Table of Contents

- Introduction

- Understanding Mortgage Financing in Dubai

- 1. Fixed-Rate Mortgages

- 2. Variable-Rate Mortgages

- 3. Capped-Rate Mortgages

- 4. Islamic Mortgage Options

- 5. Buy-to-Let Mortgages

- 6. Offset Mortgages

- 7. Non-Resident Mortgages

- Case Study: Choosing the Right Mortgage for an Apartment in Downtown Dubai

- Mistakes to Avoid When Choosing a Mortgage

- Fees and Charges Breakdown

- Frequently Asked Questions

- Conclusion

- Simplify Your Mortgage Search with Homecubes

Introduction

As Dubai’s property market continues to mature, more residents and foreign investors are turning to mortgages to finance real estate purchases. While paying in cash is common for high-net-worth buyers, many investors and first-time homeowners rely on bank financing. However, navigating the variety of mortgage types in Dubai can be confusing, especially with terms like fixed-rate, variable-rate, and capped-rate options.

Buying your first home in Dubai just got easier.

A new scheme allows residents to invest in properties worth up to Dh5 million, with special financing from partner banks and discounts from developers https://t.co/OQ2U9Lw4Za

— The National (@TheNationalNews) July 4, 2025

In this guide, we break down each mortgage type available in the UAE, explaining how they work, what to look for, and how to align your financing choice with your long-term investment goals.

Understanding Mortgage Financing in Dubai

Dubai’s mortgage system is regulated by the Central Bank of the UAE, and eligibility is generally based on:

- Age (typically under 65 for employees, 70 for self-employed)

- Minimum income thresholds

- Employment status

- Loan-to-value (LTV) limits:

- Up to 80% LTV for UAE nationals

- Up to 75% LTV for expats

- Up to 50% LTV for off-plan properties (based on valuation)

Mortgage terms typically range from 5 to 25 years, and the UAE’s banking sector offers a mix of conventional and Islamic finance products.

1. Fixed-Rate Mortgages

🔒 How It Works

A fixed-rate mortgage locks in your interest rate for a predetermined term, typically 1 to 5 years. During this period, your monthly repayment does not change—regardless of fluctuations in the Emirates Interbank Offered Rate (EIBOR).

✅ Advantages

- Predictable monthly payments

- Protection against rate hikes

- Easier long-term budgeting

⚠️ Drawbacks

- Less flexibility if market rates drop

- Early settlement fees apply

Best For:

Buyers seeking stability and long-term residency in the property.

2. Variable-Rate Mortgages

🔄 How It Works

Also known as tracker mortgages, the interest rate is pegged to EIBOR and changes every 3, 6, or 12 months based on market performance.

✅ Advantages

- Can benefit from falling interest rates

- Often lower initial rates than fixed options

⚠️ Drawbacks

- Unpredictable monthly payments

- Higher risk during inflationary periods

Best For:

Investors expecting short-term ownership or market rate reductions.

3. Capped-Rate Mortgages

🔐 How It Works

A capped-rate mortgage is a hybrid. It allows the rate to fluctuate like a variable mortgage, but places a maximum limit (“cap”) above which the rate cannot rise during the cap period (usually 1–3 years).

✅ Advantages

- Offers flexibility with some rate protection

- Peace of mind for mid-term buyers

⚠️ Drawbacks

- Slightly higher base rates than standard variable mortgages

- Cap period is limited

Best For:

Buyers who want flexibility with some safety.

4. Islamic Mortgage Options

Sharia-compliant mortgage options in the UAE are popular and formats such as:

- Ijara (rent-to-own)

- Murabaha (cost-plus financing)

These do not charge interest. Instead, the bank purchases the property and leases it to the buyer, with monthly payments until ownership transfers.

✅ Advantages

- Sharia-compliant

- Predictable costs

⚠️ Drawbacks

- May come with additional bank fees

- Limited flexibility in early repayments

🔗 More about Islamic mortgages – Emirates NBD

5. Buy-to-Let Mortgages

These mortgages are designed for buyers purchasing property specifically for rental income. Requirements and LTV ratios may differ from residential mortgages.

✅ Advantages

- Income-producing assets

- Suitable for portfolio investors

⚠️ Drawbacks

- Higher down payments and interest rates

- Landlord insurance may be required

6. Offset Mortgages

An offset mortgage links your home loan with your current or savings account. Your interest is calculated based on the mortgage balance minus the balance in your linked account.

✅ Advantages

- Reduced interest payments

- Flexibility to withdraw savings anytime

⚠️ Drawbacks

- Not widely offered

- Requires disciplined saving

7. Non-Resident Mortgages

Foreign nationals who don’t live in the UAE can still apply for mortgages from selected banks, However, mortgage loans for non-residents in Dubai and the whole country are usually limited to 50–60% of property value.

