Dubai has long been a global hub for innovation, and its real estate sector is no exception. Among the most recent innovations in property transactions is the integration of cryptocurrency. Known for its tech-forward approach, Dubai has embraced blockchain and digital currencies. This is mainly because of simplifying processes across various industries, including real estate. The city’s free zones, particularly the ones in areas like Dubai Silicon Oasis, Dubai International Financial Centre (DIFC), and Dubai Internet City, have adopted crypto-friendly policies, making them ideal environments for digital asset-based property transactions. This article explores how cryptocurrency is streamlining property transactions in Dubai’s free zones and how investors and property buyers can benefit from this modern approach.

What Are Free Zones in Dubai?

Free zones in Dubai are special economic zones that offer businesses and investors unique incentives. Those incentives include tax exemptions, 100% foreign ownership, and reduced red tape. These zones are designed to attract foreign investment and facilitate the establishment of businesses in key industries such as technology, finance, media, and trade.

Key Characteristics of Dubai’s Free Zones

- 100% Foreign Ownership: Investors in free zones can own 100% of their businesses without the need for a local sponsor.

- Tax Benefits: Free zones offer significant tax advantages such as exemptions from income tax, import/export duties, and corporate tax for a set number of years.

- Streamlined Regulatory Processes: Setting up a business in a free zone is faster and more efficient compared to other parts of the UAE.

- Cryptocurrency-Friendly Policies: Many of Dubai’s free zones have embraced cryptocurrency and blockchain technology, creating a supportive environment for digital asset transactions.

The adoption of cryptocurrency in these free zones is transforming how businesses and investors approach real estate purchases. That would make property transactions faster, more secure, and more accessible.

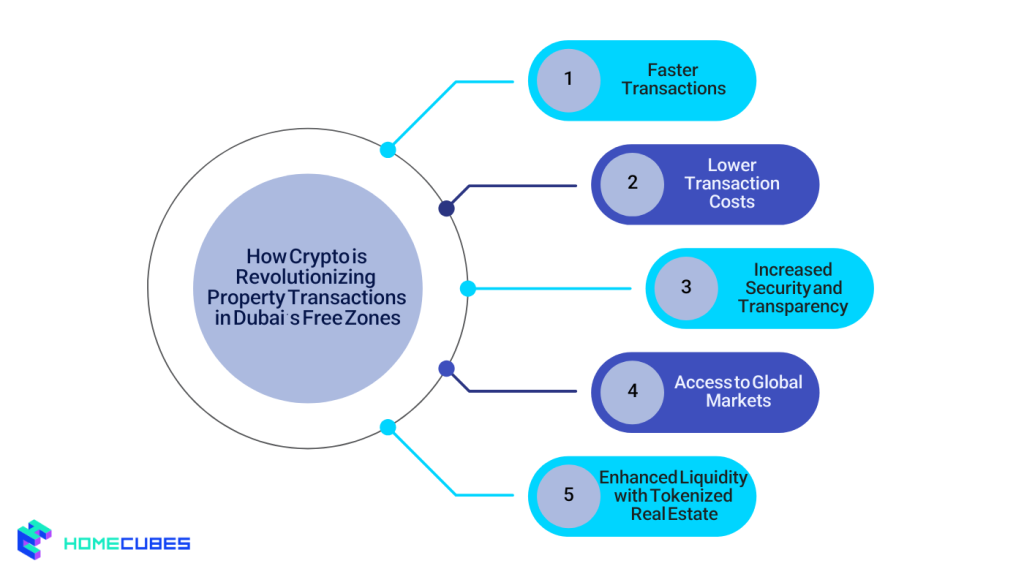

How Crypto is Revolutionizing Property Transactions in Dubai’s Free Zones

From rental cash flows and REITs to individual properties, tokenized real estate can enhance liquidity, encourage price discovery, and lower administrative costs in the real-estate market.

Here are four theoretical implementations of tokenized real estate 🧵⬇️ pic.twitter.com/QkUfrkscsL

— Chainlink (@chainlink) May 30, 2023

Dubai has become a leader in the adoption of cryptocurrency within real estate transactions, particularly within its free zones. Traditionally, property transactions in Dubai involved long waiting periods, multiple intermediaries, and hefty transaction fees. With the rise of crypto property transactions, the process is becoming more efficient, streamlined, and cost-effective. Let’s take a closer look at how cryptocurrency is changing the property landscape in Dubai’s free zones.

