Table of Contents

- Introduction

- Understanding Rental Valuation in Dubai

- What Is the RERA Rental Index?

- Features

- Benefits

- Limitations

- What Is a Lease Valuation Certificate?

- Process

- Benefits

- Limitations

- RERA Rental Index vs Lease Valuation Certificate (Detailed Comparison)

- Practical Scenarios: When to Use Each

- Case Study: Dispute Resolution Between Tenant and Landlord

- Mistakes to Avoid in Rental Valuation

- Fees and Charges: What to Expect

- Future Outlook: Digitalization and Smart Rental Tools

- Frequently Asked Questions (FAQs)

- Conclusion

- Next Steps with Homecubes

Introduction

Dubai’s real estate rental market is one of the most dynamic in the world. With thousands of new tenants and investors entering each year, the demand for fair and transparent rental valuation has never been greater. To support this, two key mechanisms exist:

- The RERA Rental Index, which provides average rental benchmarks.

- The Lease Valuation Certificate, which delivers a property-specific, legally binding rental value.

While both are part of Dubai’s regulatory framework under the Dubai Land Department (DLD) and Real Estate Regulatory Agency (RERA), they serve very different purposes. This article provides a comprehensive breakdown to help tenants, landlords, and investors understand which tool to use, when, and why.

Dubai’s real estate market delivered exceptional performance in 2024 with 20% residential price growth, 19% rental increases, and 78% hotel occupancy rates. Our latest article analyses how this momentum translates into strategic opportunities for the second half of 2025, as the… pic.twitter.com/VgHfWZeavZ

— Prop.com (@PropGlobal) June 3, 2025

Understanding Rental Valuation in Dubai

Rental valuation refers to the assessment of a property’s fair rental price in line with current market conditions, legal standards, and property-specific factors.

Why It Matters

- Protects Tenants – Ensures fair rental prices and prevents sudden unjustified rent hikes.

- Guides Landlords – Helps set competitive yet profitable rents aligned with regulations.

- Supports Investors – Provides reliable data for ROI calculations and financial planning.

- Enables Legal Enforcement – Disputes can be resolved based on transparent valuations.

Rental valuation is not optional—it underpins market trust and stability. For example, if you are considering investing your money and considering stocks vs real estate in Dubai in 2025, rental valuation is a key component of your analysis to make the best decision.

What Is the RERA Rental Index?

The RERA Rental Index is a government-managed tool that reflects the average market rental values in Dubai. The index helps investors and tenants in many ways, from when is the right time to invest in Dubai real estate all the way through to if the rent for a property is fair. It is accessible online and widely used for lease renewals and market benchmarking.

👉 Explore the official tool here: Dubai Land Department – Rental Index

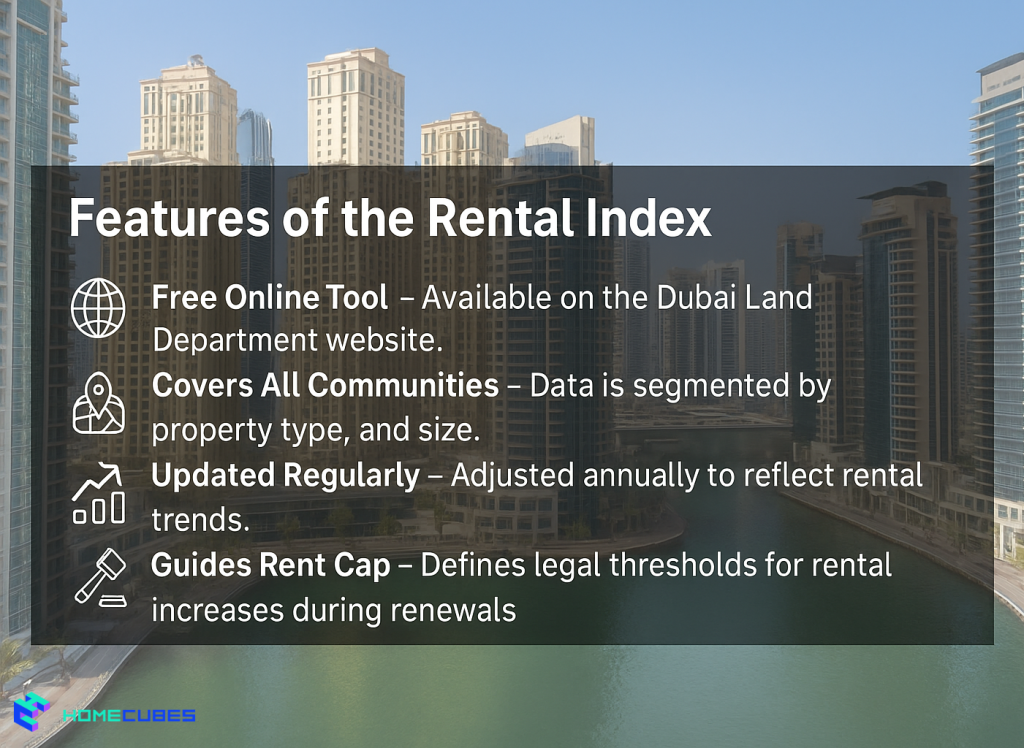

Features of the Rental Index

- Free Online Tool – Available on the Dubai Land Department website.

- Covers All Communities – Data is segmented by neighborhood, property type, and size.

- Updated Regularly – Adjusted annually to reflect rental trends.

- Guides Rent Cap – Defines legal thresholds for rental increases during renewals.

Benefits of the Rental Index

- Transparency – Tenants can check if their rent aligns with the market average.

