The UAE has long been a hub for real estate investment, drawing attention from both local and international investors. However, despite its booming property market, many young individuals in the country, particularly millennials, have found it difficult to afford property ownership due to the high costs and significant financial requirements involved. Traditional homeownership models have left many millennials locked out of the market. Enter fractional ownership — an innovative solution that is reshaping the property landscape in the UAE. By allowing individuals to own a share of a property, fractional ownership is changing property real estate investment for first time buyers in Dubai as well as millennials. This article explores how fractional ownership is expanding property access for millennials in the UAE.

Understanding Fractional Ownership

$RWA assets aren’t the future—they’re the now.

Fractional ownership of the world’s wealth.

— Kingsley Advani (@kadvani) November 22, 2024

Fractional ownership as an application of blockchain in real estate, refers to a model where multiple buyers pool their resources to collectively purchase a property. Each participant owns a share or fraction of the asset, which is usually represented as a percentage or through tokens in the case of real estate or a tangible asset tokenization. In return, investors receive proportional ownership rights. These rights are including the ability to use the property, receive income generated from the asset, and benefit from any potential increase in property value.

This model has gained traction in industries such as aviation (with fractional jet ownership) and luxury assets. However, fractional ownership application in coworking spaces in Dubai and the real estate sector has proven to be particularly effective in making high-value properties more accessible to a wider audience. In particular for millennials who often face financial barriers to homeownership.

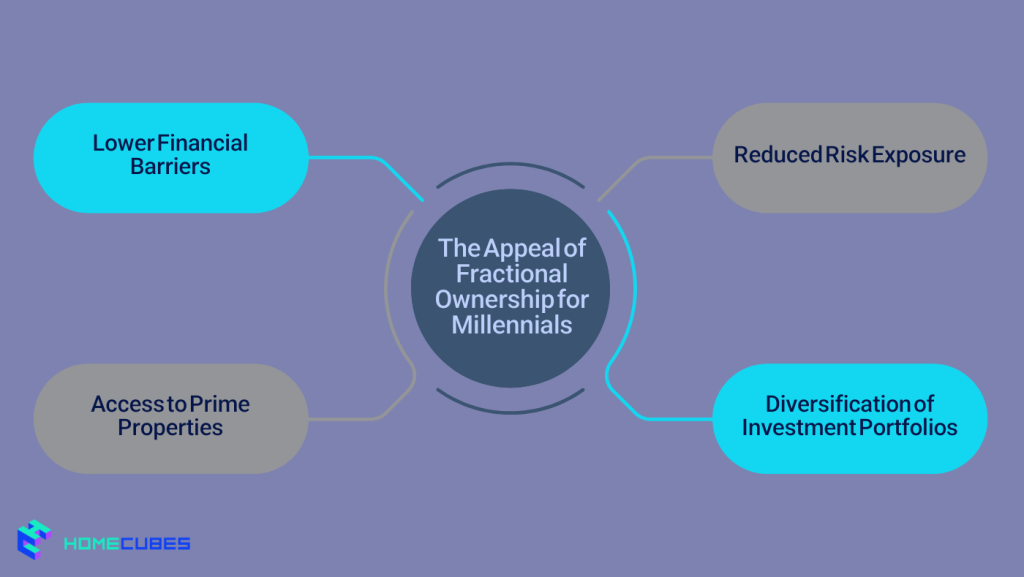

The Appeal of Fractional Ownership for Millennials

Millennials, typically defined as individuals born between 1981 and 1996. They are often characterized by their tech-savviness, preference for experiences over ownership, and a more cautious approach to financial commitment. They are also facing with challenges like rising living costs, student debt, and the challenge of securing large down payments for properties.

Fractional ownership addresses these challenges by offering several key benefits:

1. Lower Financial Barriers

One of the most significant advantages of fractional ownership is the reduced financial barrier to entry. Instead of needing to come up with the full cost of a property, millennials can invest in a fraction of the asset at a much lower cost. For example, rather than needing millions of dirhams to buy a luxury apartment, a millennial can purchase a fraction for a relatively small sum. This democratization of property ownership opens the door for millennials who otherwise would not have been able to afford real estate.

