The rapid evolution of technology has introduced innovative solutions across various sectors, with real estate standing out as a prime candidate for transformation. In Dubai, a city known for its ambitious architecture and dynamic economy, the tokenization of real-world assets, particularly in the real estate market, is reshaping investment landscapes. This article delves into the concept of asset tokenization, its significance in Dubai’s real estate sector, and the implications for investors and developers alike.

🌍 The Rise of Real-World Assets (RWA) in DeFi

Discover how tokenizing assets like real estate, bonds, and commodities are revolutionizing efficiency, transparency, and accessibility in blockchain.

A thread 🧵 pic.twitter.com/iCjAGyctnA

— DIA | Cross-Chain Oracles for Web3 (@DIAdata_org) June 24, 2024

Understanding Asset Tokenization

The process of tangible asset tokenization involves converting physical assets into digital tokens on a blockchain. Each token represents a share of the underlying asset, allowing for fractional ownership and easier transferability. This process not only democratizes access to investment opportunities but also enhances liquidity and transparency.

Key Benefits of Tokenization

- Fractional Ownership: Investors can own a fraction of high-value assets, making it more accessible to a broader audience.

- Increased Liquidity: Tokenized assets can be traded on various platforms, offering liquidity that traditional real estate investments lack.

- Transparency: Blockchain technology ensures that all transactions are recorded in an immutable ledger, enhancing trust and accountability.

- Lower Transaction Costs: By reducing the need for intermediaries, tokenization can significantly lower the costs associated with buying and selling properties.

The Evolution of Dubai’s Real Estate Market

Dubai’s real estate market has undergone significant transformations over the past few decades. From the establishment of freehold ownership for foreigners to the development of iconic structures like the Burj Khalifa, the city has consistently attracted global investors. The introduction of asset tokenization marks the latest evolution in this vibrant market.

Early Developments and Global Appeal

Dubai’s real estate sector began to flourish in the early 2000s, driven by government initiatives and economic diversification efforts. The introduction of freehold property laws allowed foreign investors to purchase real estate in designated areas, leading to a construction boom and increased foreign direct investment. The city’s strategic location, luxurious lifestyle, and robust infrastructure have solidified its position as a global real estate hub.

The Shift Towards Innovation

In recent years, Dubai has positioned itself as a leader in adopting cutting-edge technologies. The government’s commitment to the Dubai Blockchain Strategy aims to make Dubai the first city fully powered by blockchain by 2025. This vision extends to the real estate sector, where the tokenization of assets is gaining traction.

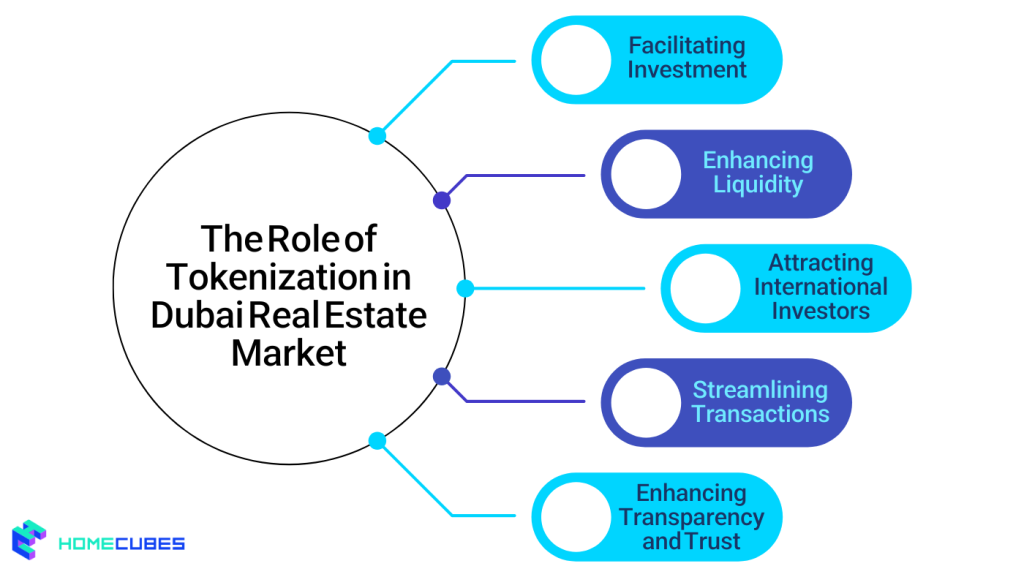

The Role of Tokenization in Dubai’s Real Estate Market

1. Facilitating Investment

Tokenization opens the door to a new class of investors, including millennials and smaller investors who previously found real estate investment prohibitive. By allowing fractional ownership, individuals can invest in luxury properties or large-scale developments without committing substantial capital. This democratization of investment aligns with Dubai’s vision to attract diverse talent and investment.

