Introduction

For U.S. investors seeking global diversification and long-term, tax-advantaged growth, one strategy stands out: using a Self-Directed IRA (SDIRA) to invest in UAE real estate. While the UAE is a thriving, fast-growing market attracting billions in foreign capital, many American investors are unaware that they can leverage their retirement funds to access its dynamic property sector—without ever touching their traditional brokerage account.

1. 🇦🇪 UAE: The Zero-Tax Haven

The clear winner with 6,700 millionaires expected to relocate there in 2024.

– Zero income tax (the big one)

– Golden Visa program

– Luxury lifestyle

– Strategic global location

– Sophisticated wealth managementTax efficiency at its finest. pic.twitter.com/F8TITyqN8O

— Alessandro Palombo (@thealepalombo) April 10, 2025

This comprehensive guide will walk you through how to legally and strategically use a Self-Directed IRA to invest in residential, commercial, or fractional real estate in the UAE, explore the benefits and limitations, and show how platforms like Homecubes make the process smoother and more transparent than ever before.

Understanding the Basics: What Is a Self-Directed IRA?

A Self-Directed IRA is a retirement account that allows you to invest in a wide range of alternative assets, including:

- Real estate (domestic and foreign)

- Private equity

- Precious metals

- Cryptocurrency

- Notes and private lending

Unlike traditional IRAs limited to stocks, bonds, and mutual funds, SDIRAs offer greater control and a key step to build a diverse real estate portfolio for 2025 in the UAE or elsewhere. These accounts are managed by custodians or trustees who handle compliance, reporting, and transaction facilitation—but you, the investor, make all key decisions.

Learn more from the IRS Publication 590-A on rules and requirements for IRAs.

Why Choose UAE Real Estate for Your SDIRA?

The UAE, particularly Dubai and Abu Dhabi, has emerged as a global hotspot for real estate investment due to its:

- Tax-free environment: No capital gains or property taxes

- Strong rental yields: Residential properties average 6–9%

- Strategic location: Gateway to Asia, Europe, and Africa

- Political and economic stability

- Regulatory support for foreign ownership in freehold zones

Post-COVID recovery, Expo 2020 legacy projects, and growing digital nomadism have further boosted property demand, especially for smart homes, mixed-use developments, and branded residences.

Is UAE Real Estate Eligible for SDIRA Investment?

Yes—under IRS rules, foreign real estate is permitted in a Self-Directed IRA, provided:

- It is titled in the name of the IRA, not you personally

- The IRA pays all property-related expenses

- All rental income is returned to the IRA

- No “prohibited transactions” occur (e.g., you or family members using the property)

To ensure compliance, you’ll need to work with a U.S.-based SDIRA custodian that permits international real estate investments.

