Table of Contents

- Introduction

- What Proptech Means in the UAE Context

- Top Proptech Companies UAE

- Property Finder

- Bayut

- SmartCrowd

- Stake

- Houza

- Realiste AI

- Emaar’s eMart Platform

- Homecubes (Future Vision)

- Case Study: How Homecubes Aims to Pioneer Blockchain in Real Estate

- How Proptech Is Transforming the UAE Market

- Data-Driven Transparency

- Fractional Ownership & Investment Platforms

- Blockchain & Tokenization

- Virtual Reality, AR & Metaverse Integration

- Government & Regulatory Support for Proptech in UAE

- Mistakes to Avoid When Engaging with Proptech Companies UAE

- Fees, Charges & Monetization Models in UAE Proptech

- Risks & Challenges Facing the Sector

- Outlook & Future Trends (2025–2030)

- Final Thoughts

- Frequently Asked Questions (FAQs)

- Unlock Dubai’s Property Potential with Homecubes

Introduction

The UAE real estate market is undergoing one of the most significant technological transformations in its history. At the heart of this change are Proptech companies UAE, a sector combining property and technology to enhance transparency, accessibility, and efficiency across real estate transactions.

With Dubai ranked as one of the fastest-growing real estate markets globally in 2025, fueled by 5–7% average rental yields (GlobalPropertyGuide), investors and residents alike demand faster, smarter, and more secure platforms. Proptech firms — from AI-powered marketplaces to blockchain-based fractional ownership platforms — are responding to this demand by reshaping the way property is searched, managed, and traded.

What Proptech Means in the UAE Context

I discussed with @pmarca , Co-founder and General Partner of Andreessen Horowitz (a16z), the latest updates and developments in emerging technology and their positive impact on enhancing efficiency, productivity, and advancing e-commerce mechanisms.

The UAE is a leading investor… pic.twitter.com/DSa849NC4y

— Tahnoon Bin Zayed Al Nahyan (@hhtbzayed) March 12, 2025

Globally, proptech covers a wide range of innovations — from real estate marketplaces and digital CRMs to smart contracts, tokenization, and AR/VR visualization. In the UAE, however, the sector has some unique traits:

- Integration with Dubai’s Smart City strategy — government-backed digital initiatives and blockchain adoption across public registries.

- High international investor demand — proptech simplifies onboarding and compliance for non-resident buyers.

- Fractional investment & tokenization — making prime Dubai real estate accessible with as little as AED 500.

- AI & big data analytics — providing better property valuations and rental yield forecasting.

In short, UAE proptech isn’t just about convenience — it’s about building trust, expanding access, and aligning with global innovation hubs.

Top Proptech Companies UAE

Property Finder

Founded in 2007, Property Finder remains the region’s largest real estate portal, with more than 10 million monthly visits. Its strength lies in advanced AI-driven search, property valuation tools, and partnerships with Dubai Land Department (DLD) for verified listings.

Bayut

Owned by the Emerging Markets Property Group (EMPG), Bayut is a close competitor to Property Finder. Known for TruCheck, which validates listings to combat fraud, Bayut leads in verified rental and sale transactions.

SmartCrowd

The UAE’s first regulated fractional real estate investment platform, SmartCrowd allows investors to buy fractional shares of income-generating properties from AED 500 upwards. It is licensed by the Dubai Financial Services Authority (DFSA), making it one of the most secure platforms for retail investors.

Stake

Another fast-growing fractional investment platform, Stake raised over $14 million in funding (2023) and offers retail investors exposure to Dubai properties with rental returns paid monthly.

Houza

Houza is a homegrown challenger portal that aggregates listings from top real estate agencies. Its subscription-based model ensures transparency and higher listing quality compared to commission-heavy rivals.

Realiste AI

A proptech startup leveraging artificial intelligence to forecast real estate values, Realiste AI provides investment recommendations across Dubai neighborhoods. Backed by international VCs, it represents the intersection of AI and real estate strategy.

Emaar’s eMart Platform

As one of Dubai’s largest developers, Emaar launched eMart, a blockchain-based auction and sales platform for properties. It enables instant online transactions while aligning with DLD’s registry systems.

