Table of Contents

- Introduction

- Overview of Mortgage Structure in Dubai

- Types of Mortgages Available in Dubai

- Key Parties Involved in the Mortgage Process

- Step-by-Step Mortgage Application Process

- Mortgage Terms and Repayment Structures

- Eligibility Criteria for Mortgage Applicants in Dubai

- Fees and Charges Associated with Mortgages in Dubai

- Case Study: Mortgage Financing for a Downtown Dubai Apartment

- Common Mistakes to Avoid in the Mortgage Process

- Frequently Asked Questions (FAQs)

- Conclusion

- Contact Homecubes

Introduction

Dubai’s real estate landscape is not only modern and investor-friendly, but it also boasts a diverse range of financing options for buyers from around the world. However, the mortgage structure Dubai has developed is unique and operates within its own legal, regulatory, and cultural frameworks. Buyers unfamiliar with the local system may struggle to understand key concepts such as loan-to-value (LTV) limits, Sharia-compliant mortgage options and financing in the UAE, and DLD mortgage registration requirements.

In many countries (eg. Dubai) homes loans are available at 4-5% interest rates.

People buy such houses, put it on a rent.

And, get yearly yield of around 5-6%.And, they pay 0 taxes on that income.

So in real terms, they make money.In India, people borrow at 9%

Get a…— Akshat Shrivastava (@Akshat_World) May 12, 2024

This article serves as a comprehensive guide for residents, non-residents, and investors — explaining mortgage products, repayment options, government oversight, and how to navigate the financing process with confidence.

Overview of Mortgage Structure in Dubai

Mortgages in Dubai are based on a framework established by the UAE Central Bank and enforced locally by the Dubai Land Department (DLD). Unlike some Western markets where private lending plays a dominant role, Dubai’s market is highly regulated, with strong requirements for documentation and compliance. Besides , the Dubai government provides a wide range of facilities, like DLD’s offer and deposit services, to streamlining property transactions and protecting buyers and sellers.

Key Components of the Structure

✅ Loan-to-Value (LTV) Ratios

The Central Bank sets LTV caps to reduce market risk. These are:

- 80% for first-time resident buyers (property under AED 5 million)

- 75% if above AED 5 million

- 70% for second properties

- 60–70% for non-residents, depending on the bank and loan amount

✅ Loan Term

The standard repayment term is up to 25 years, and it must not exceed the borrower’s retirement age (usually capped at 65 for salaried workers, 70 for self-employed individuals).

✅ Interest Calculation Methods

- Flat rate: Rarely used, but sometimes seen in promotional products

- Reducing balance: Most common method in Dubai. Interest applies to the remaining loan principal

✅ Legal Obligation: Mortgage Registration

Every mortgage must be registered with DLD to be enforceable. This ensures the lender has legal rights over the property in the event of default.

➡️ Learn more: DLD Mortgage Registration eService

Types of Mortgages Available in Dubai

Dubai’s mortgage market offers various loan structures to suit diverse financial profiles and risk appetites. Here’s a closer look:

1. Fixed-Rate Mortgage

Borrowers lock in a specific interest rate for a defined period (e.g., 1–5 years). This shields them from market fluctuations and ensures consistent monthly payments. After the fixed period, many banks convert the loan to a variable rate.

Best for: Long-term planners, first-time buyers, buyers with limited risk tolerance.

2. Variable-Rate Mortgage

Rates are pegged to EIBOR (Emirates Interbank Offered Rate). This means your monthly repayment changes as EIBOR rises or falls. Variable-rate mortgages often start with lower rates but may become expensive over time if interest rates spike.

Best for: Experienced investors, buyers confident in falling/stable rate environments.

3. Capped-Rate Mortgage

A hybrid mortgage where the interest rate may vary but cannot exceed a set limit. It offers a middle ground between fixed and variable models, combining flexibility with risk management.

4. Islamic Mortgage Products

These Sharia-compliant alternatives are common in Dubai and include:

- Ijara: The bank buys the property and leases it to you, collecting rent instead of interest.

- Murabaha: The bank purchases the property and sells it to you at a profit margin agreed upfront.

Best for: Muslim buyers or any borrower seeking non-interest-based financing.

5. Non-Resident Mortgages

Offered by selected banks such as HSBC, Mashreq, and Standard Chartered, these mortgages are tailored for foreign investors. Documentation, down payments, and rates are more stringent due to the higher risk profile.

