Introduction: The Gen Z Shift in Real Estate Investment

Globally, Gen Z investors—those born between 1997 and 2012—are reshaping traditional investment behavior with their unique values, digital fluency, and desire for ethical returns. While their predecessors leaned into stocks, bonds, or physical gold, Gen Z is showing a marked preference for property-backed assets, especially in progressive markets like the UAE.

In a region known for skyscrapers, smart cities, and regulatory innovation, the UAE is actively building infrastructure and policies that align with Gen Z’s lifestyle, tech-savviness, and long-term goals. These young investors are not just passive participants; they’re digitally informed, sustainability-driven, and impact-conscious—qualities that align perfectly with the emerging real estate landscape in the Emirates.

It’s official:

Gen Z will never be able to afford homes.

30yr fixed mortgage rates just hit 7.5%

Home price to median household income level is now much higher than the peak housing bubble in 2006

With housing costs and these rates at highs, Is there any hope left for Gen Z? pic.twitter.com/mCNC5KQLad

— Saiyan Finance (@SaiyanFinance) April 17, 2024

This article explores 7 major trends making the UAE real estate market increasingly attractive for Gen Z investors in 2025 and beyond.

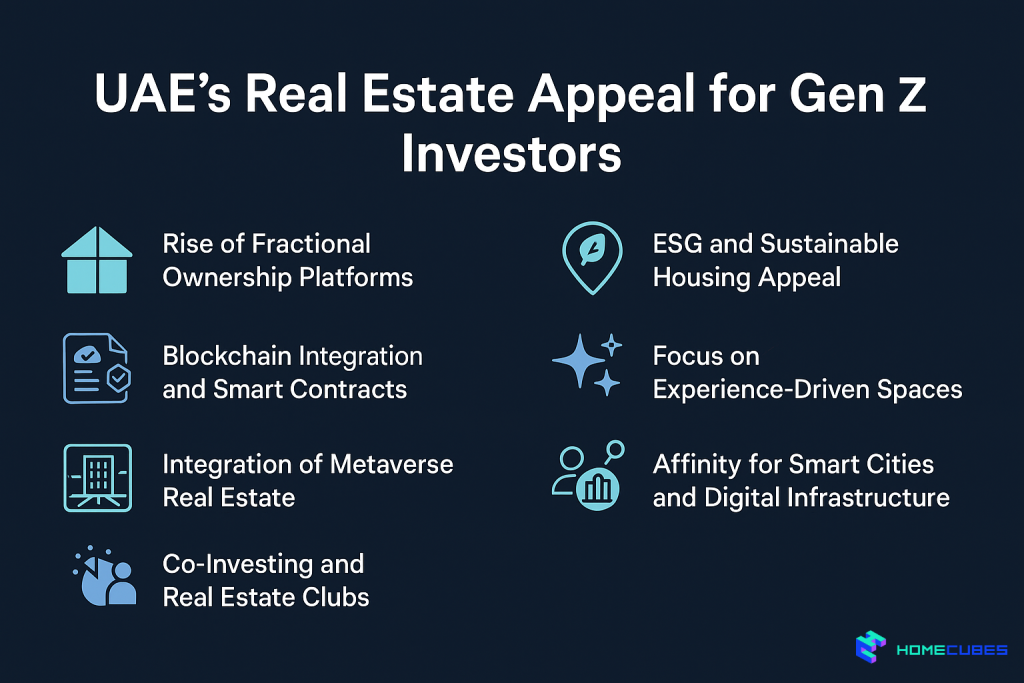

1. Rise of Fractional Ownership Platforms

Making Real Estate Affordable for Digital Natives

The traditional barrier to entry in real estate—high capital requirements—is being dismantled by fractional ownership models. These platforms allow Gen Z investors to purchase small equity shares in real estate assets, often starting from as little as AED 1,000–5,000. In return, investors receive proportionate rental income and capital appreciation.

This model resonates with Gen Z’s mobile-first financial behavior, where apps and blockchain wallets dominate. It also offers liquidity, allowing them to trade their property shares on digital secondary markets.

Several UAE-based PropTech startups are currently piloting tokenized real estate investment products geared specifically towards younger investors, as highlighted in this Forbes Middle East article. Hence, it is crucial for investors to understand fractional and shared property ownership in Dubai and UAE.

2. ESG and Sustainable Housing Appeal

Investing with Purpose

Gen Z is highly influenced by environmental, social, and governance (ESG) values. A 2024 Deloitte survey found that over 77% of Gen Z believe climate change should be a top investment priority. As a result, properties built with sustainable materials, smart energy systems, and green certifications are particularly appealing.

