Table of Contents

- Introduction to Islamic Mortgage in the UAE

- Core Principles of Sharia-Compliant Home Financing

- How Islamic Mortgage UAE Differs from Conventional Mortgages

- Popular Sharia-Compliant Mortgage Structures

- 4.1 Murabaha

- 4.2 Ijara

- 4.3 Diminishing Musharakah

- Top Banks Offering Islamic Mortgage UAE

- Benefits of Choosing an Islamic Mortgage

- Eligibility and Requirements for Islamic Mortgages

- Potential Risks and Considerations

- Real-World Case Study: Choosing an Ijara Home Loan in Dubai

- Fees and Charges in Islamic Mortgages

- Common Mistakes to Avoid

- FAQs About Islamic Mortgage UAE

- Partner with Homecubes for Sharia-Compliant Property Investments

Introduction to Islamic Mortgage in the UAE

The UAE has become a thriving hub for Islamic finance, offering innovative and flexible Sharia-compliant home financing options for both residents and international investors. An Islamic mortgage in the UAE is structured to comply with Islamic law, which prohibits riba (interest). Instead of charging interest, banks use alternative structures based on partnership, leasing, or profit margin.

#BREAKING: What is a halal mortgage?

Islamic mortgages are mortgages that are Sharia law compliant. They differ from traditional home loans in that you don’t pay interest as this is forbidden under Sharia law. Making money from loans goes against Islamic beliefs. #cdnpoli pic.twitter.com/GTdTGjCTSa— Jayme Knyx (@JaymeKnyx) April 17, 2024

As the real estate market continues to attract Muslim and non-Muslim investors seeking ethical finance, understanding how these products work can help you make a more informed choice. We would also like to recommend you to make yourself familiar with the real estate market in Dubai, using platforms like DXB interact; Dubai real estate platform.

Core Principles of Sharia-Compliant Home Financing

Islamic home finance is built on the following Sharia principles:

- Prohibition of Interest (Riba): No interest is charged or paid.

- Risk-Sharing: The bank and borrower share risk via partnership or lease agreements.

- Asset-Backed Financing: The mortgage must be backed by a tangible asset (the property).

- Ethical Investments: The property cannot be used for prohibited (haram) activities such as gambling or alcohol.

These principles ensure a more ethical and transparent financing structure for buyers in the UAE.

How Islamic Mortgage UAE Differs from Conventional Mortgages

| Feature | Islamic Mortgage | Conventional Mortgage |

| Interest | Not allowed; profit-based | Based on fixed or variable interest |

| Ownership Structure | Shared or leased | Owned with lien by bank |

| Legal Framework | Sharia Law + UAE Civil Law | UAE Civil Law only |

| Flexibility | Fixed profit margin, no compounding | Compounding interest possible |

Unlike conventional mortgages, Islamic mortgages do not involve lending money in exchange for interest. Instead, the bank purchases the property and either resells or leases it to the buyer.

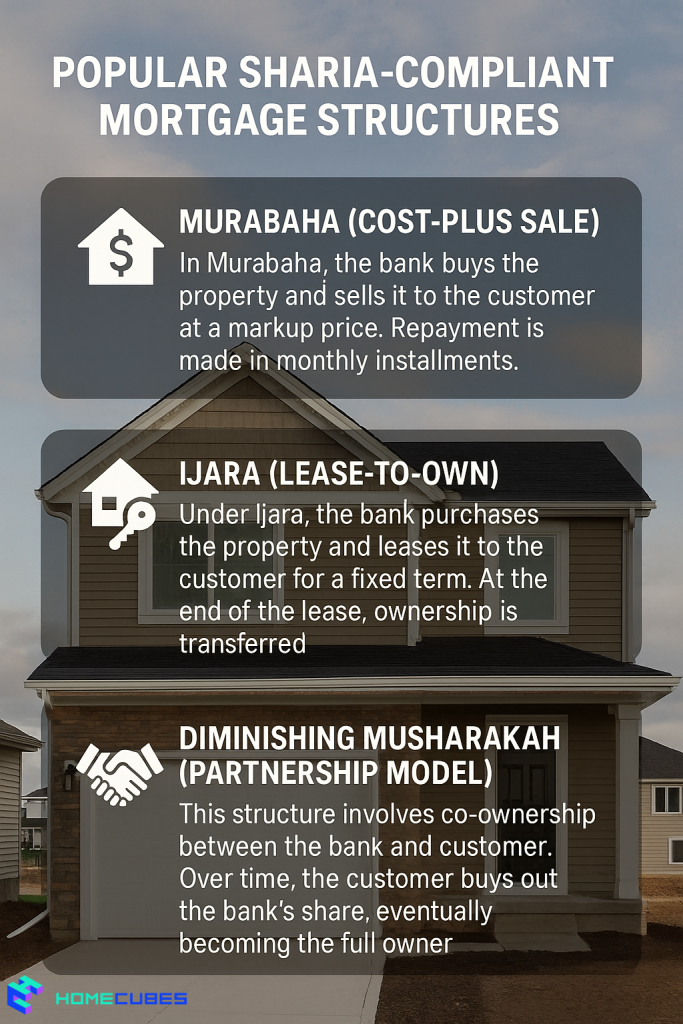

Popular Sharia-Compliant Mortgage Structures

Murabaha (Cost-Plus Sale)

In Murabaha, the bank buys the property and sells it to the customer at a markup price. Repayment is made in monthly installments.

Ijara (Lease-to-Own)

Under Ijara, the bank purchases the property and leases it to the customer for a fixed term. At the end of the lease, ownership is transferred.