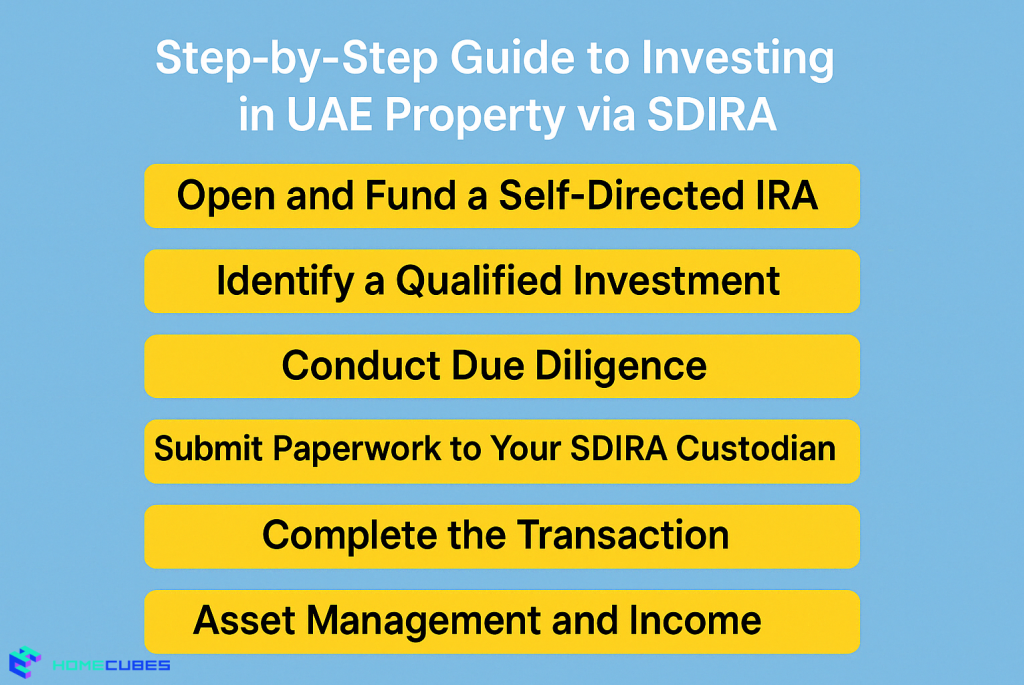

Step-by-Step Guide to Investing in UAE Property via SDIRA

1. Open and Fund a Self-Directed IRA

Choose a reputable custodian like Equity Trust, Madison Trust, or Entrust Group. Madison Trust offers a comprehensive guide on setting up and managing your SDIRA.

2. Identify a Qualified Investment

Work with UAE-based experts like Homecubes to select a compliant and high-performing real estate opportunity. Fractional ownership options reduce your exposure and increase diversification.In other words, this model offers all advantages associated with UAE’s real estate coownership model.

3. Conduct Due Diligence

Review legal structures, ownership zones, lease agreements, and developer reputations. Ensure the asset is registered and zoned for foreign ownership.

4. Submit Paperwork to Your SDIRA Custodian

Your custodian will handle the transaction but needs documentation such as a purchase agreement, proof of zoning compliance, and expense forecasts.

5. Complete the Transaction

The custodian wires funds directly from your IRA account. The title is recorded in the name of your SDIRA, not you personally.

6. Asset Management and Income

Rental income and appreciation accrue inside the IRA, deferring taxes until distribution. Work with licensed property managers or platforms like Homecubes for hands-off asset oversight.

Benefits of Using an SDIRA for UAE Real Estate

- Tax-Deferred or Tax-Free Gains: Traditional SDIRAs defer taxes until withdrawal, while Roth SDIRAs offer tax-free growth.

- Global Diversification: Hedge against domestic market cycles and currency risks.

- Asset Control: You choose where and how your retirement dollars are allocated.

- High ROI Potential: UAE properties often outperform U.S. rental yields.

- Inflation Hedge: Real estate is a tangible asset with long-term value retention.

Risks and IRS Compliance Challenges

- No personal benefit use: You can’t live in or visit the property

- Higher legal and tax complexity

- Currency fluctuation risk

- Limited liquidity: Real estate is not a fast-exit asset

- Transaction and management fees

IRS scrutiny on SDIRA rules is increasing, especially regarding prohibited transactions. Using an experienced custodian and international partner is essential to avoid penalties.

Choosing the Right SDIRA Custodian

Look for:

- International investment experience

- Real estate-focused support teams

- Transparent fee structures

- Fast processing for real estate approvals

Popular SDIRA Custodians:

- Equity Trust Company

- Madison Trust

- IRA Financial

- New Direction Trust

Case Study: Using an SDIRA to Buy Fractional Property in Dubai

Investor Profile:

- Name: Amanda B.

- Age: 47

- Retirement Account: $180,000 in traditional IRA

Goal:

- Diversify globally and increase long-term yield

Solution:

- Amanda transfers $60,000 into a Self-Directed IRA and uses $35,000 to invest via Homecubes in a Dubai fractional ownership opportunity.

Results:

- Estimated annual yield: 7%

- 100% of income goes back into her IRA

- Property is managed by Homecubes; no manual involvement

Comparison: SDIRA in UAE vs Traditional REIT

| Feature | UAE Property via SDIRA | U.S. REIT |

| Control | Full (you choose) | Limited (fund manager) |

| Yield | 6–10%+ | 2–4% |

| Diversification | Global exposure | U.S. only |

| Tax Structure | Tax-deferred or free | Dividends taxed |

| Asset Class | Physical property | Paper asset |

Tools and Resources

Conclusion

Using a Self-Directed IRA to invest in UAE real estate is one of the most powerful yet underutilized strategies for global retirement diversification. With the right custodian, regulatory understanding, and local partner, U.S. investors can access high-yield, tax-advantaged real estate assets in one of the world’s most dynamic economies.

Homecubes CTA – Invest Globally with Confidence

At Homecubes, we help American investors unlock the full potential of their Self-Directed IRAs through fractional access to UAE real estate. Whether you’re targeting income-producing logistics hubs, smart apartments, or mixed-use towers, we handle the complexity while you build retirement wealth.

- IRA-compliant investment structures

- Property sourcing and due diligence

- Hands-free management

- Digital portfolio dashboards

👉 Get in touch with us today to explore vetted opportunities in the UAE real estate market and diversify your retirement strategy.