Homecubes (Future Vision)

Homecubes is preparing to enter the UAE proptech ecosystem with a blockchain-powered platform focused on fractional ownership and tokenized real estate investments. Once its VARA license application is approved, Homecubes aims to provide international investors access to prime Dubai properties via secure, transparent, and compliant tokens and make UAE real estate investors diversify their portfolio.

Case Study: How Homecubes Aims to Pioneer Blockchain in Real Estate

Unlike listing portals or marketplaces, Homecubes is designed around tokenized ownership, giving both local and international investors the ability to own fractional shares of Dubai real estate.

Key Elements of the Homecubes Model:

- Blockchain security: All ownership shares recorded immutably on-chain.

- Regulatory compliance: Operating under Dubai’s Virtual Assets Regulatory Authority (VARA).

- Investor access: Enabling foreign investors to buy into Dubai property without traditional friction.

- Automation: Smart contracts handling rental payouts and ownership transfers.

If successful, Homecubes could significantly increase real estate liquidity and cement Dubai’s role as a tokenized property hub — a trend already observed in studies like this ResearchGate paper.

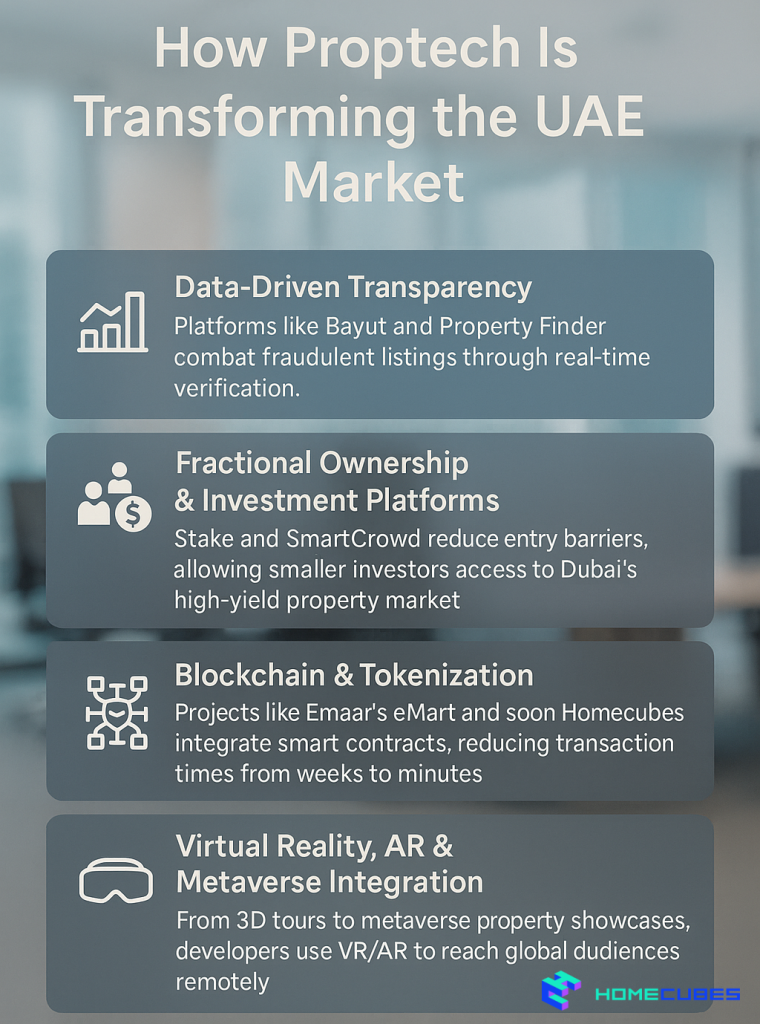

How Proptech Is Transforming the UAE Market

Data-Driven Transparency

Platforms like Bayut and Property Finder combat fraudulent listings through real-time verification.

Fractional Ownership & Investment Platforms

Stake and SmartCrowd reduce entry barriers, allowing smaller investors access to Dubai’s high-yield property market.

Blockchain & Tokenization

Projects like Emaar’s eMart and soon Homecubes integrate smart contracts, reducing transaction times from weeks to minutes.

