Introduction: Why Long-Term Appreciation Matters for Real Estate Investors

In a fast-evolving real estate landscape like the UAE’s, making short-term gains is common — but building sustainable wealth hinges on identifying properties with long-term appreciation potential. Whether you’re investing in Dubai’s premium zones, Sharjah’s smart cities, or up-and-coming freehold communities in Ras Al Khaimah, understanding what drives property value over 5, 10, or even 20 years is critical.

Long-term appreciation refers to the consistent increase in a property’s market value over time due to factors like economic growth, strategic infrastructure projects, legal stability, and demographic expansion. For serious investors, knowing how to assess these drivers is the difference between speculative buying and wealth-building.

As part of our commitment to ensuring the sustained progress of government initiatives that reinforce Dubai’s global leadership, I met with Marwan bin Ghalita, Director General of the Dubai Land Department, to review the strategic projects of the Dubai Real Estate Sector Strategy… pic.twitter.com/2g0yodwMmS

— Hamdan bin Mohammed (@HamdanMohammed) November 25, 2024

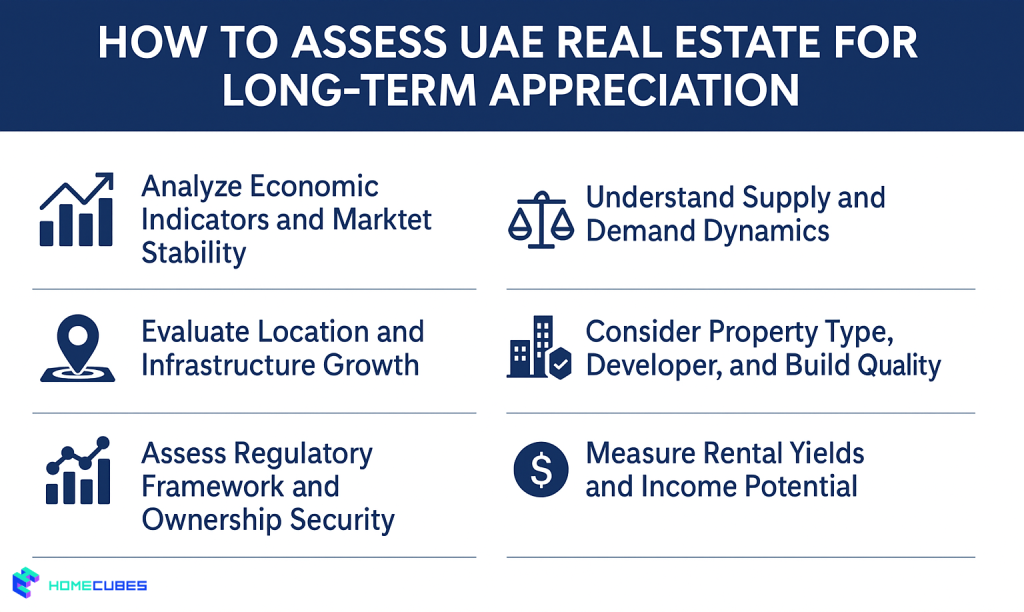

In this guide, we break down six actionable steps to evaluate real estate for long-term value growth in the UAE, supplemented by case studies, market data, and industry insight.

Step 1: Analyze Economic Indicators and Market Stability

A strong, diversified economy underpins any long-term investment strategy. Fortunately, the UAE continues to perform exceptionally on this front. The country’s GDP is projected to grow steadily, driven by non-oil sectors such as tourism, logistics, and green energy.

Dubai’s property market, for example, recorded 20.7% year-on-year residential price growth as of March 2024, according to a Greenberg Traurig market outlook.

What to Watch:

- National GDP trends and inflation control

- Real estate investment inflows (FDI)

- Government-backed development budgets

- Changes in household income and employment rates

Macro stability across these areas helps ensure property values continue to trend upward over time.

Step 2: Evaluate Location and Infrastructure Growth

In the UAE, location is not just about proximity — it’s about connectivity and future integration with key urban, business, or lifestyle zones.

Property buyers in areas with expanding metro coverage, road improvements, and new economic districts tend to benefit from rapid value escalation. For example, Dubai South, Mohammed Bin Rashid City, and Sharjah’s Aljada have appreciated significantly after being linked to infrastructure upgrades.

New mega-projects like Etihad Rail are expected to unlock value in satellite towns by reducing commuting times between emirates — positioning properties there for long-term gains.

Indicators of a High-Appreciation Zone:

- Upcoming metro or transit hubs

- Announced government urban master plans

- Healthcare, education, and retail expansions

- Public-private infrastructure partnerships

Step 3: Understand Supply and Demand Dynamics

One of the clearest predictors of Long-Term Appreciation is the supply-demand imbalance in a given district. When demand outpaces supply — especially in well-planned communities — capital values and rental yields rise in tandem.

Dubai’s population, for instance, is projected to reach 5.8 million by 2040, requiring over 500,000 additional housing units.

Source: Business Insider

How to Evaluate:

- Vacancy rates in upcoming or newly completed projects

- Developer plans for phased handovers

- Job and visa creation in that area (business parks, logistics zones, etc.)

