Introduction: Why Climate Resilience Is Now a Critical Investment Factor

The global real estate industry is undergoing a paradigm shift—one where climate resilience has moved from a buzzword to a core metric in investment decisions. Nowhere is this more urgent than in the United Arab Emirates (UAE), a country known for its rapid urbanization, coastal developments, and extreme weather conditions.

As sea levels rise and desert climates intensify, real estate stakeholders are being compelled to reassess risks associated with heatwaves, flooding, sandstorms, and water scarcity. According to the United Nations Environment Programme (UNEP), over 80% of the UAE’s population and infrastructure are located along its low-lying coastline, which is at heightened risk from sea-level rise.

“How can we power a world that never sleeps with energy sources that do?”

UAE’s renewable energy firm “Masdar” apparently has an answer: A $6 billion solar and energy facility in Abu Dhabi.

The new facility, set to launch in 2027, will combine 5 GW of solar capacity with 19 GWh… pic.twitter.com/jjcaAumHef

— Rothmus 🏴 (@Rothmus) January 15, 2025

In this context, conducting a thorough Climate Resilience Evaluation is not just advisable—it’s essential for protecting property value, ensuring livability, and aligning with ESG and sustainability mandates. This guide outlines eight actionable steps for evaluating UAE properties through a climate-resilient lens.

Step 1: Assess Exposure to Environmental Hazards

Understand Localized Climate Risks by Location

The first step in any Climate Resilience Evaluation is identifying the natural hazards specific to the property’s region. While the UAE overall is arid, risk levels vary significantly depending on proximity to coastlines, valleys (wadis), and high-urban-density zones.

Key Hazards in UAE:

- Urban flooding due to poor drainage during rare storms

- Rising sea levels, particularly in Dubai and Abu Dhabi coastal zones

- Extreme heat with increasing summer temperatures

- Sand and dust storms affecting air quality and structure durability

According to the Climate Risk Index by ND-GAIN, the UAE is classified as highly vulnerable, with infrastructure resilience becoming a pressing national priority.

Action:

- Review municipal risk maps or satellite hazard overlays

- Use online platforms like Climate Central or ND-GAIN Country Index

Step 2: Evaluate Building Design for Climate Adaptability

Construction Methods Must Withstand Future Conditions

A property’s design and materials play a major role in determining its climate resilience. In the UAE’s extreme climate, this includes resistance to heat stress, wind damage, and water intrusion during seasonal storms.

Design Elements to Prioritize:

- High thermal insulation and energy-efficient facades

- Double-glazed windows to minimize heat ingress

- Reinforced foundations in coastal or low-lying developments

- Elevated ground floors in flood-prone areas

Look for buildings certified by Estidama, LEED, or WELL, which include standards related to environmental performance.

Tip:

Ask developers for a building’s green rating documentation and engineering test results.

Step 3: Examine Energy Efficiency and Carbon Footprint

Sustainable Properties Deliver Lower Long-Term Risk

Energy inefficiency increases a building’s climate vulnerability and operating costs. Properties reliant on outdated HVAC systems, low-quality insulation, or inefficient lighting will suffer under rising temperatures and future regulation.

The UAE government has committed to net-zero emissions by 2050 by taking steps to back UAE’s zero-emission property projects under its energy strategy, making energy standards central to upcoming real estate policies. You can find more details about this plan via the UAE government.