Diminishing Musharakah (Partnership Model)

This structure involves co-ownership between the bank and customer. Over time, the customer buys out the bank’s share, eventually becoming the full owner.

Top Banks Offering Islamic Mortgage UAE

Here are some leading UAE banks offering Sharia-compliant mortgage products:

1. Dubai Islamic Bank (DIB)

DIB offers various home finance solutions, including Ijara and Diminishing Musharakah. Their Sharia-compliant mortgages are known for flexible tenures and high finance-to-value (FTV) ratios. Visit DIB

2. Abu Dhabi Islamic Bank (ADIB)

ADIB provides Islamic home financing through Ijara structures with fixed or variable rental rates. It supports both UAE nationals and expatriates.

Visit ADIB

3. Emirates Islamic Bank

Offers attractive financing options for salaried and self-employed individuals using Ijara and Murabaha. Their products are approved by their Internal Sharia Board.

Visit Emirates Islamic

4. Sharjah Islamic Bank (SIB)

SIB provides up to 90% financing with flexible terms, including a Murabaha structure and life Takaful coverage.

Visit SIB

Benefits of Choosing an Islamic Mortgage

- Interest-Free: Fulfills religious obligations for Muslim buyers.

- Predictable Costs: Fixed profit margin means stable monthly payments.

- Transparent Process: No compounding or hidden charges.

- Ethical Investing: Supports financial models aligned with Islamic principles.

- Inclusivity: Available to both Muslims and non-Muslims.

Eligibility and Requirements for Islamic Mortgages

Most banks have similar requirements, including:

- Minimum Salary: AED 8,000–15,000/month

- Age Limit: 21–65 years

- Property Type: Completed, ready-to-move properties in approved locations

- Down Payment: 20%–25% of the property value

- Documents Needed:

- Valid Emirates ID and passport

- Salary certificate or trade license

- Bank statements (3–6 months)

- Property sale agreement

To make things easier, you can check your credit score in Dubai or across the country, to ensure that you have the initial requirements for going through the mortgage process.

Potential Risks and Considerations

Despite their ethical appeal, Islamic mortgages may come with certain challenges:

- Higher Initial Costs: Markup-based pricing may be more expensive initially than interest-based loans.

- Early Settlement Fees: Some banks charge penalties for early buyout.

- Limited Product Range: Fewer options compared to conventional mortgages.

- Complex Contracts: Sharia-compliant structures may require legal review for clarity.

Always review the fine print and consult with a Sharia advisor or financial expert before committing.

Real-World Case Study: Choosing an Ijara Home Loan in Dubai

Scenario: A 35-year-old expat opts for an Ijara-based Islamic mortgage through Emirates Islamic Bank to buy a ready apartment in Jumeirah Village Circle.

- Property Price: AED 1.2 million

- Bank Share (Ijara): AED 960,000 (80%)

- Monthly Lease Payments: AED 6,500 (fixed profit margin)

- Tenure: 20 years

Outcome: Over time, the buyer pays down the bank’s share and acquires full ownership without paying interest, aligning with personal and religious values.

Fees and Charges in Islamic Mortgages

| Fee Type | Approximate Cost (AED) |

| Processing Fee | 1% of finance amount (up to AED 10,000) |

| Property Valuation | AED 2,500–3,500 |

| Takaful Insurance | Based on finance value and age |

| DLD Registration | 4% of property value |

| Ijara Agreement Drafting | AED 2,000–3,000 |

| Early Settlement | 1% of remaining amount (capped at AED 10,000) |

These charges are generally similar to those in conventional mortgages, except that Sharia-compliant financing includes Takaful (Islamic insurance) instead of conventional mortgage insurance.

Common Mistakes to Avoid

- Ignoring Sharia Board Certification: Ensure the mortgage product is certified by a recognized internal Sharia board.

- Not Comparing Structures: Murabaha and Ijara work differently—choose the right fit.

- Skipping Pre-Approval: Pre-approval saves time and strengthens your negotiation position.

- Underestimating Total Costs: Look beyond monthly payments to include fees, insurance, and admin costs.

- Not Reading the Lease Agreement in Ijara: It’s legally binding—review every clause, especially regarding buyout and maintenance obligations.

FAQs About Islamic Mortgage UAE

Q1: Can non-Muslims apply for Islamic mortgages in the UAE?

Yes. Islamic finance is open to all residents and investors regardless of religion.

Q2: Is profit margin negotiable in Islamic mortgages?

In some cases, yes. Banks may offer different rates based on your creditworthiness or income.

Q3: Is there a fixed or variable profit option?

Yes. Many banks offer both fixed and variable rate profit margins depending on the product.

Q4: Are Islamic mortgages available for off-plan properties?

Rarely. Most Islamic financing options are limited to completed or ready properties.

Q5: Can I refinance a conventional loan with an Islamic mortgage?

Yes. Some banks offer conversion options to switch from conventional to Islamic financing.

Partner with Homecubes for Sharia-Compliant Property Investments

At Homecubes, we understand the growing demand for Islamic mortgage UAE options. Our platform is designed to help future investors identify and explore ethical, Sharia-compliant opportunities across Dubai and the wider UAE. While we are currently in the final stages of securing our real estate tokenization license from VARA, we are building a robust foundation to support your goals.

If you’re seeking compliant, transparent, and smart property investment strategies, get in touch with Homecubes and stay informed as we prepare to launch innovative solutions tailored for ethical and fractional real estate investing.