Virtual Reality, AR & Metaverse Integration

From 3D tours to metaverse property showcases, developers use VR/AR to reach global audiences remotely.

Government & Regulatory Support for Proptech in UAE

The UAE government actively fosters proptech adoption:

- Dubai Land Department (DLD) ensures verified listings via blockchain.

- VARA regulates tokenization and virtual assets.

- DIFC & ADGM provide frameworks for fintech-real estate hybrid firms.

A PwC Middle East report highlights Dubai as a regional leader in real estate digitalization, underpinned by regulatory flexibility and strong investor protection.

Mistakes to Avoid When Engaging with Proptech Companies UAE

- Ignoring licensing requirements — not all platforms are regulated.

- Overestimating returns — assuming every property will yield 7%+.

- Overreliance on AI forecasts — predictive models have limits.

- Failure to verify ownership — investors should cross-check via DLD.

Fees, Charges & Monetization Models in UAE Proptech

- Marketplace fees (Property Finder, Bayut): subscription fees for agencies.

- Fractional ownership fees (SmartCrowd, Stake): acquisition + management fees (~1–2%).

- Tokenized platforms (Homecubes): transaction fees, secondary market trading spreads.

- AI & SaaS tools: subscription pricing models.

Risks & Challenges Facing the Sector

- Regulatory drift — global crypto regulations may impact tokenized real estate.

- Cybersecurity risks — protecting investor wallets and property data.

- Liquidity risk — secondary markets for fractional tokens still developing.

- Market volatility — real estate cycles can affect proptech adoption rates.

Outlook & Future Trends (2025–2030)

- Mainstream tokenization of Dubai’s prime properties.

- AI-powered predictive valuations replacing manual appraisals.

- dMRV integration for green real estate investments.

- Cross-border digital property exchanges linking UAE to Europe & Asia.

CBRE’s UAE Real Estate Market Outlook 2025 shows continued investor appetite for tech-driven access, supported by strong demand across both residential and commercial sectors.

Final Thoughts

The rise of Proptech companies UAE marks more than a tech trend — it signals a structural transformation in how property is bought, sold, and managed. By combining blockchain, AI, fractional ownership, and immersive tools, these firms are opening the UAE market to a broader base of investors while improving transparency and efficiency for real estate professionals.

Still, adoption hinges on regulation, trust, and user experience. Platforms that deliver clear compliance, strong security, and measurable value will lead the sector. As reports like CBRE’s UAE Market Review Q1 2025 highlight, Dubai continues to outperform global peers, making proptech adoption not just innovative, but essential for staying competitive.

Frequently Asked Questions (FAQs)

- What are the top Proptech Companies UAE in 2025?

Property Finder, Bayut, SmartCrowd, Stake, Houza, Realiste AI, and Homecubes are among the leaders. - Is fractional real estate investment legal in Dubai?

Yes — SmartCrowd and Stake operate under DFSA regulation, while Homecubes awaits VARA approval. - How do Proptech companies UAE make money?

Through subscription fees, listing charges, transaction commissions, and token issuance fees. - Can international investors use UAE proptech platforms?

Yes — many platforms, especially tokenized ones, cater to global investors. - What risks should investors watch out for?

Liquidity, regulatory uncertainty, and cybersecurity are the top concerns. - Will blockchain dominate UAE proptech?

Given Dubai’s strategy and VARA oversight, blockchain adoption will grow — particularly in tokenization.

Unlock Dubai’s Property Potential with Homecubes

Homecubes is preparing to launch a next-generation tokenized real estate platform that will enable fractional property ownership across Dubai. Our mission is to make high-value property markets accessible to investors worldwide — securely, transparently, and in full compliance with UAE regulations.

Currently, Homecubes has applied for a Virtual Asset Service Provider (VASP) license with VARA. Once approved, we will introduce a platform that:

- Enables investors to purchase fractionalized tokens of Dubai real estate.

- Automates rental income distribution via smart contracts.

- Offers verified and legally compliant access for international buyers.

📩 Want to stay updated on our launch and explore how tokenized real estate can diversify your portfolio? Contact Homecubes today and join our waiting list for early access.