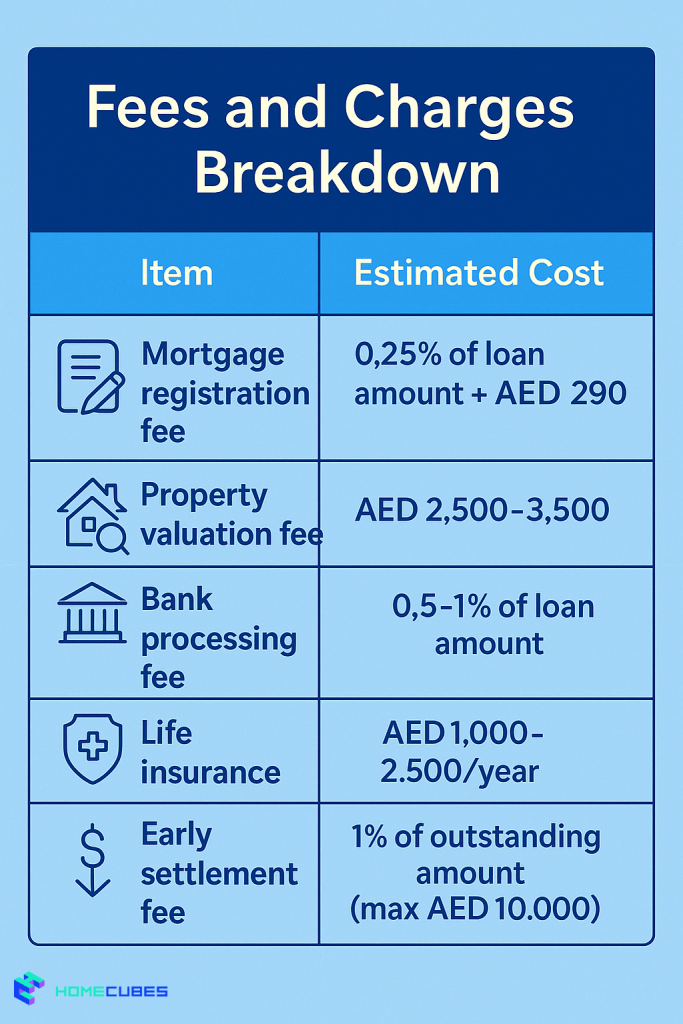

Fees and Charges Breakdown

| Item | Estimated Cost |

| Mortgage registration fee | 0.25% of loan amount + AED 290 |

| Property valuation fee | AED 2,500–3,500 |

| Bank processing fee | 0.5–1% of loan amount |

| Life insurance | AED 1,000–2,500/year |

| Early settlement fee | 1% of outstanding amount (max AED 10,000) |

🔗 Dubai Land Department Fee Structure

Frequently Asked Questions (FAQ)

Can I get a mortgage as a foreigner in Dubai or Abu Dhabi?

Yes, based on property ownership laws for foreigners in UAE you can get mortgage, but you’ll need to meet higher down payment and income requirements. Only freehold areas are allowed.

What is the maximum loan term in the UAE?

Up to 25 years for residents, and generally 15–20 years for non-residents.

Can I apply jointly with my spouse?

Yes, joint mortgages are allowed for legally married couples.

Is mortgage interest tax deductible in the UAE?

No. The UAE has no personal income tax, so mortgage interest deduction does not apply.

Can I refinance with a different bank?

Yes, many banks offer mortgage buyouts, often covering part of the transfer costs.

Understanding the Future of Mortgage Lending in the UAE

Mortgage trends in the UAE are shifting toward digitalization and flexible repayment models. The rise of fintech mortgage brokers, instant approval systems, and tokenized mortgage platforms is shaping the next generation of property financing.

Additionally, initiatives like Dubai’s Open Finance Strategy and digital KYC integration with DubaiNow and Emirates Blockchain Platform are making mortgage transactions faster and safer.

Ready to Explore Tokenized Mortgages?

At Homecubes, we’re building tools to bridge the gap between traditional real estate and the tokenized property economy. While we are currently awaiting regulatory approval from VARA for our real estate tokenization platform, our mission is to simplify property investment, including future mortgage-backed token offerings.

📩 Reach out to Homecubes and join our early access list. Be the first to explore fractional real estate opportunities, compliance education, and mortgage tokenization updates once we’re live.