Blockchain technology has the potential to transform various industries, and the mortgage securitization market in Dubai stands to benefit greatly. This article explores how blockchain is reshaping mortgage securitization in Dubai, highlighting its benefits, challenges, and future outlook. Blockchain’s ability to increase transparency, reduce costs, and streamline processes addresses many inefficiencies currently present in Dubai’s mortgage and real estate sectors.

Understanding Mortgage Securitization

Definition of Mortgage Securitization

Real World Asset Launches Mortgage-Backed Stablecoin On XRP Ledger – Benzinga https://t.co/yeFcwY9qpG

— Digital Asset Investor (@digitalassetbuy) June 27, 2023

Mortgage securitization refers to pooling various individual mortgages and creating mortgage-backed securities (MBS). These MBS are then sold to investors. This process allows financial institutions to offload risk and provides investors with an opportunity to invest in real estate without owning physical property.

Mortgage Securitization in Dubai

Dubai’s mortgage-backed securities (MBS) market has grown in recent years, driven by the expansion of the real estate sector. However, the process remains complicated, marked by inefficiencies, lengthy documentation, fraud risks, and a lack of transparency. The securitization process in Dubai is still developing, with the traditional methods failing to keep pace with the needs of the market.

Blockchain Technology: Fundamentals

What is Blockchain?

Blockchain is a decentralized, distributed ledger technology that records transactions across a network of computers in a secure and immutable way. Unlike centralized systems, blockchain uses consensus mechanisms to validate and record transactions, ensuring transparency, security, and traceability.

How Blockchain Works in Mortgage Securitization

In mortgage securitization, blockchain provides a transparent and secure method for recording every stage of a mortgage’s life cycle. All transactions, including loan origination, repayment, and ownership transfers, are tracked on a decentralized ledger. Smart contracts—self-executing contracts with terms written directly into the code—can automate processes such as loan repayments, asset transfers, and payment distributions.

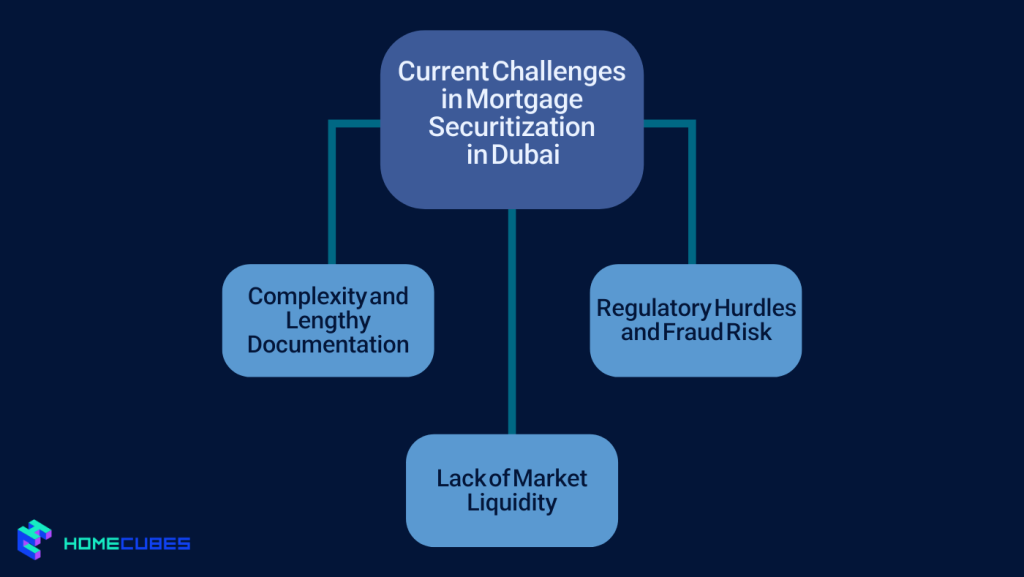

Current Challenges in Mortgage Securitization in Dubai

Complexity and Lengthy Documentation

The traditional mortgage securitization process in Dubai involves numerous intermediaries, including banks, real estate agents, and insurers. Each intermediary must verify document information, causing delays and increasing administrative costs.

Regulatory Hurdles and Fraud Risk

Dubai’s mortgage sector is governed by the Central Bank of the UAE. While these regulators maintain market stability, they can also create complexity. Fraud risks arise from inaccuracies in property titles and mortgage documentation, and a lack of market liquidity reduces investor confidence.

Lack of Market Liquidity

The mortgage-backed securities market in Dubai is still developing, limiting liquidity and making it harder for investors to easily buy and sell MBS. This reduces market efficiency and investor interest.