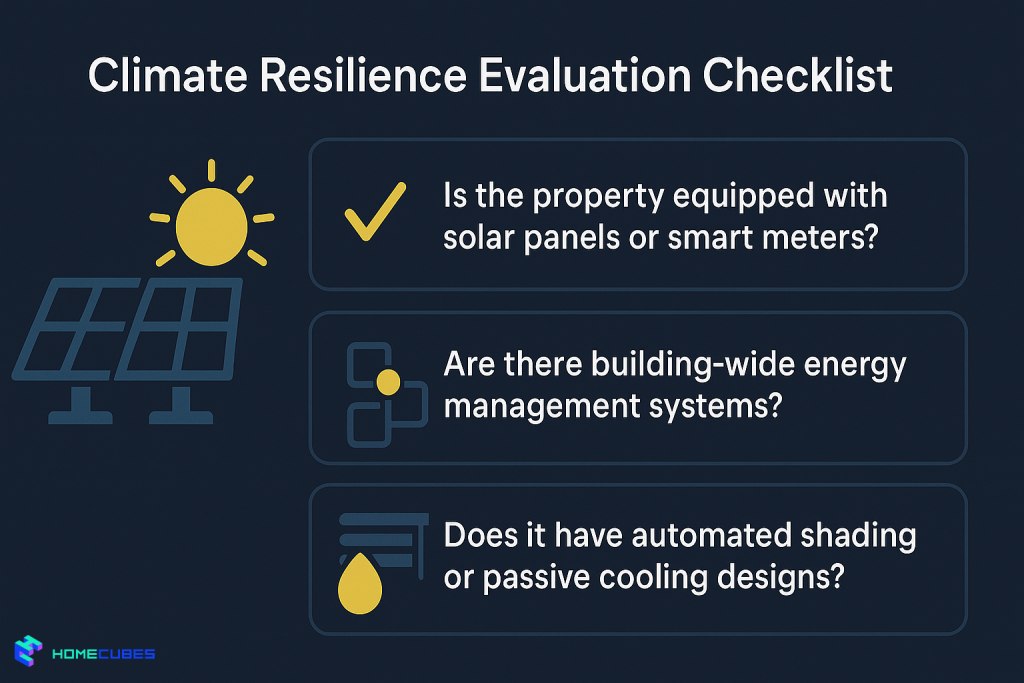

Climate Resilience Evaluation Checklist:

- Is the property equipped with solar panels or smart meters?

- Are there building-wide energy management systems?

- Does it have automated shading or passive cooling designs?

Step 4: Review Water Management and Supply Systems

Water Scarcity Is a Structural Risk in Desert Real Estate

The UAE is one of the most water-scarce countries globally, with over 90% of its potable water produced through energy-intensive desalination. This makes efficient water systems and resilient plumbing infrastructure critical to long-term property sustainability.

What to Look For:

- Greywater recycling or irrigation systems

- Low-flow fixtures and leak detection technology

- Stormwater collection capabilities

Government projects like DEWA’s hydro-storage plant in Hatta and smart water grids underscore the urgency of resilience planning in water infrastructure.

Step 5: Check Community-Level Climate Strategies

It’s Not Just About the Building—It’s About the Ecosystem

Climate resilience extends beyond individual structures to entire developments and neighborhoods. Gated communities, freehold zones, and mixed-use developments in the UAE increasingly implement community-wide climate resilience initiatives.

Key Community-Level Indicators:

- Green spaces and tree cover for microclimate control

- Smart irrigation and lighting systems

- Shared solar power installations

- Resilient transportation access (e.g., metro, EV chargers)

Real estate zones like Masdar City in Abu Dhabi or Dubai Sustainable City are exemplars of climate-aligned community planning.

Step 6: Consider Insurance, Regulation, and Compliance

Financial Resilience Is a Pillar of Climate Resilience

A thorough Climate Resilience Evaluation should include an assessment of how insurance providers, municipal authorities, and real estate regulators view the property’s risk profile.

What to Verify:

- Are climate-related perils (e.g., flood, fire, wind) covered under insurance policies?

- Is the building compliant with Dubai Green Building Regulations or Estidama Pearl Rating?

- Are there planned government infrastructure upgrades in the area?

Check with the Dubai Land Department or the Department of Urban Planning and Municipalities in Abu Dhabi for relevant data.

Step 7: Evaluate Climate Tech Integration

Smart Systems Enable Resilience and Adaptability

Modern UAE properties are increasingly integrating climate technology, which can automate energy, water, and risk management functions. That is one of the reasons that UAE real estate appeals to ESG-focused investors. These systems enhance both sustainability and livability, especially during extreme weather conditions.

Tech Features to Look For:

- Smart thermostats and real-time energy dashboards

- AI-enabled predictive maintenance

- Climate sensors that monitor indoor air and temperature

- Integration with decentralized energy grids or storage

Buildings with PropTech integrations may also qualify for green financing incentives or ESG portfolios.

Step 8: Analyze Market Perception and Future Liquidity

Climate Resilience Equals Investment Resilience

Properties that are climate-aligned are likely to appreciate faster and remain more liquid in future secondary markets. Investors are increasingly demanding ESG-compliant assets, and governments are rewarding sustainable developments with incentives.

According to JLL’s sustainability report, demand for green buildings in the UAE has doubled since 2020, driven by both policy and investor preferences.

Questions to Ask:

- Will this property qualify for future green asset classifications?

- Are institutional investors active in this development?

- How is the developer marketing climate features?

Final Thoughts: Future-Proofing Investment Starts with Evaluation

The UAE’s real estate market offers lucrative returns—but only for investors who look beyond surface-level metrics. By applying a structured Climate Resilience Evaluation, you can mitigate long-term risks, comply with emerging regulations, and future-proof your investment for both performance and ethics.

From structural design to community planning, water systems to smart climate tech, each layer of evaluation enhances not just safety—but also value and long-term viability.

🌍 Ready to Build a Climate-Smart Real Estate Portfolio in the UAE?

At Homecubes, we’re developing a platform to help investors participate in climate-resilient fractional real estate ownership across Dubai and the UAE. While we are currently awaiting our license from VARA, our mission is to provide access to digitally tracked, sustainable property investments that meet future ESG standards.

📩 Contact our team to learn more about our launch, and be the first to access real estate that’s built for a sustainable tomorrow.