Cryptocurrency has emerged as a transformative financial tool, offering new avenues for investment and income generation. One of the most popular strategies for earning passive income in the crypto space is yield farming. This practice involves lending or staking cryptocurrencies or tokenized tangible assets in decentralized finance (DeFi) protocols to earn returns. In the UAE, where crypto adoption is rapidly increasing, understanding the most lucrative yield farming strategies can help investors maximize their passive income potential. This article explores various yield farming strategies, the risks involved, and tips for successful investment in the UAE.

Understanding Yield Farming

What is Yield Farming?

Yield farming is the practice of using cryptocurrencies to provide liquidity to decentralized finance platforms in exchange for interest or rewards. By locking up their assets, users contribute to the liquidity of the platform, which is essential for its operation. In return, they receive rewards, often in the form of the platform’s native tokens or transaction fees.

Good Morning & Happy Taco Tuesday!

Advanced Yield Farming Strategies: Impermanent Loss, Leveraged Farming, and Complex Vaults

Exploring beyond-the-basics strategies for DeFi investors. Here’s what we need to know:

Impermanent Loss:

• Loss from token price changes in… pic.twitter.com/0IUjEfgYHg— ᴄᴇᴅʀɪᴄ (@cedric_web3) September 17, 2024

Key Concepts

- Liquidity Pools: These are pools of tokens that users provide to decentralized exchanges (DEXs) or lending platforms. Users earn fees proportional to their share of the pool.

- APY (Annual Percentage Yield): This metric measures the rate of return on an investment over a year. It’s crucial for comparing different yield farming opportunities.

- Staking vs. Yield Farming: While both strategies involve locking up assets, staking usually pertains to securing a blockchain network (like proof-of-stake), whereas yield farming focuses on providing liquidity in DeFi protocols.

Lucrative Yield Farming Strategies

1. Utilizing Automated Market Makers (AMMs)

Automated Market Makers, such as Uniswap and SushiSwap, have revolutionized the way liquidity is provided in decentralized exchanges. Users can deposit their tokens into liquidity pools and earn transaction fees as traders buy and sell assets..

- Select High-Volume Pairs: Choose trading pairs with high trading volumes to maximize transaction fee earnings.

- Impermanent Loss Awareness: Understand that providing liquidity exposes you to impermanent loss, which occurs when the price of tokens changes significantly.

2. Participating in Yield Aggregators

Yield aggregators, such as Yearn.finance and Harvest Finance, automatically move users’ funds between different DeFi protocols to optimize yields. They aggregate the best farming opportunities across top DeFi platforms for passive income in the UAE, saving users the hassle of manually managing their investments.

- Invest in Top Aggregators: Research and choose reputable yield aggregators with proven track records of maximizing returns.

- Use Stablecoins for Lower Risk: Many yield aggregators allow you to farm using stablecoins, which can reduce volatility and potential losses.

3. Leveraging Lending Protocols

Lending platforms like Aave and Compound allow users to lend their cryptocurrencies and earn interest on their deposits. These platforms typically offer higher APYs compared to traditional savings accounts.

- Diversify Your Loans: Spread your investments across multiple lending platforms to minimize risk.

- Use Collateral for More Yield: Some platforms let you borrow against your collateral to reinvest and amplify your returns, but be aware of the risks involved.

4. Staking Native Tokens

Many blockchain networks offer staking options for their native tokens. By staking tokens, investors can earn rewards simply for holding and locking up their assets.

- Look for Staking Rewards: Research projects with attractive staking rewards and strong fundamentals to ensure long-term viability.

- Consider Lock-Up Periods: Be mindful of lock-up periods that restrict your ability to access funds, especially in volatile markets.

5. Engaging in Liquidity Mining

Liquidity mining involves providing liquidity to a decentralized exchange and earning native tokens as rewards. Many DeFi projects incentivize users to participate by distributing their tokens, making this an attractive option for investors.

- Identify Emerging Projects: Stay updated on new projects with liquidity mining programs. Early participation can yield significant rewards.

- Assess Project Fundamentals: Evaluate the project’s roadmap, team, and community engagement to gauge its potential for growth.

