Table of Contents

- Introduction

- Why Transaction Costs Matter in Blockchain Adoption

- Ethereum Transaction Costs in 2025

- Polygon Transaction Costs in 2025

- ETH vs Polygon Transaction Cost: Direct Comparison

- Case Study: Dubai Real-Estate Tokenization on ETH vs Polygon

- Risks & Challenges of Choosing the Wrong Network

- Common Mistakes to Avoid

- Fees & Charges Breakdown in 2025

- Outlook & Future Trends

- Final Thoughts

- Frequently Asked Questions

- Unlock Dubai’s Tokenized Future with Homecubes

Introduction

One of the most important debates in blockchain development in 2025 revolves around ETH vs Polygon transaction cost. For developers, investors, and especially those building real-estate tokenization platforms in Dubai, the cost of transactions directly impacts adoption, user experience, and profitability.

Ethereum, the world’s most widely used smart-contract network, continues to face scalability challenges, while Polygon (MATIC) has emerged as one of the most cost-effective alternatives. As Dubai accelerates blockchain integration into real estate and tokenization projects, knowing which network offers the right balance of cost, compliance, and reliability has never been more crucial.

Polygon matches Ethereum with 29% of all US Treasury Bill TVL. More than all other chains.

> using Polygon gives investors an institutional grade platform, but without the high transaction prices pic.twitter.com/OuRAii1zvc

— Polygon (@0xPolygon) September 19, 2025

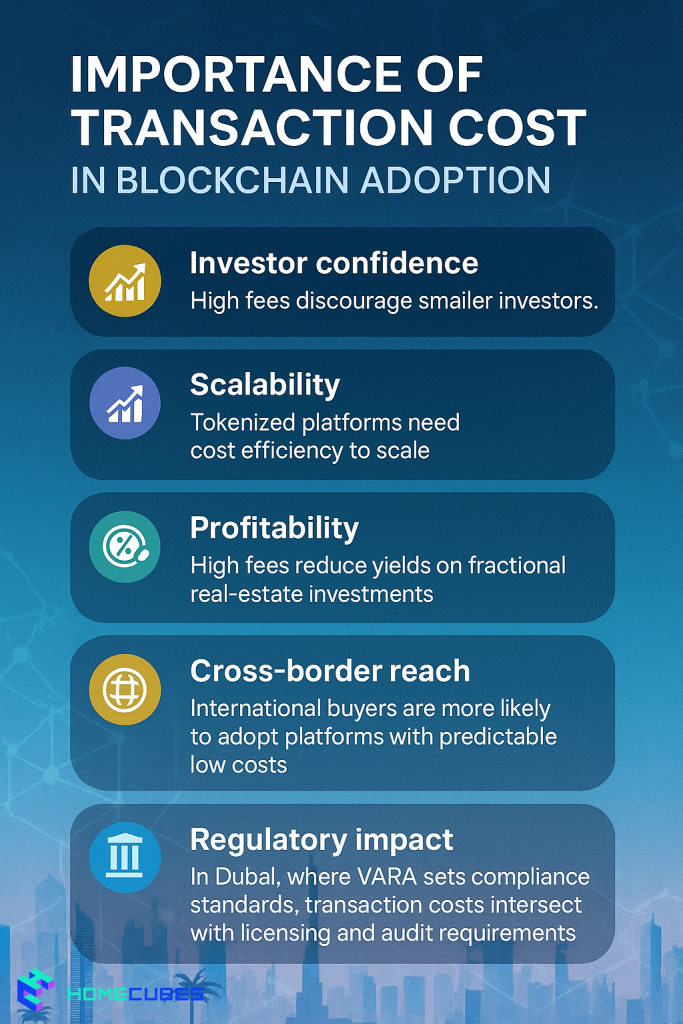

Why Transaction Costs Matter in Blockchain Adoption

Transaction fees, also known as gas fees, are paid to validators for securing the network and processing transactions. These costs matter because:

- Investor confidence: High fees discourage smaller investors.

- Scalability: Tokenized platforms need cost efficiency to scale.

- Profitability: High fees reduce yields on fractional real-estate investments.

- Cross-border reach: International buyers are more likely to adopt platforms with predictable low costs.

- Regulatory impact: In Dubai, where VARA sets compliance standards, transaction costs intersect with licensing and audit requirements.