Developers in Dubai and Abu Dhabi are responding with LEED-certified buildings, solar-ready villas, and walkable community designs—offering both moral alignment and long-term asset resilience as well as taking steps to backing UAE’s zero-emission property projects.

Popular Locations:

- Masdar City (Abu Dhabi)

- The Sustainable City (Dubai)

- Expo City Dubai (carbon-neutral smart zone)

3. Blockchain Integration and Smart Contracts

Real Estate Meets Web3

Gen Z’s familiarity with Web3 technologies makes the UAE’s blockchain real estate adoption especially appealing. From NFT-based property deeds to smart contracts that automate rental agreements and escrow payments, the entire transaction lifecycle is being transformed into a transparent, immutable, and efficient process.

This appeals to Gen Z investors who value automation, data security, and decentralized ownership models.

The Dubai Land Department has already piloted blockchain-based property registration, showing real institutional momentum toward digital ownership innovation.

4. Integration of Metaverse Real Estate

Owning Property in Digital and Physical Worlds

Gen Z investors, especially those exposed to gaming and virtual worlds, are showing interest in metaverse real estate—virtual land or structures that can be monetized via NFTs. In the UAE, metaverse projects are being developed in tandem with physical ones, offering hybrid investment portfolios.

Some developers now include “phygital” experiences, such as digital twins of physical properties, virtual walkthroughs, and augmented-reality furnishing tools. This convergence makes UAE properties more accessible and exciting to younger buyers.

5. Co-Investing and Real Estate Clubs

Collective Power, Lower Risk

Gen Z values community-driven decision-making and financial collaboration. The UAE has seen a rise in real estate investment clubs that allow groups of young investors to pool resources, split risk, and co-own high-value properties that would be unattainable individually.

These clubs often integrate:

- Group voting on assets

- Digital dashboards for tracking ROI

- Legal structures that simplify multi-party ownership

This aligns with Gen Z’s preference for peer-driven ecosystems and reduces the anxiety of solo investing.

6. Focus on Experience-Driven Spaces

Beyond Bricks and Mortar

For Gen Z, real estate is not just a financial instrument—it’s also about lifestyle, community, and user experience. Properties with shared co-working lounges, smart gyms, rooftop cafés, and pet-friendly zones are highly sought-after. These lifestyle features enhance rental demand and future resale value.

Developers in Freehold Expansion Zones and mixed-use districts are incorporating amenities tailored to the Gen Z lifestyle, especially in:

- Dubai Design District

- Abu Dhabi’s Al Maryah Island

- Ras Al Khaimah’s Marjan Island

This trend also impacts short-term rental investments, where curated design and hospitality-style services appeal to Gen Z travelers and digital nomads.

7. Affinity for Smart Cities and Digital Infrastructure

UAE’s Tech Ecosystem Attracts Tech-First Investors

The UAE is at the forefront of smart city development, from AI-powered traffic systems to IoT-integrated homes. For Gen Z investors, who value digital interfaces, smart automation, and data visibility, this makes UAE real estate incredibly attractive.

Cities like Dubai and Abu Dhabi are embedding technology into real estate through:

- Smart utilities and grid optimization

- Blockchain-based title verification

- App-controlled climate and lighting

Smart cities like Dubai South and Sharjah Sustainable City are showcasing these integrations, providing Gen Z investors with both asset functionality and futuristic appeal.

Future Outlook: Gen Z Will Reshape Real Estate Norms in the UAE

The convergence of PropTech, sustainability, digital identity, and fractional finance is perfectly suited for the expectations of Gen Z investors. In the UAE, this generation is not only participating—they are setting new standards. As their economic power grows, they are likely to demand:

- Mobile-first investment platforms

- Green asset reporting

- AI-optimized rental yields

- Interoperable portfolios between metaverse and real-world assets

The UAE’s continued emphasis on smart governance, regulatory flexibility, and infrastructure development positions it as a global magnet for Gen Z capital—not just in real estate, but across digital-first investment sectors.

🏢 Invest Smart. Invest Young. Explore the Future with Homecubes

At Homecubes, we understand the mindset of the modern investor. That’s why our upcoming platform is designed to meet the needs of Gen Z investors with fractional ownership options, blockchain-backed property shares, and secure, compliant access to premium UAE real estate opportunities.

Please note: Homecubes is currently awaiting regulatory approval from VARA and is not offering investment services yet. However, our team is building the foundation for a transparent, smart, and Gen Z–friendly investment ecosystem.

📩 Stay in the loop. Contact us to learn how we’re shaping the future of real estate investment in the UAE—tailored for the next generation.