Key Parties Involved in the Mortgage Process

Understanding the roles of each stakeholder helps reduce delays and ensures compliance.

| Party | Role |

| Borrower | Applies for mortgage, provides documentation |

| Bank or Financial Institution | Provides funding and assesses loan eligibility |

| Mortgage Broker (optional) | Assists in choosing the right bank and negotiating terms |

| Real Estate Agent | Facilitates the MOU and coordination between buyer and seller |

| Valuation Company | Independently verifies the market value of the property |

| Dubai Land Department (DLD) | Registers both the property and mortgage |

| DLD Trustee Office | Handles the final transfer of ownership and loan registration |

Step-by-Step Mortgage Application Process

1. Pre-Approval

A pre-approval letter from the bank outlines your maximum loan amount based on income, expenses, and credit history. It speeds up the purchase process and is often required before making offers.

2. Selecting the Property and Signing MOU

Once a suitable property is found, a Memorandum of Understanding (MOU) is signed. This legally binds both parties and usually involves a 10% deposit, which is held in escrow.

3. Property Valuation

The bank appoints a RERA-approved valuer to inspect the property. The final loan offer will be based on this bank valuation, not the seller’s asking price.

4. Final Approval & Offer Letter

Upon receiving the valuation report, the bank issues a final offer letter. Carefully review the terms, interest rate, repayment structure, and prepayment penalties.

5. Mortgage Registration & Transfer

All mortgage agreements must be registered through a licensed DLD Trustee Office. You’ll pay the mortgage registration fee and finalize the property title transfer.

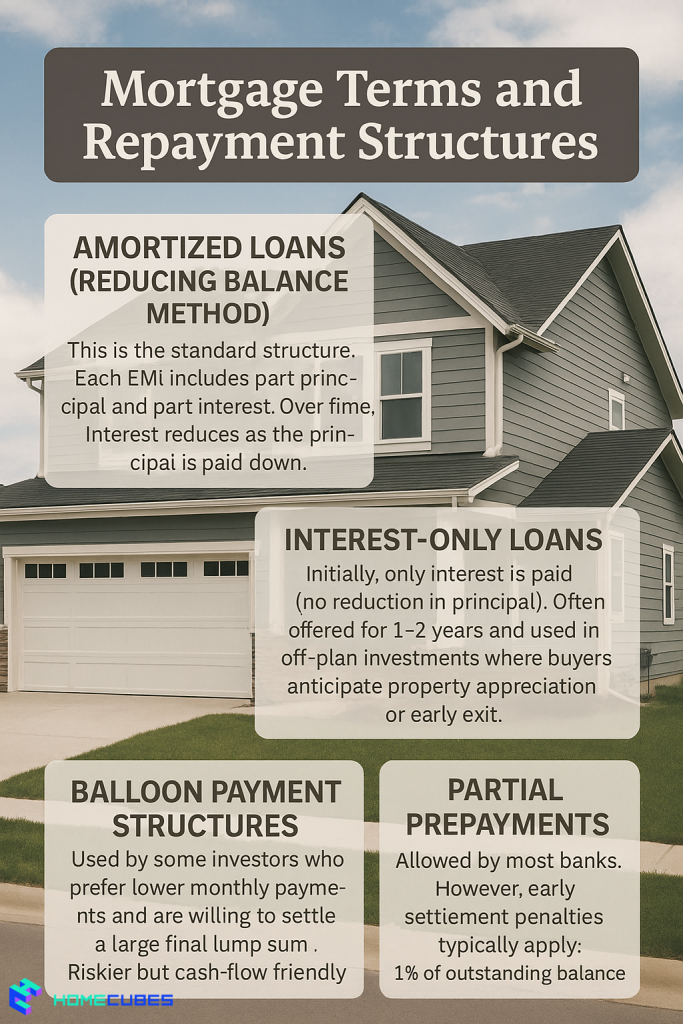

Mortgage Terms and Repayment Structures

Dubai offers flexible repayment options to cater to different borrower profiles:

1. Amortized Loans (Reducing Balance Method)

This is the standard structure. Each EMI includes part principal and part interest. Over time, interest reduces as the principal is paid down.

2. Interest-Only Loans

Initially, only interest is paid (no reduction in principal). Often offered for 1–2 years and used in off-plan investments where buyers anticipate property appreciation or early exit.