Ethereum Transaction Costs in 2025

Ethereum remains the backbone of decentralized finance (DeFi) and NFT projects. Its ecosystem is unmatched, but its fees are a major drawback.

- In 2025, the average Ethereum transaction fee remains around $1.58 but can spike between $5 and $50+ during congestion (Coinlaw.io).

- Complex smart contracts, such as real-estate tokenization agreements, often require multiple steps, multiplying costs.

- Despite Ethereum 2.0 proof-of-stake improvements, scalability remains a challenge.

For Dubai real-estate developers, this means minting or transferring property-backed tokens can be prohibitively expensive on Ethereum during peak activity.

Polygon Transaction Costs in 2025

Polygon has positioned itself as one of the most cost-efficient blockchain networks.

- Polygon’s average gas fees in 2025 are $0.0005 to $0.01 per transaction (Exolix).

- Even complex smart contracts rarely exceed a few cents.

- Polygon’s use of layer-2 scaling allows faster confirmation and lower costs.

- For tokenization, fractionalized ownership transfers, and microtransactions, Polygon is far more sustainable than Ethereum.

This makes Polygon highly attractive for Dubai’s fractional property ownership projects, where investors might buy shares as small as AED 500.

ETH vs Polygon Transaction Cost: Direct Comparison

| Feature | Ethereum | Polygon |

| Avg. Transaction Cost | $1.58–$50+ (variable) | $0.0005–$0.01 |

| Speed | 15–30 TPS | Up to 65,000 TPS |

| Scalability | Limited | Highly scalable |

| Energy Consumption | Higher, though PoS improved | Lower, eco-friendly |

| Suitability for Real-Estate Tokenization | High compliance, but expensive | Low cost, efficient for fractional ownership |

Polygon is not just cheaper; it’s also faster and greener. However, Ethereum still enjoys greater institutional credibility and deeper liquidity.

Case Study: Dubai Real-Estate Tokenization on ETH vs Polygon

Imagine a Dubai fractional real-estate platform that tokenizes luxury apartments on both Ethereum and Polygon.

- Ethereum Minting: A single NFT representing ownership costs $50–100 in gas fees during peak congestion. Selling 1,000 fractional shares may push fees to several thousand dollars.

- Polygon Minting: The same NFT minting costs less than $1, with fractional transfers costing fractions of a cent.

Outcome: While Ethereum provides unmatched trust and a global investor base, Polygon enables scalable tokenization accessible to retail investors worldwide.

For a platform like Homecubes, Polygon offers the ability to make fractional real-estate investment affordable to small investors, aligning with Dubai’s 2040 Urban Master Plan goals of inclusive investment.

Risks & Challenges of Choosing the Wrong Network

- Ethereum: High fees can deter small investors and reduce liquidity in fractional ownership projects.

- Polygon: While cheaper, it may face centralization critiques and is still more dependent on Ethereum’s main chain security.

- Regulatory oversight: Dubai’s VARA requires platforms to demonstrate both compliance and sustainability, meaning the choice of blockchain must align with licensing.

- Market reputation: Institutional investors may still prefer Ethereum due to its maturity and liquidity, even at higher costs.

Common Mistakes to Avoid

- Assuming Ethereum fees are “fixed” — they fluctuate heavily.

- Believing Polygon has no risks — it still faces governance and long-term adoption questions.

- Ignoring compliance — even with low costs, VARA requires regulated structures.

- Overlooking investor psychology — some investors equate “low cost” with “low quality.”