Risks Involved in Yield Farming

While yield farming offers the potential for high returns, it also comes with risks that investors must consider:

- Smart Contract Risks: Bugs or vulnerabilities in smart contracts can lead to loss of funds. Always use reputable platforms and conduct thorough research.

- Market Volatility: Cryptocurrencies are known for their price volatility. The value of your staked or lent assets can fluctuate significantly.

- Impermanent Loss: This risk arises when the price of your assets changes relative to one another while they are in a liquidity pool, potentially resulting in losses when you withdraw your funds.

- Regulatory Risks: The regulatory landscape for cryptocurrencies is still evolving. Changes in regulations can impact the viability of certain platforms or strategies.

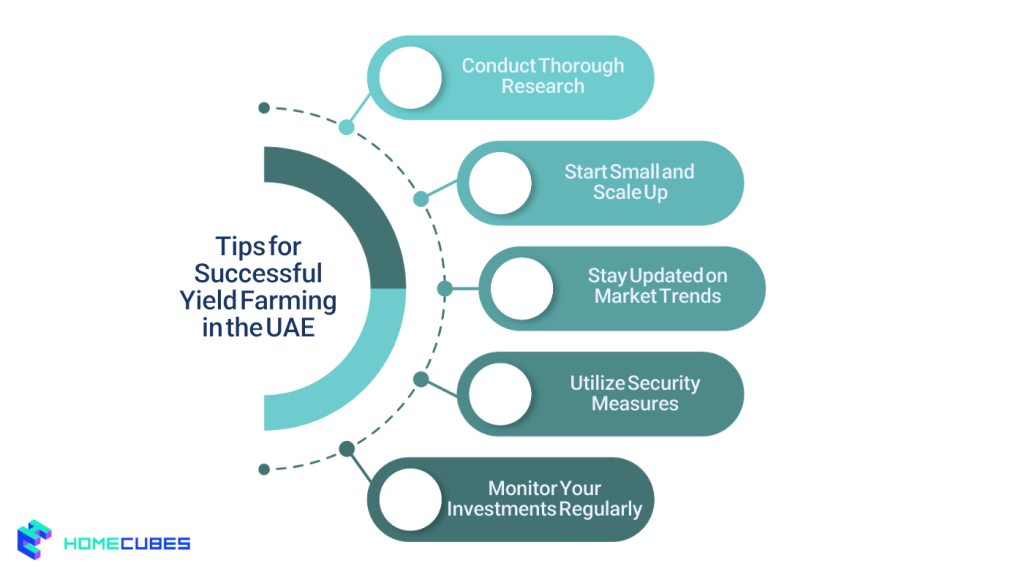

Tips for Successful Yield Farming in the UAE

1. Conduct Thorough Research

Before investing in any yield farming strategy, perform due diligence on the protocols and platforms you plan to use. Look for user reviews, community discussions, and expert opinions.

2. Start Small and Scale Up

If you’re new to yield farming, consider starting with a small investment. This allows you to familiarize yourself with the mechanics of the process and manage risks effectively.

3. Stay Updated on Market Trends

The cryptocurrency landscape is constantly changing. Keep an eye on market trends, new projects, and updates in the DeFi space to identify emerging opportunities.

4. Utilize Security Measures

Use hardware wallets and enable two-factor authentication to secure your assets. Be cautious about phishing attempts and always double-check URLs before entering sensitive information.

5. Monitor Your Investments Regularly

Regularly review your yield farming investments to assess performance, potential risks, and market conditions. Adjust your strategies as needed to optimize returns.

Bottomline

Yield farming presents a compelling opportunity for investors and entrepreneurs to generate passive income in the UAE’s by crypto mining and lending. By employing effective strategies such as utilizing AMMs, participating in yield aggregators, and engaging in liquidity mining, investors can maximize their returns while mitigating risks.

However, as with any investment, it is crucial to stay informed, conduct thorough research, and manage risks effectively. With the right approach, yield farming can be a lucrative avenue for passive income, contributing to the broader adoption of cryptocurrencies and decentralized finance in the UAE.

Homecubes is about to launch their tokenized real estate platform focusing on the Dubai real estate market soon. We encourage you to contact us for detailed information about our fractional ownership investment opportunities in Dubai. With our projects, you would not only enjoy passive rental income, but become entitled to capital growth, as the real estate market appreciates.