2. Reduced Risk Exposure

Investing in real estate traditionally involves significant risk. If a millennial buys a property and the market dips, they stand to lose a substantial amount of money. With fractional ownership, however, this risk is spread among several investors, thus reducing the financial burden on any single participant. Furthermore, if the property is rented out, the rental income is shared among owners, generating a relatively stable return on investment.

3. Access to Prime Properties

In a typical homeownership scenario, millennials may only be able to afford properties in less desirable locations or smaller units. Fractional ownership allows individuals to invest in higher-value properties in prime locations that they might not have been able to afford on their own. This includes luxury properties, beachfront villas, or commercial real estate in some of Dubai’s most sought-after neighbourhoods. Fractional ownership involves dividing the cost among multiple parties. Hence, millennials gain access to a higher standard of living without the hefty price tag.

4. Diversification of Investment Portfolios

Fractional ownership also provides millennials with an opportunity to diversify their investment portfolios. By holding a share in different properties or types of real estate, millennials can spread their financial risk across a broader range of assets. This diversification helps reduce the exposure to any one property’s performance and mitigates financial loss in a volatile market.

How Fractional Ownership Works in the UAE

Fractional ownership in the UAE is typically facilitated through real estate investment platforms. It often combines with blockchain technology for added transparency and security. These platforms or tokenized real estate companies allow investors to buy fractions of properties. This happens through issuing digital tokens or shares that represent their stake in the property. These tokens are stored on a blockchain, which provides an immutable record of ownership and transaction history, enhancing the overall security and transparency of the investment process.

Fractional Ownership and the Future of Dubai’s Real Estate Market

The UAE’s real estate market, particularly in Dubai, has long been recognized as a prime destination for investment. Dubai’s skyline is dotted with iconic towers, luxury resorts, and world-class residential developments. However, the high cost of entry has traditionally made it difficult for younger generations to participate in this market.

Millennials are becoming a larger part of the UAE’s working population. Hence, their demand for more affordable and accessible property options is increasing. Fractional ownership provides an avenue for millennials to participate in Dubai’s booming real estate market without the need for massive upfront capital. This model aligns with millennials’ values, including their preference for flexible, low-commitment investments and their growing reliance on digital platforms for managing finances.

Furthermore, as Dubai continues to embrace innovation in real estate and financial services, fractional ownership is poised to expand further, particularly with the integration of blockchain technology.

The Challenges of Fractional Ownership for Millennials

While fractional ownership provides numerous benefits, it is not without its challenges. Some of the key considerations for millennials investing in fractional real estate include:

Regulatory and Legal Uncertainty

The legal framework surrounding fractional ownership, particularly with tokenized assets, is still evolving in the UAE. Investors need to be aware of the regulatory landscape and ensure that the platforms they are using comply with local laws and regulations.

Management and Maintenance

With shared ownership comes the responsibility of property management. In some cases, millennials may not have full control over the property’s maintenance, which could impact their returns. It’s important for investors to carefully vet property management companies and understand how decisions will be made.

Market Risks

Like any investment, fractional ownership is subject to market risk. While the fractional ownership model reduces some risk, the value of the underlying property can still fluctuate based on market conditions, affecting the returns for investors.

Conclusion

Fractional ownership is rapidly transforming the UAE’s real estate market, providing millennials with unprecedented access to property ownership in a high-cost environment. By reducing financial barriers, offering shared risk, and enhancing liquidity, fractional ownership opens the door to real estate investment for a generation that has long been shut out of traditional property markets. As technology continues to evolve, the adoption of fractional ownership models, particularly those powered by blockchain, is likely to grow, further democratizing property access and shaping the future of real estate investment in the UAE.

Homecubes has developed their sophisticated property tokenization in full compliance with UAE regulation on asset tokenization. Contact us with confidence for further information on such a lucrative fractional investment opportunity in the Dubai real estate market.