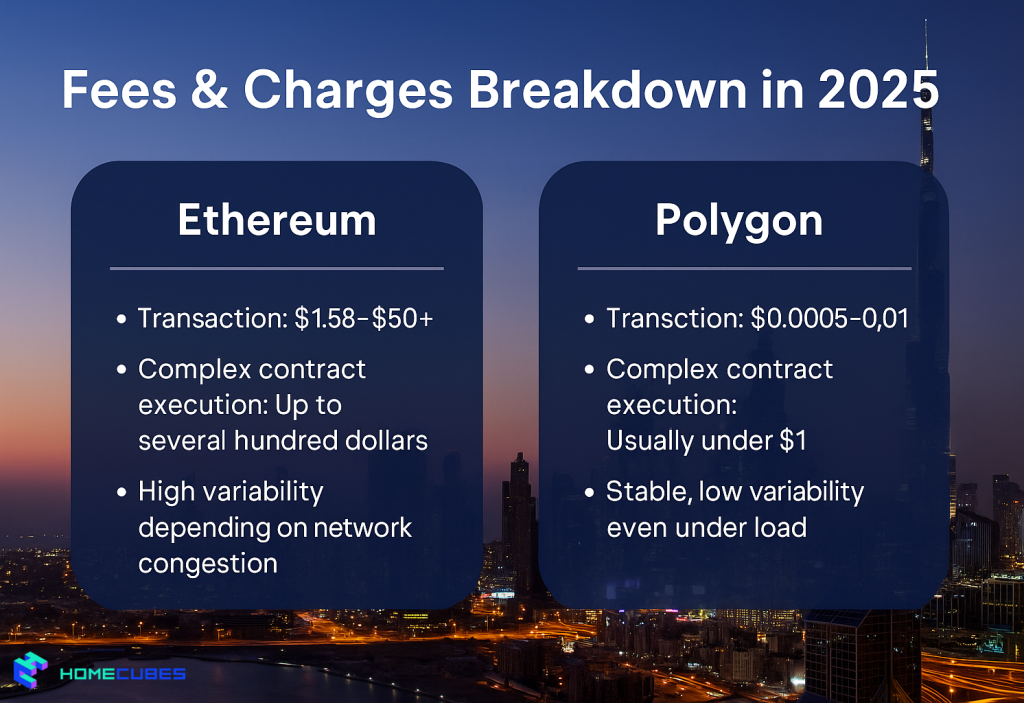

Fees & Charges Breakdown in 2025

Ethereum

- Transaction: $1.58–$50+

- Complex contract execution: Up to several hundred dollars

- High variability depending on network congestion

Polygon

- Transaction: $0.0005–$0.01

- Complex contracts: Usually under $1

- Highly stable fee structure

For Dubai tokenization projects, predictable fees are critical. Investors need assurance that transaction costs won’t wipe out potential yields.

Outlook & Future Trends

- Ethereum Scaling: Sharding and rollups may reduce costs, but not dramatically in 2025.

- Polygon Expansion: Growing ecosystem and partnerships with governments (including Dubai smart-city initiatives) will drive adoption.

- Hybrid Models: Some projects will use Ethereum for settlement and Polygon for day-to-day transactions.

- Regulatory Alignment: Networks compliant with VARA will attract institutional backing.

- Sustainability: As Dubai pushes green initiatives, low-energy chains like Polygon will be favored.

Final Thoughts

The ETH vs Polygon transaction cost debate in 2025 goes beyond simple numbers. Ethereum offers trust, global reach, and maturity but remains costly. Polygon is lean, affordable, and scalable, making it ideal for fractional ownership models and microtransactions in Dubai’s real-estate market.

For investors and developers, the decision should align with project goals, compliance requirements, and investor expectations. The future likely lies in multi-chain models, where Ethereum ensures credibility while Polygon ensures affordability.

Frequently Asked Questions

Why are Ethereum transaction fees so high?

Ethereum fees depend on network demand and complexity of smart contracts. High activity leads to spikes in costs.

How much cheaper is Polygon compared to Ethereum?

Polygon transactions average under $0.01, compared to Ethereum’s $1.58–$50+.

Is Polygon safe for real-estate tokenization?

Yes, provided contracts are audited and the platform complies with VARA licensing in Dubai.

Will Ethereum become cheaper in the future?

Ethereum scaling solutions may lower costs, but Polygon and other layer-2s will likely remain cheaper.

Which network is better for fractional real-estate?

Polygon is more accessible for retail investors, while Ethereum offers institutional trust. Many projects use both.

Does Polygon rely on Ethereum?

Yes, Polygon inherits Ethereum’s security but improves scalability with layer-2 architecture.

Are transaction fees important for Dubai’s tokenization market?

Absolutely. High fees can deter small investors, while predictable low fees encourage wider adoption.

Unlock Dubai’s Tokenized Future with Homecubes

At Homecubes, we are preparing to launch fractional real-estate investment opportunities built on blockchain. We are currently in the process of securing our VARA license, after which services will officially launch.

By leveraging efficient networks like Polygon, Homecubes aims to make Dubai property investment accessible to global investors, from institutional buyers to individuals starting with just AED 500.

👉 Stay ahead of the curve—connect with Homecubes today to join our early-access list and receive exclusive updates as we prepare to transform Dubai real estate through blockchain tokenization.