- Absorption rates (how fast units are selling/leasing post-launch)

When these numbers align, long-term value growth is usually sustainable.

Step 4: Assess Regulatory Framework and Ownership Security

The UAE’s legal environment has become increasingly transparent and pro-investor. Key policies like the freehold property rights for foreigners, residency-linked property investment, and escrow protections have made the country one of the safest places in the MENA region to own property.

Considering the property ownership laws for foreigners in Abu Dhabi and Dubai, foreign buyers can own properties outright in most Dubai and Abu Dhabi zones, and Sharjah recently extended its own freehold ownership to international buyers in projects like Maryam Island.

The government’s clarity on land use, inheritance for expats, and real estate dispute resolution ensures investor protection — a cornerstone for long-term value preservation.

Step 5: Consider Property Type, Developer, and Build Quality

Not all property categories are appreciated equally. For example, ultra-luxury properties in oversupplied zones may plateau, while smartly priced mid-income housing in rising districts sees steady compounding.

Additionally, the developer’s reputation, build quality, and post-handover service can dramatically impact a property’s long-term value and rental viability.

Consider:

- Branded residences or projects with long-term maintenance contracts

- Developments with integrated community management

- Smart buildings (IoT integration, energy saving, security systems)

- Track record of developer (past delivery timelines and resale history)

Investors focusing on quality over hype often enjoy stronger returns during market cycles.

Step 6: Measure Rental Yields and Income Potential

A property that offers solid net rental income while you wait for appreciation reduces holding costs and enhances your total return. In the UAE, this is especially relevant, as rental yields in mid-tier Dubai neighborhoods can reach 6%–8% annually. Understanding usage of the RERA rental calculator in Dubai is quite helpful, though for Dubai inventors.

In emerging Tier-2 zones like Ajman, Ras Al Khaimah, and Sharjah, yields can be even higher due to low initial capital costs and strong rental demand.

Read more at DAMAC’s forecast for 2025

Combine this rental income with even a modest 3–5% yearly appreciation, and long-term compounded returns become very attractive.

Common Challenges to Watch For

Even the best-planned long-term strategy can face obstacles. Here’s what to be aware of:

- Market Cycles: Over Exuberant price booms often lead to correction phases. Stay invested long-term.

- Overdevelopment Risk: Watch for sudden oversupply in zones with minimal absorption history.

- Hidden Costs: Service charges, maintenance, and sinking funds can eat into yield and resale margin.

- Legal Surprises: Always verify title deeds, zoning permissions, and resale restrictions before committing.

Conducting due diligence, engaging with certified agents, and staying current with RERA/DLD updates helps protect your position.

Future Outlook for Long-Term Appreciation in the UAE

With Expo 2020’s legacy projects, Dubai 2040 Urban Master Plan, and Vision 2031 across all emirates, long-term planning is firmly embedded in the UAE’s development strategy.

The rise of:

- Smart mixed-use districts

- Sustainable energy-integrated homes

- Tokenized real estate ownership models

- Blockchain-based property registration

…will ensure future investors gain access to more transparent, digital, and globally aligned opportunities.

Expect moderate but stable 5–10% annual appreciation in core districts and 12–15% in emerging areas with strong fundamentals.

DXBInteract reports detailed 2025 forecasts here

Case Studies: Real-World Appreciation in UAE Real Estate

1: Business Bay Apartment (2014–2024)

Investor purchased a 1-bedroom in Executive Towers for AED 1.1 million. Rented consistently at AED 75,000/year. Sold in 2024 for AED 1.72 million.

ROI: 56% appreciation + 6.5% net annual yield

2: Aljada Townhouse, Sharjah (2020–2025)

A 3-bed townhouse bought off-plan at AED 990,000 appreciated to AED 1.35 million by mid-2025, boosted by smart city infrastructure and retail development.

3: Meydan (MBR City) Villa

Purchased in 2018 for AED 2.7 million. Post-Hartland School development and metro access, price reached AED 3.85 million.

Buyer used 50% mortgage; capital gain supported partial equity withdrawal for reinvestment.

Conclusion: Strategy, Patience, and Planning Drive Long-Term Gains

UAE real estate offers one of the most promising environments in the region for capital growth — but success lies in selectivity, not speculation. Long-Term Appreciation isn’t guaranteed by location alone; it requires data, timing, developer insight, and exit planning.

By following the six steps outlined — from macroeconomic evaluation to location scouting and yield analysis — investors can stack the odds in their favor and build portfolios that thrive in cycles and corrections alike.

Secure Your Long-Term Future with Homecubes

At Homecubes, our upcoming platform is designed to simplify the journey to long-term success in UAE real estate. While we’re currently awaiting our operating license from VARA, our mission is clear:

- ✅ Provide data-driven, fractional access to appreciating UAE real estate

✅ Equip investors with tools for lifecycle analysis and capital gain projections

✅ Bridge global investors with Dubai’s most strategic emerging zones

📬 Contact Homecubes to join our pre-launch community and get early access to tools that help you identify the UAE’s most profitable long-term real estate opportunities.