1. Faster Transactions

Traditional property transactions in Dubai often require a significant amount of time to process. From verifying documents to arranging payments through banks, the entire procedure could take weeks or even months. Cryptocurrency transactions, on the other hand, are processed much faster.

Blockchain technology enables near-instantaneous transfers. Whether it’s Bitcoin, Ethereum, or stablecoins, the funds are transferred directly between buyer and seller without the need for a bank intermediary. This speed of transaction greatly reduces the time it takes to close property deals. In particular, that’s be beneficial for investors who may be working across borders or seeking to finalize deals in record time.

2. Lower Transaction Costs

One of the most significant benefits of using cryptocurrency for property transactions is the potential for lower transaction costs. In traditional property purchases, buyers and sellers incur several fees, such as agent commissions, bank transfer fees, and administrative costs.

Crypto property transactions in Dubai’s free zones eliminate many of these middlemen. Blockchain removes the need for intermediaries like banks, which typically charge fees for wire transfers or currency conversion. By bypassing these traditional financial systems, both buyers and sellers can save substantial amounts on transaction costs, making property deals more financially attractive.

3. Increased Security and Transparency

One of the most appealing features of cryptocurrency in property transactions is the enhanced security it provides. Blockchain technology, the foundation of cryptocurrencies, offers a transparent and tamper-proof record of all transactions. Each transaction is securely logged on the blockchain, providing an immutable audit trail.

This transparency is particularly important in the real estate sector, where fraud and misrepresentation have historically been issues. Using cryptocurrencies in property deals ensures that funds are traceable and that ownership is properly transferred without the risk of double sales or fraudulent activity. Moreover, the decentralized nature of blockchain makes it nearly impossible to alter or manipulate transaction records.

4. Access to Global Markets

One of the major hurdles for international investors looking to buy property in Dubai is navigating the complexities of currency exchange, cross-border payments, and banking systems. Cryptocurrency offers a solution to this problem by allowing global transactions without the need for traditional banking infrastructure.

In Dubai’s free zones, crypto property transactions facilitate seamless cross-border deals. Whether the buyer is located in Europe, Asia, or North America, the process is the same. There’s no need to deal with multiple currencies, and cryptocurrency ensures that the funds can be transferred quickly and securely to complete the deal.

This global access is a game-changer for investors from countries with more volatile currencies or strict capital controls. This is because it allows them to invest in Dubai’s real estate market without being hindered by financial barriers.

5. Enhanced Liquidity with Tokenized Real Estate

Tokenization is an emerging trend in real estate that involves dividing a property into smaller, tradable units using blockchain technology. These digital tokens represent ownership shares in a property and can be bought or sold on secondary markets, increasing the liquidity of traditionally illiquid assets like real estate.

In Dubai’s free zones, some real estate developers are using tokenization to offer fractional ownership of properties, including commercial and residential spaces. The role of tokenized real estate in enabling mico-investment in the UAE is important by allowing smaller investors to participate in property investments without needing significant upfront capital. By leveraging cryptocurrency, tokenized property assets can be traded more easily, providing investors with more flexibility and the ability to liquidate their investments when needed.