✅ Advantages

- Allows overseas investment

- Open to several nationalities

⚠️ Drawbacks

- Requires more paperwork

- Higher interest rates and risk premiums

🔗 Non-resident mortgage overview – HSBC UAE

Case Study: Choosing the Right Mortgage for an Apartment in Downtown Dubai

Profile:

James, a UK national earning AED 40,000/month, is purchasing a 1-bedroom in Downtown Dubai worth AED 1.5M.

Mortgage Offers:

- Fixed-Rate (3 years @ 4.2%)

- Variable-Rate (EIBOR + 1.8%, currently ~5.0%)

- Capped-Rate (3-year cap @ 5.5%)

Decision:

James opts for the fixed-rate mortgage to ensure stable payments, as he plans to live in the property for the next 5–7 years. He avoids the risk of rising EIBOR rates.

Mistakes to Avoid When Choosing a Mortgage

- ❌ Choosing the lowest rate without understanding fee structures

- ❌ Ignoring early repayment penalties

- ❌ Assuming you can refinance anytime without fees

- ❌ Overestimating rental income for buy-to-let loans

- ❌ Not comparing Islamic vs conventional loans side-by-side

- ❌ Failing to lock in favorable rates during stable market periods

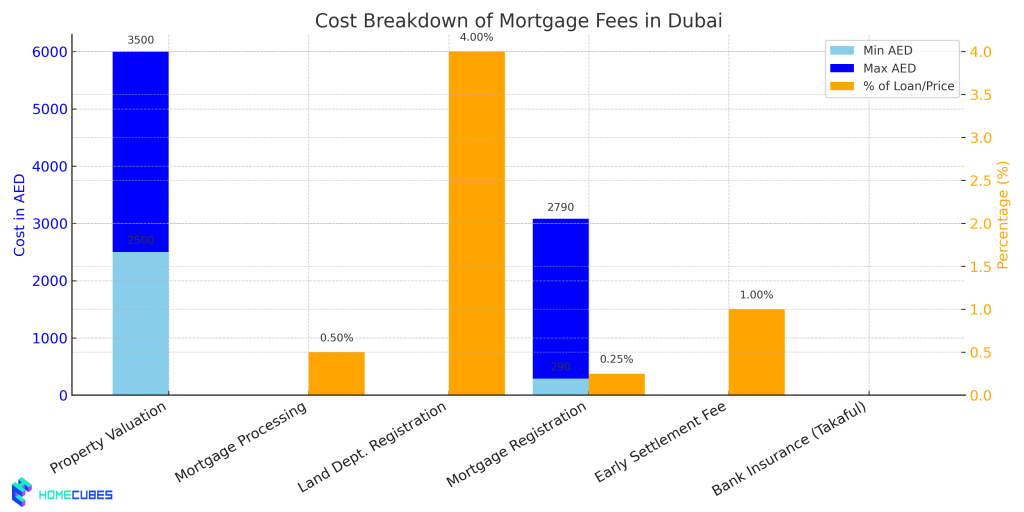

Fees and Charges Breakdown

| Fee Type | Approx. Amount (AED) |

| Property Valuation | 2,500 – 3,500 |

| Mortgage Processing | 0.5% – 1% of loan amount |

| Land Department Registration | 4% of property price |

| Mortgage Registration | 0.25% of loan + AED 290 |

| Early Settlement Fee | Up to 1% of remaining loan |

| Bank Insurance (Takaful) | Variable (check lender) |

🔗 Dubai Land Department fees guide – Bayut

Frequently Asked Questions

1. Can expats get mortgages in Dubai?

Yes, most UAE banks offer mortgages to expats who meet income and employment criteria.

2. What is the maximum loan tenure?

Typically 25 years, but it must not exceed age 65 for employees or 70 for self-employed individuals.

3. Can I pay off my mortgage early?

Yes, but expect early settlement fees, typically 1% of the remaining amount.

4. What is EIBOR?

The Emirates Interbank Offered Rate, used as a benchmark for variable mortgages in the UAE.

5. Do I need a UAE residence visa to apply?

Yes, for resident mortgages. Some banks offer non-resident mortgage products with more conditions.

Conclusion

Choosing the right mortgage in Dubai isn’t just about chasing the lowest interest rate. It’s about aligning the mortgage type with your financial goals, risk tolerance, and property timeline. Whether you seek the predictability of fixed rates, the flexibility of variable rates, or the balance of capped rates, understanding your options can save you thousands of dirhams over the life of the loan.

Take time to compare offers, review fine print, and assess your repayment capacity with real-world projections. With Dubai’s evolving mortgage landscape, being informed is your best financial advantage.

Simplify Your Mortgage Search with Homecubes

At Homecubes, we understand how complex choosing a mortgage in Dubai can be. While we’re currently finalizing our Virtual Assets Regulatory Authority (VARA) license, our upcoming platform will offer tools that help investors and buyers compare mortgage types, calculate long-term costs, and select the best financing solution.

If you’re navigating the Dubai property market or planning your next investment, we’re here to guide you toward smarter choices.

📩 Contact us now to get notified when our services launch:

Your future in Dubai real estate begins with knowledge—and we’re here to make it simpler.