- Simplicity – Quick and easy to use without professional assistance.

- Tenant Protection – Prevents exploitation by landlords demanding unjustified rent.

- Market Monitoring – Provides a city-wide overview for investors.

Limitations

- Generalized Data – Does not reflect property condition, view, or amenities.

- Lagging Updates – Annual revisions may not keep up with fast-moving markets.

- Not Legally Binding – Serves as guidance, not enforceable evidence in disputes.

What Is a Lease Valuation Certificate?

Unlike the index, the Lease Valuation Certificate is property-specific and legally recognized. It is issued by DLD valuers following an on-site assessment.

👉 Learn more about applying for a Lease Valuation Certificate on the Dubai Land Department Services Portal.

Process

- Application Submission – The landlord or tenant applies through DLD.

- Inspection by Certified Valuer – A licensed professional evaluates the property.

- Detailed Assessment – Considers property condition, amenities, view, and demand.

- Issuance of Certificate – A formal document with official rental valuation is provided.

Benefits

- Accuracy – Tailored to the specific property.

- Legal Recognition – Accepted in rental dispute committees and courts.

- Investor Utility – Used in financing, mortgages, and portfolio valuation.

- Neutral Reference – Independent, reducing conflict between tenants and landlords.

Limitations

- Costs – Fees apply depending on property size and location.

- Time – Requires scheduling inspections and document processing.

RERA Rental Index vs Lease Valuation Certificate (Detailed Comparison)

| Criteria | RERA Rental Index | Lease Valuation Certificate |

| Nature | Market-wide guidance | Property-specific valuation |

| Cost | Free | Paid service |

| Speed | Instant online results | Several days (inspection & report) |

| Accuracy | Approximate | Highly precise |

| Legal Standing | Informational only | Legally binding |

| Best For | Renewals, benchmarking | Disputes, financing, investments |

Practical Scenarios: When to Use Each

- Tenant Renewing Lease – Use RERA Rental Index to check if your landlord’s proposed increase is legal.

- Landlord Setting Rent for New Tenants – Use RERA Rental Index to set a competitive price.

- Tenant-Landlord Dispute – Use Lease Valuation Certificate for an enforceable figure.

- Investor Seeking Bank Financing – Use Lease Valuation Certificate to prove property income value.

Case Study: Dispute Resolution Between Tenant and Landlord

Scenario:

A tenant in Downtown Dubai received a rent increase notice from AED 100,000 to AED 130,000 upon renewal.

- The tenant checked the RERA Rental Index, which showed an average range of AED 95,000–110,000.

- The landlord insisted that due to a Burj Khalifa view and upgraded interiors, AED 130,000 was justified.

Resolution:

Both parties approached the Dubai Rental Dispute Center. The committee ordered a Lease Valuation Certificate. After inspection, DLD’s valuer set the rent at AED 115,000—higher than the index but lower than the landlord’s demand.

This demonstrates how the index provides a baseline, but the certificate finalizes the exact rental valuation.

Mistakes to Avoid in Rental Valuation

- Relying Only on RERA Rental Index – It’s a guide, not a final decision-maker.

- Skipping Documentation – Always retain valuation reports for disputes.

- Ignoring Fees – Some tenants fail to account for DLD certificate fees.

- Uninformed Negotiations – Not knowing the valuation tools weakens bargaining power.

- Assuming Certificates Are Optional – In disputes, only the certificate carries legal weight.

Fees and Charges: What to Expect

- RERA Rental Index: Free, accessible online.

- Lease Valuation Certificate: Fees typically range from AED 2,000 to AED 4,000, depending on property type, size, and urgency.

- Additional Costs: Fast-track processing may include extra charges.

Always check the Dubai Land Department’s official fee schedule before applying.

Future Outlook: Digitalization and Smart Rental Tools

Dubai is pushing towards AI-driven real estate solutions. Future rental valuation is expected to integrate:

- Blockchain-backed smart contracts for rental agreements.

- AI-powered predictive rent calculators based on real-time demand.

- Integrated digital platforms connecting the Rental Index with Lease Valuation Certificates for seamless transactions.

This will create a smarter, faster, and more transparent rental market.

Frequently Asked Questions (FAQs)

- Can tenants challenge landlords using the RERA Rental Index?

Yes, but only as a reference. For disputes, you must request a Lease Valuation Certificate. - How long does it take to receive a Lease Valuation Certificate?

Typically 3–5 business days, depending on property access and inspection scheduling. - Is the Lease Valuation Certificate mandatory for renewals?

No, it is only required in disputes or legal processes. - Do banks accept Lease Valuation Certificates for financing?

Yes, they are often used as part of mortgage assessments. - How often is the RERA Rental Index updated?

It is reviewed annually but may not reflect sudden market fluctuations.

Bottomline

Both the RERA Rental Index and the Lease Valuation Certificate are critical tools for rental valuation in Dubai. While the index provides a broad guideline, the certificate delivers a specific, enforceable figure. Tenants, landlords, and investors should use them together to ensure fairness, compliance, and informed decision-making.

Next Steps with Homecubes

At Homecubes, our mission is to make Dubai’s real estate market more transparent and accessible. While we are awaiting final approval of our VARA license, we are committed to educating landlords, tenants, and investors about essential processes like rental valuation.

📌 Whether you are disputing rent, planning an investment, or simply learning about your rights, Homecubes will be your trusted partner once fully licensed.

👉 Stay ahead of Dubai’s rental market with insights, updates, and expert resources. Contact Homecubes today to learn more.