3. Balloon Payment Structures

Used by some investors who prefer lower monthly payments and are willing to settle a large final lump sum. Riskier but cash-flow friendly.

4. Partial Prepayments

Allowed by most banks. However, early settlement penalties typically apply:

- 1% of outstanding balance

- Some banks may waive this if the borrower refinances with the same institution

Eligibility Criteria for Mortgage Applicants in Dubai

Meeting lender eligibility is crucial for approval. Here are the essentials:

| Category | Requirement |

| Income | AED 15,000/month (residents), AED 25,000 (non-residents) |

| Employment | Minimum 6 months in current job or 2 years for self-employed |

| Credit Score | Clean history with Al Etihad Credit Bureau (AECB) |

| Nationality | Mortgages are open to most nationalities; additional scrutiny may apply for high-risk countries |

| Age Limits | Typically 21–65 (70 for self-employed at loan maturity) |

Fees and Charges Associated with Mortgages in Dubai

| Fee Type | Approximate Cost |

| DLD Transfer Fee | 4% of property price (DSX Guide) |

| Mortgage Registration Fee | 0.25% of loan + AED 290 |

| Valuation Fee | AED 2,500–3,500 |

| Processing/Arrangement Fees | 0.5%–1% of loan value |

| Insurance | Property and life insurance mandatory |

| Admin/Trustee Fees | AED 4,000–5,000 |

| Early Repayment Penalty | 1% of remaining loan (sometimes negotiable) |

All these charges should be documented in the bank’s Cost Sheet and discussed before signing the mortgage offer letter.

Case Study: Mortgage Financing for a Downtown Dubai Apartment

Scenario

- Buyer: UAE resident, salaried

- Monthly salary: AED 30,000

- Property: 2-bedroom apartment in Downtown Dubai

- Price: AED 2,000,000

Mortgage Details

- LTV: 80% (Loan = AED 1.6M)

- Interest: 4.25% fixed (3 years), then variable

- Term: 20 years

- EMI: ~AED 9,900/month

Upfront Costs

- DLD: AED 80,000

- Mortgage Reg.: AED 4,000

- Valuation/Admin: AED 18,000

- Total: AED 102,000

Common Mistakes to Avoid in the Mortgage Process

- Assuming loan will cover full property cost

→ Banks finance only up to 80%, sometimes less. - Skipping credit score check

→ A low AECB score can lead to denial or high rates. - Rushing into high-interest products

→ Compare offers from multiple banks before committing. - Underestimating insurance and fees

→ Total upfront cost can exceed AED 100,000. - Overlooking early repayment penalties

→ Could cost thousands if you refinance or sell early. - Not reading the fine print

→ Terms like rate resets and admin fees are often buried in offer letters.

Frequently Asked Questions (FAQs)

Can non-residents get mortgages in Dubai?

Yes. Many UAE banks offer non-resident mortgage products, though LTV is typically lower and rates are higher.

What documents are needed for mortgage approval?

- Passport, visa, Emirates ID

- Salary certificate or audited financials

- 6 months’ bank statements

- Property documents and MOU

- AECB credit report

How long does mortgage registration take?

Usually 1–3 business days via a DLD Trustee Office if documents are complete.

Can I refinance my mortgage?

Yes. Many banks offer refinancing packages, particularly for borrowers nearing the end of their fixed-rate period.

Conclusion

Understanding the mortgage structure in Dubai is critical for anyone considering property financing in the emirate. From choosing between fixed or variable interest rates, to navigating DLD fees, insurance, and prepayment penalties — each step requires clarity and informed decision-making.

With proactive preparation, you can avoid common pitfalls, secure better terms, and gain a strong financial footing in Dubai’s ever-evolving real estate market.

Contact Homecubes

At Homecubes, our mission is to simplify real estate complexity for global and local investors alike. Whether you’re interested in co-ownership models, fractionalized assets, or traditional mortgage-based investments, we provide trusted, regulation-aware insights tailored to your journey.

🚨 Please Note: Homecubes is currently awaiting its real estate tokenization platform license from the Virtual Assets Regulatory Authority (VARA). We do not offer regulated services at this time but continue to deliver educational resources until licensing is complete.

📬 To stay informed or join our early-access list, contact us. Let’s shape the future of smart property ownership together.