2. Enhancing Liquidity

Traditionally, real estate transactions can be lengthy and complex, resulting in illiquidity. Tokenization addresses this issue by enabling the buying and selling of property shares on digital exchanges. Investors can easily liquidate their assets without waiting for lengthy sales processes, enhancing the overall appeal of real estate as an investment class.

3. Attracting International Investors

Dubai’s reputation as a global investment hub is further strengthened by tokenization. International investors can easily access the Dubai real estate market, navigating transactions through familiar digital platforms. This increased accessibility is essential for attracting foreign capital, which is vital for sustaining the growth of the market.

4. Streamlining Transactions

The integration of smart contracts in the UAE’s tokenized real estate transactions automates various processes, including payment settlements, title transfers, and compliance checks. This efficiency reduces the reliance on intermediaries, such as real estate agents and lawyers, ultimately lowering transaction costs and expediting deals.

5. Enhancing Transparency and Trust

The transparent nature of blockchain technology builds trust among investors and developers. All transactions are recorded on a public ledger, providing a clear history of ownership and transfers. This level of transparency can decrease concerns regarding fraud and misrepresentation, which are prevalent in traditional real estate markets.

Case Studies of Tokenization in Dubai

1. Smart Dubai’s Initiatives

Smart Dubai, an initiative launched by the government to promote innovation and enhance the city’s global competitiveness, has championed the use of blockchain technology in real estate. One notable project is the tokenization of properties through partnerships with private companies, allowing for fractional ownership of luxury developments. These initiatives not only showcase the potential of tokenization but also encourage private sector participation in digital transformation.

2. Real Estate Investment Platforms

Several platforms have emerged in Dubai focused on tokenizing real estate assets. Tokenized real estate companies in the UAE like Homecubes are leading the charge by creating platforms where investors can purchase fractional shares in properties. These platforms utilize blockchain to ensure transparency and security, making it easier for investors to track their investments and engage with the asset.

Challenges to Overcome

While the benefits of tokenization are compelling, the key challenges in real world asset tokenization in the Dubai real estate market are still considerable.

1. Regulatory Framework

The regulatory landscape for tokenized assets in Dubai is still evolving. Clear guidelines are needed to define the legal status of tokenized real estate, ownership rights, and compliance requirements. The Dubai Land Department is working towards establishing a regulatory framework to govern these transactions, which will be crucial for fostering investor confidence.

2. Market Education

For tokenization to succeed, there must be an increase in awareness and understanding among potential investors and developers. Educational initiatives are essential to inform stakeholders about the benefits and mechanics of tokenization, ensuring that the market is ready to embrace this new model.

3. Technological Infrastructure

A robust technological infrastructure is necessary to support the growth of tokenization in real estate. Ensuring security, scalability, and user-friendliness will be essential for platforms that facilitate tokenized real estate transactions. Collaboration between tech firms and real estate developers can help build this infrastructure.

4. Consumer Trust

Building trust in tokenized assets is vital. Investors need assurance that their investments are secure and that the platforms they use are reliable. This can be achieved through transparency, regulatory compliance, and positive user experiences.

The Future of Tokenization in Dubai’s Real Estate Market

The future of tokenization in Dubai’s real estate market looks promising. As technology continues to advance and the regulatory environment matures, more real estate projects are likely to embrace this innovative approach.

Emerging Trends

- Integration with Smart Cities: As Dubai develops its blockchain framework, the role of real world asset tokenization in Dubai’s smart city initiatives becomes pivotal. RWA tokenization can facilitate better management of real estate assets and urban development projects.

- Sustainability Initiatives: Tokenization can be leveraged to promote sustainable development projects, allowing investors to fund green initiatives and eco-friendly buildings.

- Global Collaboration: Tokenized assets may pave the way for cross-border investments. Hence, attracting global capital into Dubai’s real estate market and fostering international partnerships are expected.

Conclusion

The tokenization of real-world assets, particularly in Dubai’s real estate market, is a game-changer that promises to redefine investment and ownership models. By facilitating fractional ownership, enhancing liquidity, and promoting transparency, tokenization aligns with Dubai’s vision of becoming a global hub for innovation. While challenges remain, the potential benefits make it clear that tokenization will play a crucial role in shaping the future of real estate in Dubai, creating a more accessible, efficient, and transparent market for all stakeholders involved.

Homecubes is leading the emergence of property tokenization in the Dubai real estate market. If you are seeking lucrative fractional investment opportunities in Dubai, ensure to contact us to get detailed information about our multiple property tokenization projects across prime locations in Dubai.