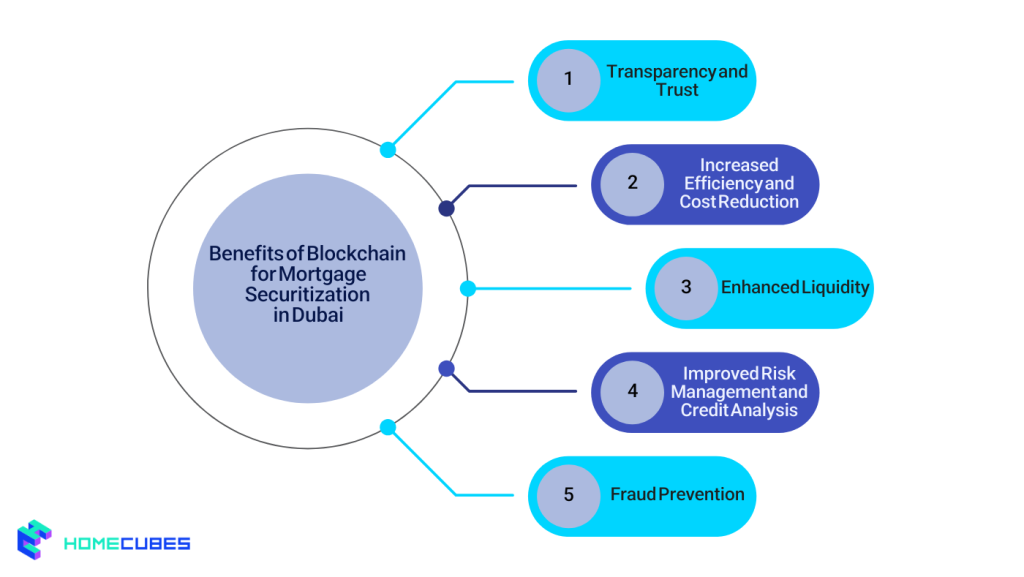

Benefits of Blockchain for Mortgage Securitization in Dubai

Transparency and Trust

Blockchain increases transparency by providing an immutable, public ledger for every transaction. Each transaction is recorded in real time, making it easier to verify property ownership, loan histories, and payments.

- Impact on Trust: Investors, lenders, and borrowers gain access to verifiable, real-time data on mortgage-backed securities, fostering trust among all parties involved.

Increased Efficiency and Cost Reduction

Blockchain reduces cost in Dubai property selling and buying, by reducing reliance on intermediaries through providing a decentralized system where participants can access shared information. This feature also streamlines the mortgage securitization process, cutting down on paperwork, verification delays, and administrative costs.

- Smart Contracts: Blockchain-enabled smart contracts automate tasks like loan repayment and asset transfers, further reducing operational costs.

Enhanced Liquidity

Blockchain allows for the fractionalization of mortgage-backed securities. Large assets, such as MBS, can be divided into smaller, more tradable units, making them more accessible to a broader range of investors. Thus, blockchain can be a solution for property liquidity challenges in Dubai as well as large assets such as MBS.

- Secondary Market: Blockchain’s ability to track and transfer ownership in real time makes it easier to trade MBS in the secondary market, thus increasing liquidity.

Improved Risk Management and Credit Analysis

Blockchain provides a transparent and real-time view of mortgage performance, allowing investors to assess risk more accurately. Detailed records of payment histories and borrower statuses offer a better understanding of potential defaults.

- Enhanced Creditworthiness Assessment: Investors can analyze the risk profile of mortgage pools more effectively by relying on data stored on the blockchain.

Fraud Prevention

Blockchain’s decentralized nature makes it resistant to fraud. All transactions are encrypted and recorded on a public ledger, making it nearly impossible to alter historical data without being detected.

- Verification of Property Ownership: Blockchain ensures that property titles and mortgage liens are recorded correctly, reducing the risk of fraudulent property transactions.

Challenges and Regulatory Considerations

Legal and Regulatory Challenges

Dubai’s commitment to blockchain adoption, exemplified by the Dubai Blockchain Strategy, shows promise. However, the legal and regulatory frameworks for blockchain-based mortgage securitization are still in development.

- Regulatory Clarity: The legal status of blockchain-based transactions and smart contracts is not fully defined. Clear regulations will be necessary for integrating blockchain into the mortgage sector.

- Compliance and Standardization: A well-defined regulatory framework will ensure blockchain-based transactions align with current laws and regulations.

Integration with Traditional Systems

Dubai’s real estate and financial systems are based on traditional methods that rely heavily on intermediaries. Moving to a blockchain-based model requires integrating new technologies into these legacy systems, which could meet resistance from stakeholders accustomed to the existing process.

- Adoption Resistance: Banks, regulators, and other participants may resist blockchain adoption due to the cost and effort involved in shifting to a new model.

Technological Infrastructure

To fully implement blockchain in mortgage securitization, Dubai will need to establish robust technological infrastructure. This includes ensuring the security and scalability of the blockchain platform, as well as addressing any potential cybersecurity risks.

Future Outlook of Blockchain in Mortgage Securitization in Dubai

Increasing Adoption of Blockchain Solutions

As blockchain technology matures and regulatory clarity improves, Dubai is well-positioned to become a leader in blockchain-based mortgage securitization in the Middle East.

- Pilot Projects: Dubai will likely see more pilot projects and partnerships between financial institutions, real estate developers, and blockchain start-ups aimed at testing blockchain’s role in mortgage securitization.

Potential for Global Investment

Dubai’s status as a global financial hub makes it an ideal location for attracting international investors. Blockchain’s transparency and efficiency could appeal to global investors seeking secure and accessible ways to invest in the city’s real estate sector.

- Cross-border Investment: Blockchain could facilitate cross-border investments by providing a secure platform for international investors to engage in mortgage-backed securities.

Regulatory Evolution

As blockchain adoption grows, Dubai’s regulatory bodies, such as the DFSA and DLD, will likely update their frameworks to accommodate blockchain technology. Clear regulations will help ensure that blockchain-based transactions in mortgage securitization are legally enforceable.

Bottomline

Blockchain technology offers significant potential to improve the mortgage securitization process in Dubai. By enhancing transparency, increasing market liquidity, and reducing costs, blockchain can address many inefficiencies in the current system. However, overcoming challenges related to regulation, integration with existing systems, and technology will be crucial for the widespread adoption of blockchain in mortgage securitization. With Dubai’s ongoing commitment to innovation and digital transformation, blockchain could play a pivotal role in shaping the future of mortgage securitization in the city, contributing to the growth and efficiency of its real estate market.

Homecubes as a licensed blockchain-based platform has got exciting real estate tokenization projects in the Dubai real estate market. Contact us with confidence or further information on our lucrative fractional investment opportunities in prime properties across Dubai.