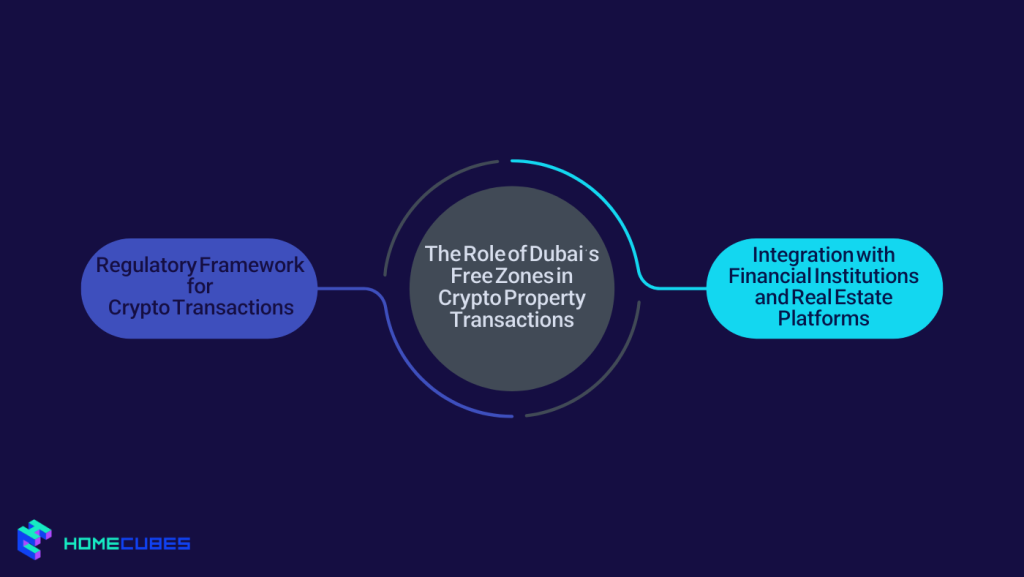

The Role of Dubai’s Free Zones in Crypto Property Transactions

Dubai’s free zones have become critical players in facilitating cryptocurrency-based property transactions. The government has taken proactive steps to establish regulations and infrastructure that support the use of blockchain technology and digital currencies. These zones are now attracting crypto-savvy investors looking to make property purchases in a regulated and future-oriented environment.

1. Regulatory Framework for Crypto Transactions

Dubai has implemented a favorable regulatory framework for cryptocurrency and blockchain use, making it easier for businesses and individuals to transact in digital currencies. The Dubai International Financial Centre (DIFC) and Dubai Silicon Oasis (DSO) are just two examples of free zones that have adopted regulations allowing the use of cryptocurrencies in real estate transactions.

In addition to these zones, the Dubai Multi Commodities Centre (DMCC) has also introduced the DMCC Crypto Centre, further reinforcing Dubai’s position as a global leader in crypto adoption. These free zones provide a supportive environment for crypto property transactions, with clear legal and regulatory guidelines, ensuring a secure and trustworthy ecosystem for investors and buyers alike.

2. Integration with Financial Institutions and Real Estate Platforms

Dubai’s free zones are home to a growing number of blockchain-based real estate platforms and crypto-friendly financial institutions. These platforms facilitate seamless property transactions, allowing buyers and sellers to transact in digital currencies and access services such as crypto-backed loans and tokenized property investments.

Several real estate agencies and developers in Dubai are now partnering with crypto platforms to facilitate property sales, including offering cryptocurrency payment options. This collaboration between traditional real estate agencies and emerging blockchain technologies provides investors with new ways to buy, sell, and finance property investments.

Challenges in Using Crypto for Property Transactions

While the integration of cryptocurrency into Dubai’s free zones offers numerous benefits, challenges remain. These include:

1. Market Volatility

Cryptocurrencies are famous for their price volatility, which can make property transactions less predictable. For instance, the value of Bitcoin or Ethereum can fluctuate significantly during the transaction process. Buyers and sellers may need to agree on a specific cryptocurrency value at the time of transaction to avoid unexpected price changes.

2. Regulatory Evolution

While Dubai has made strides in creating a crypto-friendly environment, the regulatory landscape is still evolving. Future changes in regulatory aspects of buying properties in the UAE using cryptocurrency could impact the use of cryptocurrency in real estate, so investors should stay informed about potential updates that could affect their transactions.

Conclusion

The integration of cryptocurrency into property transactions is revolutionizing Dubai’s real estate market, particularly within the city’s free zones. The use of digital currencies in property deals offers significant advantages, including faster transaction times, lower costs, increased security, and access to global markets. Free zones like DIFC, DSO, and DMCC are at the forefront of this transformation, providing a regulatory framework that supports blockchain and cryptocurrency adoption.

For investors and property buyers, cryptocurrency presents a modern, efficient, and transparent alternative to traditional property transactions. While challenges like volatility and evolving regulations remain, the future of crypto property transactions in Dubai’s free zones looks promising.

Homecubes as a licensed real estate tokenization platform focusing on Dubai real estate has got a range of exciting property tokenization projects in the pipeline. We encourage you to contact us for further infraction on our lucrative fractions investment opportunities in premium properties across Dubai.